Assortment rationalization: Why retailers need to get it right

Mar 20, 2024 • 6 min

No matter what vertical, season, day of the week, or region, consumers go into stores for one simple reason: to purchase products. Their primary interest is whether the retailer can fulfill their needs at that specific location. In addition to an efficient supply chain and optimized shelves being essential for the business, you are at serious risk of lost sales and, worse, lost customers if the assortment is not given equal attention.

“Of all tactical decisions that retailers and manufacturers make, the assortment decisions are the most critical. If assortment in a category is not correct, all other tactical decisions – shelf management, promotion, pricing, purchasing, buying – will be suboptimal.”

Brian F. Harris, creator of the study of category management

During the last few years, changing market conditions have meant that assortment rationalization has become even more of a consideration for retailers. The challenges are varied, including:

- Hypermarkets and “warehouse” retailers carry vast amounts of inventory, including many slow-moving items that drive up costs.

- Private-label items are gaining in the market, competing with national brands for precious shelf space.

- Discounters are on the rise in many regions, chipping away market share from their more traditional retail competitors.

- Consumers face analysis paralysis and decision fatigue in front of never-ending online assortments.

- Inflation and the rising cost of living are making consumers ever more price-sensitive, driving switching and cannibalization.

In this article, we will focus on assortment rationalization: what it is about, its benefits, and why every retailer should have a solid process for it.

What is retail assortment rationalization?

Assortment rationalization is the business process of identifying and removing underperforming products from the assortment. The assortment rationalization process forms a pivotal part of retailers’ overall category review process, directly and indirectly driving several benefits.

As discussed in greater detail below, the need for assortment rationalization often transpires where the category and/or the shelves become bloated and inefficient with too many customer choices or similar items that fill the same need.

The key goals of assortment rationalization are:

- Making the assortment more effective and efficient by removing products that do not perform well enough to support category goals and strategy.

- Eliminating duplication from the assortment to help reduce cannibalization and improve sales for better-performing products.

- Providing additional space for better selling products and thus reducing stock-outs or for new product innovations

- Reduce supply chain and warehousing costs through increased operational efficiency.

How assortment rationalization works

As the industry grows more complex, retailers must get their product assortments right. Success requires not only assortment rationalization but detailed analysis and planning and, eventually, assortment optimization to ensure that assortments remain profitable and customer-centric.

Best practices

Under-performing products take up precious space on shelves and reduce the potential profitability of the category. What we’ve learned working with our customers is that there are three essential steps to a successful assortment rationalization process:

- Determine which are the best and worst-selling items.

- Assess profitability to maximize margins.

- Review product duplication to ensure all need states are met.

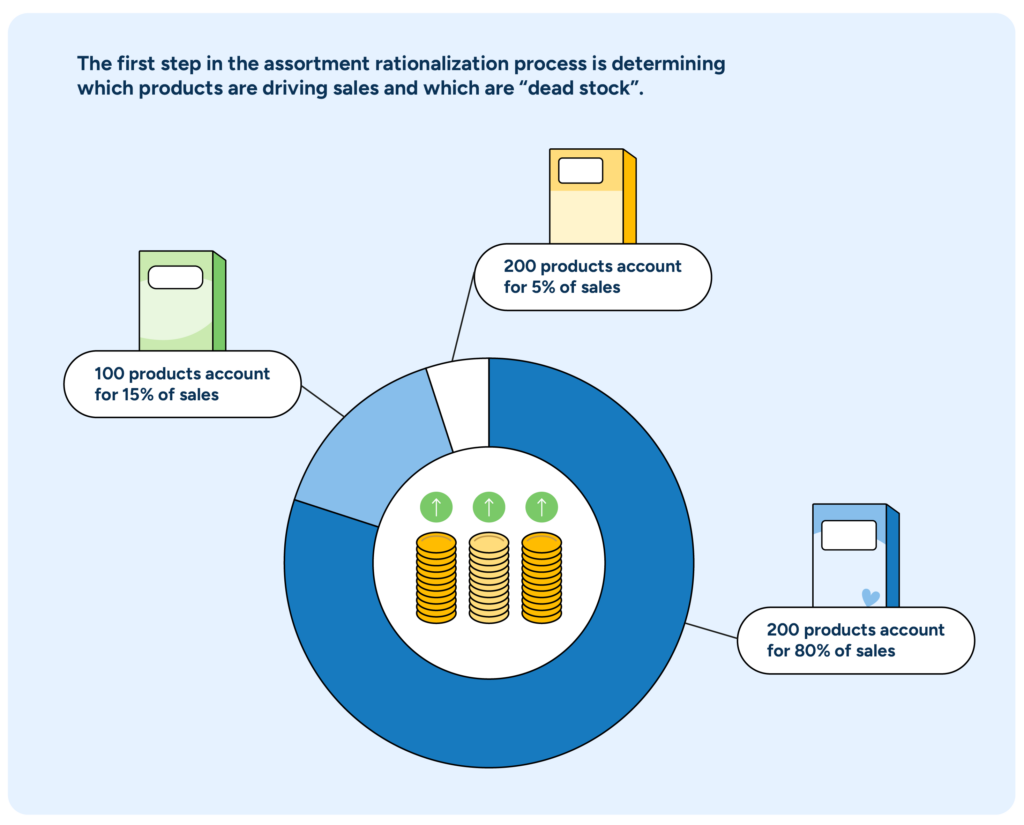

The first step in the process is to determine “dead stock”, such as those products with little to no incremental sales volume. To do this, we recommend carrying out a Pareto analysis to identify both the “head” (those products that account for the top 80% of your category sales) and the “tail” of your assortment (those products which account for the bottom 20% of category sales). Many retailers are surprised to see how few products form the “head” of the assortment, meaning a long tail of products contributes minimally to the category’s sales and performance.

For example, when analyzing a category with 500 products, we discovered that the 200 best-performing products generated 80% of sales. Expanding our analysis to the top 300 products, we saw the result rise to 95%. This means that 200 products – almost half the category – accounted for only 5% of sales in the category and were ideal candidates for removal. While this example may sound far-fetched, it is more common than you might think.

While we may be tempted to simply remove those 200 products (the tail) from our assortment, unfortunately, it is not that simple. While performance is often the primary method for deciding which products remain and which are cut, we also need to consider which products might be in the “tail” but ensure that our assortment remains credible in the eyes of the customer. Take “gluten-free bread”, for example. While it may be one of the poorest performing products in our assortment, removing it may cause certain shoppers to do their entire grocery shop elsewhere.

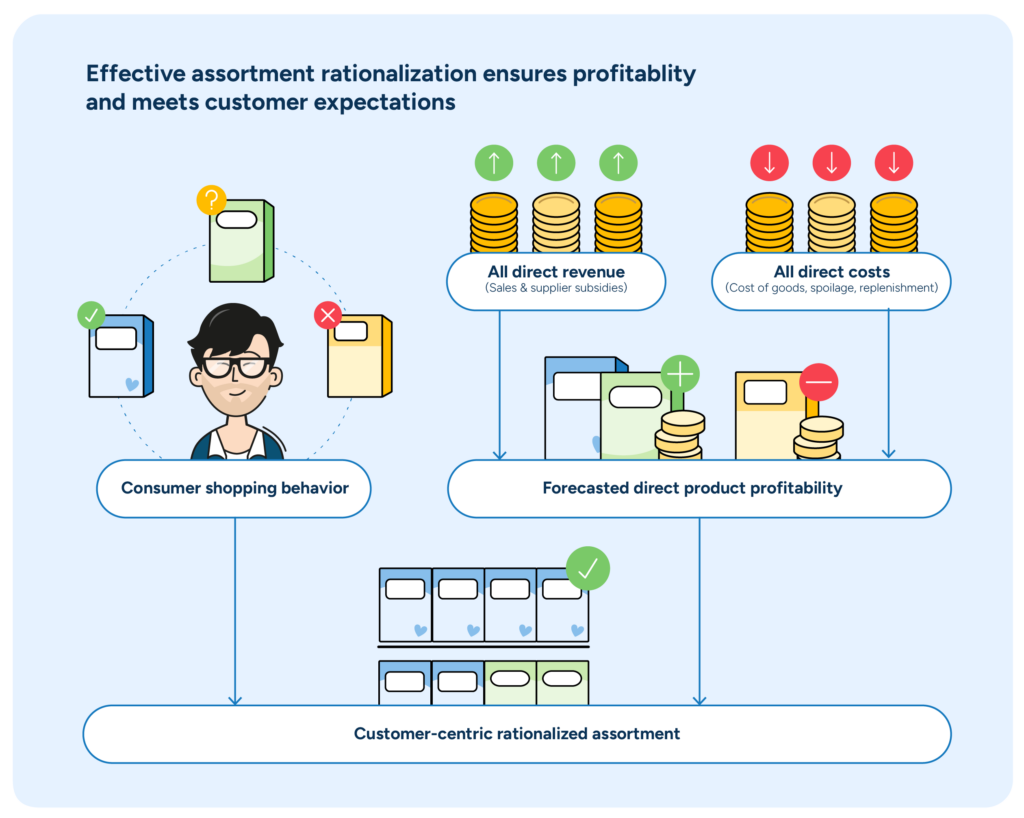

Therefore, after determining the best and worst performing products in the category, we want to identify those products that can be safely removed without negatively impacting margin or customer satisfaction. To achieve this, we calculate the true forecasted profitability of each product location.

Incorporating forecast data into the process enables us to estimate each item’s quantity and profitability for a specific period. The products’ direct revenues and costs can then be combined with the forecast, telling us how much actual profit the product in question will generate during the forecast period.

A consumer decision tree (CDT), also called a category decision tree, helps us understand the key customer need states within the category and ensure we avoid accidentally removing some need states completely. Using the CDT, we can identify core products that must always be kept in the assortment and cull duplicate products that can safely be removed while preserving a customer-centric assortment.

Once the above steps are complete, we can create a removal recommendation based on the thresholds we have set for the category, such as the forecasted direct product profitability level the product should generate compared to the category average.

Business benefits

How can we measure the benefits that assortment rationalization brings to the business? There are a few metrics that can be utilized. However, it is essential to note that distinguishing between cause and effect can be challenging when we look at the data, as many external factors could influence the results.

That said, we will examine several areas where the positive impacts of successful assortment rationalization should be most apparent:

Increased inventory turnover – Assortment rationalization seeks to cull underperforming and duplicate products from the mix. Removing these products gives more space and attention to higher-performing products and removes decision fatigue from consumers. The result is that the products left in the assortment will sell more frequently, driving improved inventory turnover and reducing costs.

Reduced delivery rows – Removing unnecessary products through assortment rationalization enables you to allocate more space to remaining products based on their replenishment needs and goals. This additional space means these products don’t need to be replenished as often, which saves costs and store associates’ time restocking shelves.

Improved net margin – By removing products with low profitability and keeping those with higher profitability on the shelf, we can increase the category margin. Utilizing the forecasted DPP metric mentioned above ensures we only remove those products forecasted to bring in the least profit during the forecasting period.

Improved space planning efficacy – Assortment rationalization improves space planning and optimization processes by providing more room for the best-selling items that need it. Based on our preliminary analyses with our pilot customers, we have seen assortment rationalization multiplying the benefits from space optimization.

Getting the most from assortment rationalization

While assortment rationalization is invaluable for solving issues of dense assortments by removing poorly performing products, the process raises a few questions for retailers. Most frequently, they want to know what they should do with the newly freed-up space after removing poorly performing products. While some may think adding new products is the solution, the correct answer is to reallocate the space to the best-selling items that need it and ensure that the benefits listed above are realized.

When done properly with a best-in-class solution, assortment rationalization can be a game-changer for any retailer. Assortment managers are busy people who don’t have time for complex, manual analyses of their products and categories. With RELEX, assortment managers can leverage automated recommendations on what products to remove based on the rules set for their categories. The only thing the assortment manager needs to do is to review the recommendations and act.