Supply Chain Planning Challenge Facing Mid-market Retailers

Nov 24, 2014 • 4 min

Supply chain planning is particularly challenging for mid-market retailers. Therefore, it is not surprising that they form the biggest customer group for RELEX, and we have helped many mid-market retailers to increase their profit by means of more advanced supply chain planning. Most big retailers consider themselves to be in the toughest spot, but we argue that mid-market retailers face a more challenging situation, as they encounter all the same complexities as big retailers with a volume that makes manual processes inefficient and risky but fall behind the big players in terms of possibilities to invest in resolving these challenges. In order to compete effectively, mid-market retailers need to employ efficient and effective supply chain optimisation solutions.

A typical mid-market retailer must wrestle with all the retail supply chain planning complexities that call for a top-notch solution:

- The volumes require good planning performance, and processes based on manual adjustment are inefficient. Typically, the SKU combinations used by a mid-sized retailers number in the hundreds of thousands or the low millions, and several thousand purchase order lines are processed daily. Therefore, spending time to adjust control of individual SKU-store orders is out of the question. At the same time, there are serious cost implications if a large proportion of the orders are far from optimal.

- Several logistics models are applied, usually direct store delivery, DC stock, and cross-docking. All these models and the various lead-times and order rules of individual suppliers must be taken into account in order operations. Furthermore, the material flow is usually so great that integrated control between store and DC planning has a huge impact on business. This creates a very complex supply chain environment, which requires solutions that remove the complexity and add efficiency.

- There are plenty of product introductions and terminations. The number of product introductions with our mid-market clients ranges from a few thousand products to hundreds of thousands. And the number increases by orders of magnitude with a move to SKU-store level. The quantity is so great that robust and automated processes are needed for handling the forecasting and replenishment linked to these product introductions, along with the corresponding product terminations.

- There is a huge volume of promotions. A large and increasing share of sales comes about through promotional campaigns in all sectors of the retail industry. On average, 30–70% of our mid-market retail clients’ sales come from promotions at any given time. Being able to forecast the demand associated with these promotions, effectively and accurately, and deliver the stock to stores in a timely manner has a great impact on their supply chain cost.

- Economies of scale are absent. Multibillion retailers can have teams of people handling and developing the forecasting and replenishment. Though the number of products and challenges is roughly the same for mid-sized retailers, it’s just not feasible to devote the same amount of labour to solving the challenges.

- There are fewer development and IT staff. Mid-sized retailers usually have only a few people who can lead combined business and IT development projects. Therefore, they do not have the capacity to take on huge and resource-intensive development or system-implementation projects.

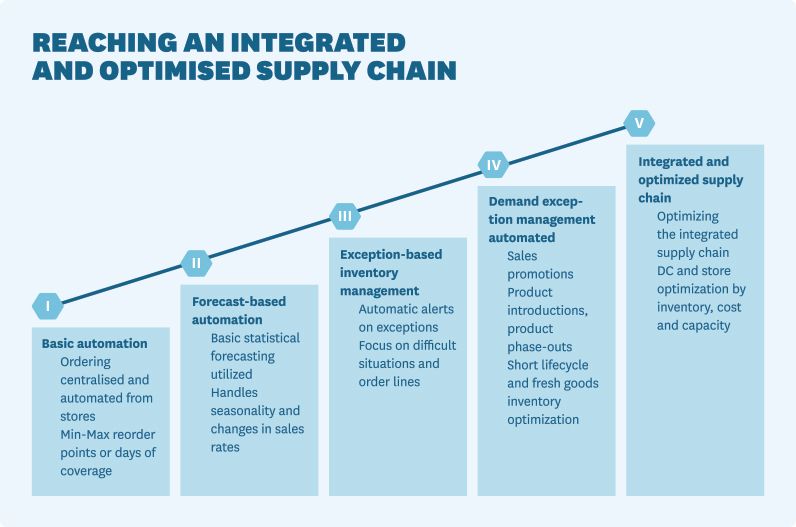

We have often described the maturity level of retail supply chain planning on a continuum starting with basic centralised replenishment and order automation such as min/max-based replenishment and ending with integrated planning of the whole supply chain through normal demand as well as exception factors such as seasonality, promotions, and product introductions. Our view of the planning continuum is depicted in the figure below, and for the best economic results the mid-market players need to include it all – just as the big guys do. Simple solutions are just not enough!

Mid-market retailers, however, face the added challenge that they cannot commit to several years of development initiatives continuously sucking away investment money and scarce development resources that are needed by all parts of the business.

In essence, this means that the intensive forecasting development projects or huge SAP implementations seen among the big retailers are not feasible for increasing performance in the mid-market realm. The cost, resource needs, and risk most often prohibit mid-market retailers from engaging in such projects, even though they recognise the need for such solutions.

We have a solution, which several multibillion retailers use with great satisfaction. It is built on our unique retail-supply-chain-optimised big data technology and offers a competitive advantage in the largest-scale environments. The big retailers have selected RELEX for the processing power and flexibility the solution delivers to help them solve their complex business challenges. However, mid-sized retailers are our biggest customer group.

The primary reason for our success in this sector is that we offer a comprehensive system that can be delivered with rapid implementation and minimal investment risk on a SaaS model. These strengths are clearest in work with mid-sized retailers. We have achieved great results with mid-sized retailers in all countries in Northern Europe and practically all sectors of retail – for example, food, books, clothing, consumer electronics, diy & builders merchants, general merchandise, and pharmacies.

All of them have reported significantly improved KPI values and the investment paying for itself within a few weeks to a few months, and all are happy to continue as RELEX customers. We will launch a series of articles presenting the challenges of mid-market retailers in more detail, along with some of the innovative solutions we have developed alongside them. If you would like to learn how RELEX could help your business compete for efficiency and be more profitable, please contact us.

** By ‘mid-market retailers’, we refer to retail companies with an annual turnover between £100 million and £1.5 billion.