There are several trends currently being faced by retailers which are putting them under a lot of pressure:

- Consumers are more price-aware than ever. They’re benefitting from better information, price comparisons are easier to make, and private labels are major brands in some cases. Pressures on household budgets are growing, driving increased competition in many markets, particularly from limited-assortment discounters (LADs) in grocery (such as Aldi and LIDL) and low-overhead e-commerce businesses in many general merchandise sectors.

- Consumers have always valued personalized service, wanting to be presented with their preferred assortment, and they like their dealings with their chosen retailers to be easy and stress-free. But the more retailers fight for their business, the more confidently consumers demand these things.

- Consumer loyalty is getting harder to secure. Previous generations often identified strongly with a particular brand, for instance, choosing to make a statement about their status through their choice of supermarket. However, today’s consumers might buy staples from a limited-assortment discounter (dried pasta, tinned tomatoes, bagged salad, for instance) and more specialized items (i.e. sourdough bread, pine kernels, monkfish) from a traditional grocery store.

In the grocery sector, most retailers are working to raise their game to stop the rise of limited-assortment discounters. Many grocers are responding with a drive towards ‘customer centricity’ – and leveraging their ability to craft assortments at an individual-store level to best retain the loyalty of customers shopping in each particular outlet. However, as the same competitors continue to squeeze prices, it’s vital to remain cost-effective simultaneously.

The primary tactic in assortment management is to identify those parts of the assortment to keep as tight and centrally managed as possible with minimal impact on sales. At the same time, the categories where selection has the most significant impact on consumer perception and behavior are used to create customer-focused assortment differentiation. The retailer’s overall strategy remains paramount.

Finding the optimum balance between that tight core and customer-centric differentiation is critical. To clarify how this optimum can be reached, we need to examine more closely the benefits of a centralized assortment and a customer-focused store-specific assortment.

The Benefits of a Centralized Assortment

Centralized assortment – carrying the same range of products in every store – is an essential driver of sourcing and supply chain economics. A large retailer with over a thousand stores wields much more power in its purchasing negotiations when it can leverage the options of either having the product in a thousand stores or none. These economies of scale have been a significant incentive to build central assortments.

Moreover, a dense centralized assortment effectively drives down supply chain costs. For example, having five variants of the same product can more than double DC inventory due to the extra safety stock needed to ensure availability for distribution. More variety also means more warehouse picking locations, which leads to lower volumes per product and thus increases supply chain handling and space costs. Variety means more capital is tied up in stock, while supply chain operations are far less cost-effective.

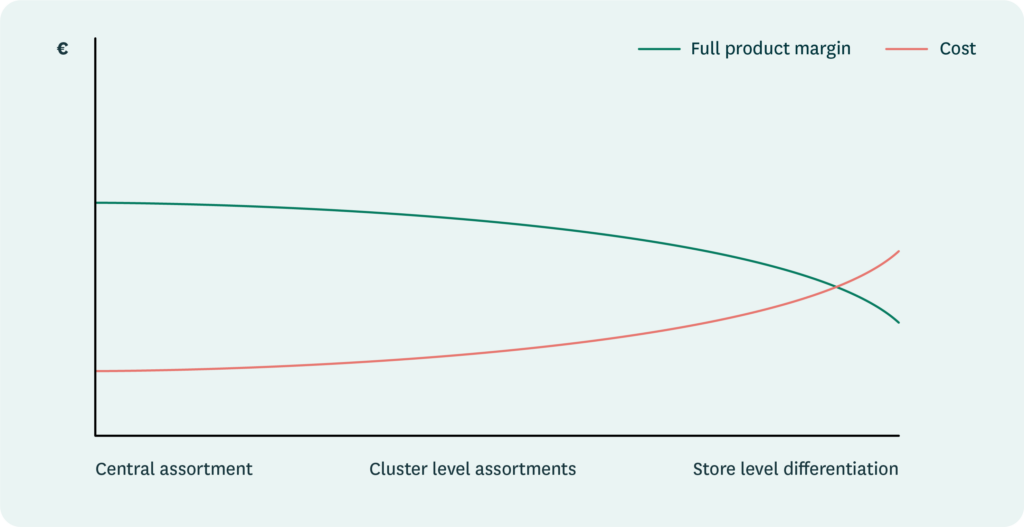

So, operating a completely centralized assortment allows a retailer to seek the lowest possible cost base. Then, if the retailer prices items at standard market levels, the centralized assortment delivers the highest, fully-cost-loaded product margin. Cluster-level assortments, where retailers group stores by consumer demographic and demand characteristics and where the assortment is varied accordingly, fall in the midpoint of the cost/margin range, as per the picture below.

A retailer’s most cost-effective mode of operating is offering a central assortment, modified only by store size to increase assortment variety within larger stores. However, it is also a market in which limited-assortment discounters are hard to beat. Limited-assortment discounters typically operate tight ranges with hundreds of SKUs rather than thousands, buying and selling them in huge volumes.

Furthermore, most retailers want to understand and serve their customers better and offer them the products they really want – i.e., they want to build a more ‘customer-centric’ assortment.

The Benefit of Customer Centricity

The most substantial benefits of a customer-centric assortment are increased sales and sales margins. The increased sales are typically a consequence of consumers being more likely to buy products from a range matched directly to their tastes, requirements and needs. In the longer term, an additional benefit is increased customer loyalty as they perceive stores to be more convenient and pleasant to shop in because of the carefully tailored assortment.

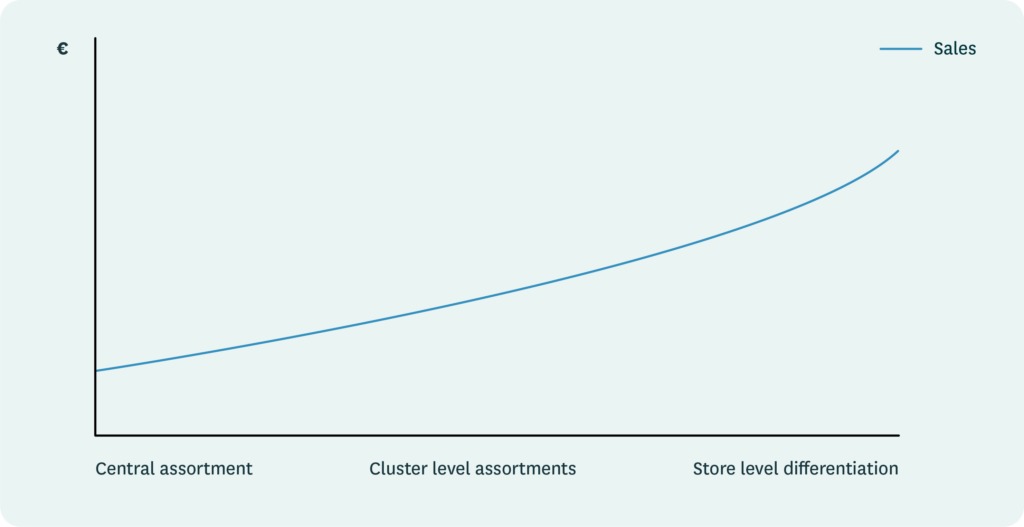

So, sales and sales margins increase when a retailer increases their assortment differentiation ‘intelligently’. By ‘intelligent assortment differentiation’, we mean adjusting each store’s assortment to meet its customers’ requirements, whereby the “differentiation” is data and insight-driven, not the result of guesswork. The first step towards intelligent differentiation is clustering stores based on the similarities between the demand characteristics experienced by each – grouping stores based on how customers want to shop in them. Clustering stores by demand and demographics enables the building of customer-focused assortments while allowing for centralized efficiencies, such as leveraging volume to secure discounts from suppliers. Many retailers have increased sales by 2 to 4% through intelligent assortment differentiation without building store-level assortments.

The effect on sales of different assortment options is illustrated below.

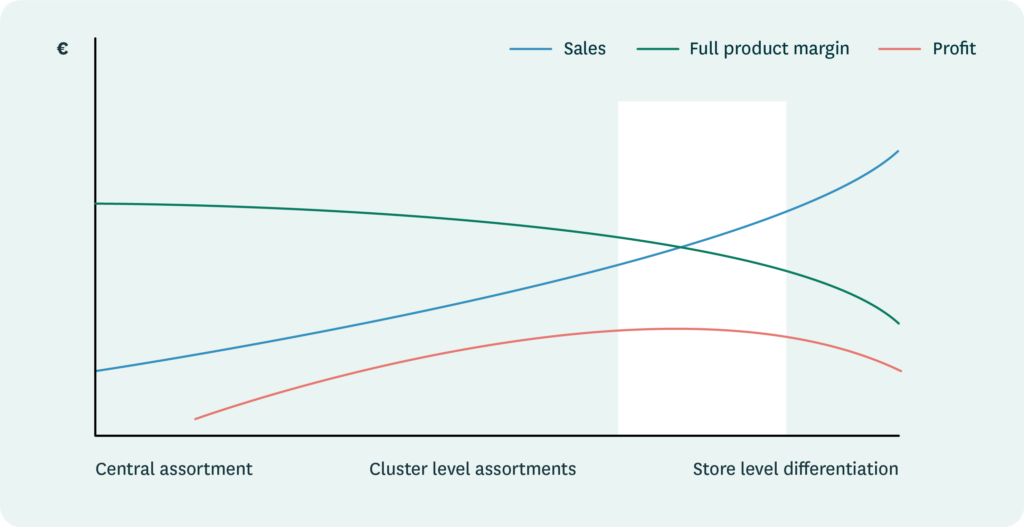

The Optimal Point of Assortment Differentiation

The point where profits are maximized is reached when the increasing costs of differentiation start to outweigh the impact of increased sales margins that would be achieved through further differentiation. The zone marked out in white indicates the degree of assortment differentiation, a sustainable position balancing low costs with excellent customer-focused service, which yields the most profit for the retailer.

The Optimal Differentiation Level

The optimal point of differentiation varies considerably from category to category and is mainly driven by three category characteristics:

- The category relevance to a store’s regular shoppers

- The strategic importance of the category to the retailer

- The ratio of costs in stores to expenses elsewhere in the supply chain

Usually, the more variation there is in consumer preferences within a particular category, the more it pays to differentiate.

Another major factor is waste, as an assortment tailored more tightly to the demand of the store’s natural customers makes it easier to maintain high availability while minimizing spoilage. Keeping products no one wants to buy on the shelves in the name of “availability” always pushes up spoilage.

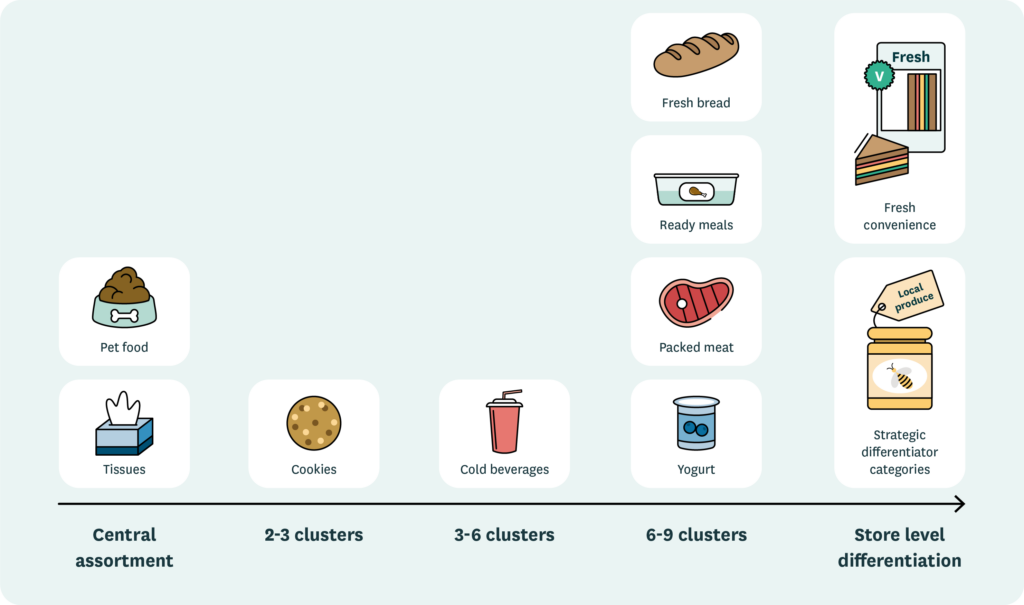

Store-level assortments are generally relevant only for fresh product categories with a high risk of spoilage and for those where the retailer wants to be recognized for having excellent variety, i.e. as part of its differentiation strategy. The chain-level (central) assortment is most suitable for categories like batteries, cards, toilet rolls, etc. At the other end of the scale, demand for ready meals, for instance, varies considerably from store to store, influenced by location and demographics. The illustration below shows typical differentiation levels by category.

Conclusions

Retailers are currently facing competing pressures: to provide more customer choice and to lower prices. From the point of view of assortment management, the best response is to identify the right assortment-differentiation level for each category offered by the retailer – and ensure the possibility of implementing it with intelligent clustering capabilities and the ability to drive assortment differentiation from centralized to store level.

At RELEX, we have years of experience building quick-to-implement solutions that create highly accurate assortment recommendations for every category. The assortments are constructed and tailored to each store’s space and demand profiles. Assortment optimization can be so effective that a pilot in selected stores can clearly demonstrate its potential to improve footfall, customer loyalty and sales.

In the following whitepaper, we explore how store-level planograms are always the best option for retailers capable of providing them if they can produce them cost-efficiently.