Q&A: How to cure phantom inventory pains with predictive technology

May 28, 2024 • 10 min

Phantom inventory haunts retailers. The inability to trust when an inventory system claims products are on shelves or in stock is enough to frighten any profit-minded retailer. Scarier still: phantom inventory is so hard to detect that retailers may never be able to identify how much money the issue costs them in the long run.

We spoke with RELEXians Ulla Huopaniemi, a Lead Product Marketing Manager with 20 years of industry experience, and Stuart Douglas, a Product Lead with 14 years in the field, to explain the challenges of detecting phantom inventory — and how the right predictive inventory solution can overcome them.

Q: What is phantom inventory?

Ulla: Phantom inventory is a phenomenon where inventory system discrepancies increase the risk of stores ordering products either too soon or too late. The former scenario can exacerbate storage issues and lead to spoilage, and the latter can result in lost sales due to stockouts.

Retailers usually feel the pain of phantom inventory when their data shows products are out on the shelves despite those shelves being empty. You can’t sell something that doesn’t exist, but this causes teams not to order more products when they should.

Retailers usually feel the pains of phantom inventory when their data shows there are products out on the shelves despite those shelves being empty.

Simply put: phantom inventory causes ordering issues because retailers don’t realize their inventory data is bad.

Stuart: Maybe you’re a retailer that carries a broad assortment, or one that places inventory across multiple locations within a store. You could also deal in high-value items, making stockouts especially costly. Regardless of your situation, phantom inventory can get scary fast.

Q: What causes phantom inventory?

Ulla: The baseline problem is that companies keep inaccurate inventory records, which usually results from problems in capturing the data in various parts of the supply chain. When goods are received, not all items are scanned accurately. This leads to incorrect recording of inventory movements between locations.

Stuart: And that’s assuming a company has a system for perpetual inventory balance. A lack of records is a problem unto itself.

Ulla: There are other causes of inventory inaccuracies. Theft may occur in the store, resulting in missing items — often of high value — that go unaccounted for. But everyday loose or fresh items can also cause issues. Customers sometimes weigh items with the wrong labels, whether mistakenly or deliberately. This causes inventory to be assigned incorrectly, complicating tracking and management.

Stuart: That’s right, and the infrequency of inventory audits only makes matters worse. Audits are crucial to keeping accurate inventory records, as they verify that the inventory data matches the actual stock in the stores.

Paradoxically, these counts can actually contribute to inventory inaccuracies. Workers can accidentally miscount, and the fact that products can be placed in several locations within the same store or be buried in backrooms only makes matters worse. What seems like a simple task becomes quite error-prone.

Audits also consume significant store and labor resources, so it’s unrealistic to perform them frequently enough to help in the fight against phantom inventory. And from a shop floor perspective, there really isn’t enough information to make targeted count decisions. The only option is to check everything, which is terribly inefficient.

WATCH: The Disappearing Act: Retail’s Guide to Conquering Phantom Inventory

Ulla: Another issue comes to mind — the misplacement of inventory. A customer might pick up a hammer, walk around with it, and place it in the wrong location. A store employee wouldn’t have a logical reason to look for a hammer among the lawnmowers, so it throws off the count. The fact that stores often have multiple display locations and backrooms or warehouses with additional stock only adds to the confusion.

Q: How does phantom inventory impact retailers?

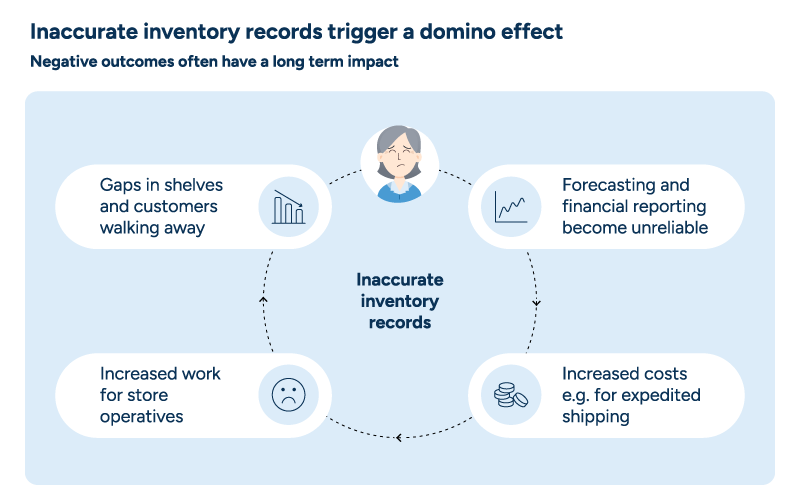

Stuart: There are the obvious results of inventory misalignment: stockouts, excess inventory, increased spoilage. Pretty much everything optimized inventory planning and management processes try to avoid, as every one of those occurrences costs a retailer money.

Don’t forget that stockouts have a long-term impact, as even loyal customers will switch to a competitor to avoid the annoyance of not finding what they need.

Ulla: I often compare the situation to dominoes. Inaccurate records cause forecasting and reporting to go haywire, resulting in supply and demand misalignments. The company then must place expedited orders to try to bridge this misalignment, which accrues additional shipping costs. The retailer then has store workers running around outside of anticipated delivery times to try and replenish the missing stock, which takes them away from their more customer-centric or sales responsibilities.

Inaccurate records cause forecasting and reporting to go haywire, resulting in supply and demand misalignments.

Stuart: And you’re still probably facing a situation where there are some missing products and gaps on your shelves, so again — unhappy customers, missed sales.

Q: How can retailers prevent phantom inventory and minimize its impact?

Ulla: The solution lies to some degree in cleaning up the processes that result in record inaccuracies. However, fixing all upstream errors is unrealistic, and issues like theft are beyond a worker’s control.

It helps to focus on where teams do have control. More intentional checks and counts can help store operations identify issues more effectively and in a more meaningful way. Basically, they can focus on more problematic areas rather than just checking all items one by one.

Linking these counts to accurate demand forecasting is especially beneficial for perishable items like fresh produce. This integration targets phantom inventory more precisely and ensures replenishment aligns closely with actual demand, making operations both more efficient and responsive.

Just as importantly, fixing inventory accuracy issues positively impacts a store’s workforce, in the sense that they can do intentional work instead of random, time-consuming scanning.

Stuart: Intentional is good. We pointed out that infrequent audits contribute to phantom inventory, but audits performed too frequently can also lead to inaccuracies. You can’t stop humans from making human errors, whether they’re customers or employees.

You can fix the processes to the best of your ability, but it will never be perfect. There will always need to be a methodology for detecting and correcting phantom inventory.

Q: How do you detect phantom inventory?

Ulla: Well, there’s the more obvious way, and then there’s the more calculated way.

Stuart: The more elegant way, maybe.

Ulla: In the more obvious way, let’s pretend I’m a home improvement or DIY retailer. I’ve stopped selling for the last two weeks. I typically sell a certain number of hammers every couple of weeks, but my inventory balance doesn’t reflect this. It shows my stock of hammers as positive and static.

By the time I send out a staff member to count, odds are they’ll realize the shelf is empty, and we’ve been losing sales for weeks without realizing it.

Stuart: I wish detecting every instance of phantom inventory were that easy! Unfortunately, most causes of phantom inventory are more subtle and require technology to measure. They’re also hard to detect early enough to mitigate.

This is where the more elegant way comes in: taking advantage of predictive inventory.

Q: What is predictive inventory?

Ulla: Broadly speaking, predictive inventory is a technology that leverages machine learning to predict inventory drift and detect inventory inaccuracies. It’s a rather innovative capability designed to improve the accuracy of inventory data used for automated replenishment. The RELEX platform builds an inventory model that estimates the impact of factors contributing to phantom inventory.

Stuart: We’re talking incorrect scanning, unrecorded damage to goods, spoilage, vaporization, theft — a wide range of contributing factors.

Ulla: Importantly, this predictive inventory model doesn’t just predict the true inventory balance. It also dynamically recommends when counts should happen in the store. These recommendations come either as an intelligent count frequency or as target items to count based on anomaly detection. They can then be prioritized by business impact and sequenced with awareness of store layout.

Additionally, the model can generate more accurate inventory estimations, which are then automatically used for order proposal calculations within RELEX.

Q: How does predictive inventory work?

Ulla: We’ve brought up predictive inventory as a method of detecting phantom inventory, but it’s more than that. A good predictive inventory model also estimates the business impact of inventory gaps, which helps to prioritize inventory checks at stores. The model can even automatically correct the drift if the retailer prefers.

Stuart: At RELEX, we use machine learning to analyze historical corrections in our inventory data. It allows us to predict and manage inventory level discrepancies effectively. But it’s crucial to understand that the past trends we learn from aren’t direct causes of these discrepancies; they’re indicators.

Ulla: We focus on factors such as product types, product groups, and store locations to contextualize the data.

A product type consideration could be, say, saws versus sandpaper. Saws are often prominently displayed in stores, and their frequent use in projects makes them generally more susceptible to mishandling. But sandpaper might not be tracked as meticulously as saws given their comparative size and cost.

Then there are product group factors — are tools more or less likely to be stolen than lawn mowers? Of course, this may vary by store location, with certain product types and groups being more vulnerable at different stores.

The model also checks the recent sales rate versus the probabilistic distribution of sales. I understand that’s a bit intense, so consider a product that typically sells at a rate of one per day. It’s not alarming if there’s a single day without a sale. After several days, if sales still haven’t occurred despite a positive inventory balance, it becomes statistically probable that an error exists within the inventory records, so the system raises a red flag.

Stuart: Exactly. The RELEX predictive inventory model can take these context points and use them to more accurately predict the likely error rates or inventory “drifts.” This helps us understand and anticipate potential inventory issues before they become problematic.

As with all things, there are limitations. We can’t predict spontaneous events — an employee accidentally dropping a crate because they stayed out too long at the pub the night before. That’s just unpredictable.

But we can train our model to identify general trends. A location near a university might be staffed by students, who — for the sake of this example, at least — might be more careless on average and thus lead to a predictably higher shrinkage rate.

Q: How can predictive inventory technology help mitigate phantom inventory?

Ulla: We discussed the issues phantom inventory can lead to earlier in the conversation: stockouts, excess inventory, increased spoilage. The short version is that predictive inventory helps minimize all of the above. It’s impossible to put a universal cost savings figure on it, but even a marginal decrease across those three categories would be substantial for any retailer.

Stuart: The long version: using predictions to guide inventory checks strategically.

If RELEX indicates a potential issue with a particular product at a certain location, that’s a cue for the store’s team to check that inventory. It’s about using historical and contextual data to make informed decisions and streamline operations. Ultimately, whether it’s through a predictive model or other detection methods, the result is the same: stores can identify which products need attention and provide a rationale based on our data-driven insights.

I don’t want to overstate the point, but it isn’t easy to count when you have inventory here, there, and everywhere in the store. Performing counts too often can introduce new errors even as you correct the original ones, so it’s better to use predictive inventory software to make those counts as intentional and targeted as possible.

Performing counts too often can introduce new errors even as you correct the original ones.

Ulla: RELEX can also integrate predicted balance directly into replenishment calculations. This capability allows for preemptive adjustments to replenishment, optimizing resource allocation even before targeted counts are conducted. The goal is to minimize manual interventions and ensure that only the most accurate, up-to-date inventory data informs replenishment decisions.

READ MORE: Unlock profitability with replenishment optimization

Q: How can RELEX help solve the phantom inventory problem?

Ulla: I was hoping you’d bring this up.

Existing systems on the market can detect and help with phantom inventory issues, but these systems are separate from the inventory systems most retailers already use. Retailers who want to take advantage of predictive inventory end up investing in a second technology just to gain those capabilities.

RELEX introduces predictive inventory into our existing supply chain planning and store execution solution. We have most of our customers’ data already, so we don’t often need to perform additional integrations to improve store operational efficiency and replenishment accuracy.

Stuart: I think that’s also a big point— creating and assigning tasks for store workers. RELEX can provide and prioritize the inventory count tasks based on sales impact or potentially floor plan while factoring in a store’s layout and product locations.

There are a few ways RELEX can facilitate those targeted counts we keep talking about. We do have RELEX Mobile Pro, which is our in-store execution app. It’s super easy to set up and assign a specific task for a floor worker to go, I don’t know, sort out what’s what with the tangerines because we suspect there’s a discrepancy.

But I know some customers already use an app to manage these things, and we don’t want to have people flipping around across multiple apps. We can make the data available to other applications as well to prevent that from happening. While I’m all about embracing digital tech to avoid paper waste myself, companies that aren’t quite ready to make that leap can also use printed reports for their store personnel.

Q: Any final advice for retailers?

Ulla: Embrace technology that identifies, predicts, and mitigates the impact of phantom inventory. Overcoming phantom inventory is all about moving from reactive to proactive inventory management. We want to ensure retailers can use RELEX predictive inventory technology to anticipate issues before they escalate — before they lose out on sales or see spoilage from overstocking.

Stuart: In this market — or any market, really — adaptability is critical. Retailers need a system that adjusts as their business changes — a unified system like RELEX that uses their data to inform inventory decisions in real-time, ensuring accurate forecasting and timely replenishment.

The factors that contribute to phantom inventory aren’t going anywhere. Any measures a retailer takes now contribute to long-term resilience, which makes adopting a solution like RELEX an important investment in future success.