Cracking the omnichannel code: How to unlock online retail profitability

Jul 8, 2021 • 7 min

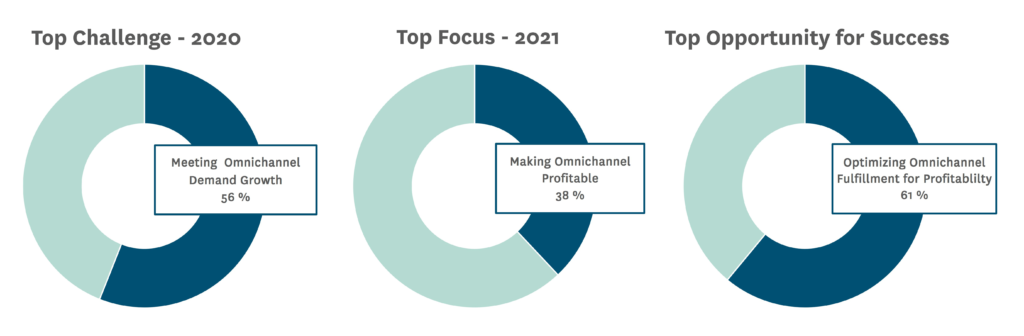

As we look back at 2020 and begin to assess all the changes that retail went through, it comes as no surprise that the necessary and rapid evolution of omnichannel is at the top of everyone’s mind. A report published by RSR Research in April of 2021 has shown that 56% of retailers named meeting omnichannel demand growth as a top challenge for 2020. Today, 38% of retailers feel they will be challenged to make omnichannel fulfillment profitable. Further, 61% of top-performing retailers are currently focused on optimizing omnichannel fulfillment for profitability by naming it a “big opportunity” for success moving forward.

How can retailers “crack the code” for success in omnichannel? I was able to sit down with Arhi Kivilahti, Retail Strategy Consultant at Ada Insights, to talk about the key models being used today for omnichannel retail, the benefits and risks of each, and the questions retailers need to ask themselves moving forward.

Johanna Småros: Hi Arhi, thank you for meeting with me today to chat about omnichannel retail.

Arhi Kivilahti: Thank you, Johanna. I’m happy to be here.

JS: Coming out of the omnichannel boom that we experienced in 2020, what do you think the future holds for online retail?

AK: Well, my first thought is that digital retail is a very nascent industry. There is a long history of experience when it comes to stores—what should and could be done. However, for omnichannel, we only have a relative handful of years, and 2020 was a very extraordinary year. We’re still waiting for all of the learnings of 2020 to accumulate. Retailers need complete data about what they did during the pandemic to figure out where to keep investing going forward.

In countries like the US and the UK, where the pandemic is easing up, brick and mortar is exploding but online is still growing. The trend I see appears to be a combination of both.

In countries like the US and the UK, where the pandemic is easing up, brick and mortar is exploding but online is still growing. The trend I see appears to be a combination of both. People still want that physical experience and the convenience of popping into a store. But they are using different channels to get a greater variation of products, get them faster, and as an information source about the products they are interested in.

JS: Now I want to get down to the nitty-gritty. Given the numerous options and variations for online retail, what are the pros and cons of the top methods being used today?

AK: The two main cost drivers for online retail are speed of service and picking efficiency. McKinsey & Company, a top management consulting firm, recently reported that cost as a percentage of sales for store picking is approximately 11%–14% and delivery is approximately 10%–13% for grocery retailers. Profitability is about balance, and each retailer must assess their own criteria to determine what they want to offer and how to execute it. Do you want to offer fast home delivery or click-and-collect? Or do you want to offer very efficient picking from a broader assortment with slower service?

Warehouses, especially those with high levels of automation, are by far the most efficient means of picking, but they are not without challenges. One online-only retailer in the UK that I’m familiar with has been talking for years about how efficient they are at picking, how few substitutions they have to make, and how big their assortments are.

However, they don’t talk about how far they are from their customers, meaning longer drives and less available drops per trip, or the sizeable investments that their large fulfillment centers require. They are now rethinking speed as the proximity of big warehouses to customers limits their ability to serve orders with immediate need.

Warehouses work best in large urban areas or when there’s a bit more leeway on delivery speed. They can also house many more products than stores, so the focus leans toward big baskets and next-day delivery or where customers reserve delivery slots for a predefined day, such as subscriptions.

Picking from the store floor was extremely scalable during the pandemic, but it’s an invasive approach. Stores are not really designed to handle this kind of fulfillment operation, especially at high volume. Picking efficiency is low and, with customers returning to the stores, the process slows even more. Additionally, the risk increases for a poor experience for both online and in-store customers.

Among the benefits of store-based picking is proximity to the customer, which enables click-and-collect or ultra-fast delivery options. It’s also important to remember that the smaller the screen, the narrower the assortment that customers actually buy. This is especially true if the customer is pressed for time. Smaller locations with smaller assortments then become the better option for specialty retailers with smaller, more valuable baskets.

Combining the automation and efficiency of a warehouse with proximity to the customer, micro-fulfillment centers and dark stores have been on the rise during the last 18 to 24 months.

Combining the automation and efficiency of a warehouse with proximity to the customer, micro-fulfillment centers and dark stores have been on the rise during the last 18 to 24 months.

The primary benefit of dark stores and micro-fulfillment centers is cost. Shorter distances save on delivery costs, especially when demand is high, and routing and vehicle utilization can be much more efficient. Further, click-and-collect options at these locations, as well as stores, can reduce or eliminate the need for delivery. The key to success with this approach is the ability to reach a warehouse-like level of picking efficiency while maintaining availability with the narrow assortment that the smaller space requires.

JS: What are your thoughts on third-party partnerships, like Instacart, versus retailers building those functions into their own operations?

AK: In my view, with delivery platforms or partners, the retailer almost becomes a supplier. There are some customers who have an affinity for a certain retail brand, but for many using Instacart, it doesn’t really matter whether the products come from retailer A or retailer B. So, the retailer gets the sale, but they don’t get the information about the customer. And, most importantly, they don’t have the relationship with the customer because that is transferred to the delivery partner.

JS: Are there any examples that you can give of retailers that are really on the right track to profitability with online?

AK: I think that the companies that are doing the best online have been very purposeful and consistent in their efforts.

Tesco in the UK have been doing this for 30 years already. They had a very smart idea and a very clear approach to how they wanted to use stores and experiment with dark stores. They stuck to their plan and maintained their long-term vision, and that consistency paid off during the pandemic when they had to double down on the online business. Tesco now says that the impact on their profitability from online and offline will soon be equal, so they’ve certainly been a great example.

I will say that it’s interesting to see more and more big US retailers utilizing stores for their online business.

I think that, in the US, there aren’t that many companies who’ve been consistently working with digital for that amount of time or with Tesco’s focus. I will say that it’s interesting to see more and more big US retailers utilizing stores for their online business. Wal-Mart did that prior to the pandemic, of course, but now Best Buy and Target have increased in-store fulfillment. Best Buy has said that increased focus will greatly influence their store network and how they utilize the space within the stores.

JS: Thank you very much for speaking with me today and sharing your expertise and insights. Before we wrap up, do you have any parting words of wisdom?

AK: I think that it boils down to retailers deciding “what are we really about.” Is it speed? Is it quality? Is it assortment? That’s going to be different for each retailer. It’s about understanding the entire business and the different relationships with different customer touchpoints. What is the value of home delivery over click-and-collect? What do various services provide for the entire business?

Service counters, for example, are often rather unprofitable, but they provide the perception of quality and service and are attractive for the most affluent and profitable customer base. The question then becomes whether online is a means to attract a certain level of customer. Understanding the big picture will inform retailers if online is creating stronger relationships. If the answer is “yes,” then it’s worth it.

My last piece of advice is, of course, to have patience, be consistent and methodical, and take small steps, small experiments.