How to manage price elasticity to enhance pricing strategies

Oct 27, 2025 • 13 min

The wisest farmers know exactly where and when to plant their seeds to ensure the best harvest. They understand their soil, weather patterns, and crop behavior to maximize returns. For instance, they know that if they throw seeds on rock, the seeds have no chance of growing, wasting valuable resources.

Smart retailers operate with the same strategic thinking. They understand customer behavior patterns and invest promotional dollars where they’ll generate the greatest return. They don’t waste discounts on products that don’t meet their customers’ needs.

But doing this well requires a clear understanding of price elasticity, the relationship between price changes and consumer demand. This insight reveals which products will drive volume when discounted, and which will quietly erode margin with little to show for it. Retailers who understand elasticity can optimize both revenue and profit, while those who ignore it risk pricing themselves into back-breaking losses.

With thousands of products and hundreds of weekly promotions, retailers need sophisticated systems that automatically calculate elasticity, predict consumer responses, and enhance promotional strategies across their entire assortment. RELEX handles the overwhelming mathematical challenge of price elasticity and turns it into actionable intelligence that prevents the kind of mistakes that have put retailers out of business.

What is price elasticity?

Price elasticity is a mathematical measurement of consumer demand that calculates the impact on revenue when a product’s price is changed. This metric helps retailers understand how certain products are sensitive to price changes.

Calculating a product’s elasticity involves examining historical pricing data to determine future forecasting behavior. For example, if a retailer previously discounted a certain item, they would analyze how that price change affected revenue and profit. This analysis is crucial for helping retailers predict future consumer responses and adjust their price planning strategies accordingly, like determining which products to promote and which ones to trust to support higher margins.

Interestingly, the same item can exhibit different elasticity depending on how it’s sold. An item might be inelastic at regular retail prices but become highly elastic when promoted or placed on clearance. This variation requires retailers to calculate elasticity separately for each nuanced sales method, ranging from base pricing to promotional and clearance scenarios.

How price elasticity in retail works

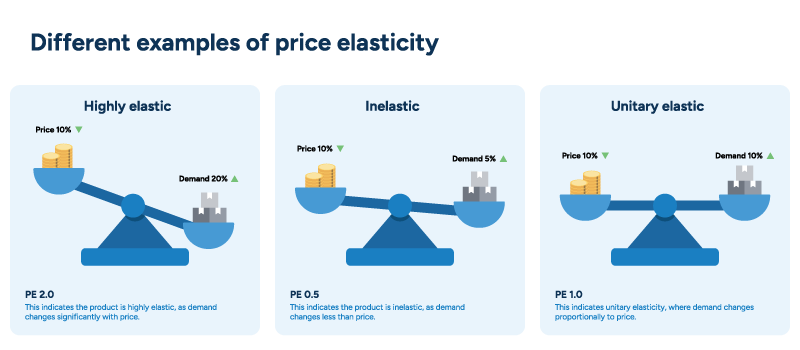

Price elasticity measures consumer demand mathematically by calculating the percentage change in demand divided by the percentage change in price.

Mathematically, this might be written as:

Price Elasticity (PE) = (% Change in Quantity Demanded) ÷ (% Change in Price)

The formula creates a numerical PE value that reveals how sensitive customers are to pricing changes. The numbers tell a clear story about consumer behavior. Elasticity is expressed as a positive number that indicates the strength of demand response.

| PE Value | Status | Explanation |

| 0 | Inelastic | Demand remains unchanged regardless of price change. |

| 1 | Unitary (Parity) | 10% price reduction leads to a 10% increase in demand. |

| 2 or higher | Highly Elastic | 10% price reduction leads to a 20% (or greater) increase in sales. |

Most retail products fall within the 0 to 3.5 range, where pricing strategies can meaningfully influence purchasing decisions. Elasticity values above 3.5 usually indicate poor data quality rather than genuine consumer behavior. Most pricing systems cap elasticity calculations at approximately 3 to maintain data reliability and produce actionable insights.

The more accurate your elasticity calculations, the more accurate your forecasts become. Retailers can confidently predict the exact sales response and revenue impact when discounting products by specific amounts and use this insight to make well-informed decisions.

Elastic demand vs inelastic demand

After learning about how PE is calculated as a numerical value, retailers need to know how this translates to real-world pricing strategies. Generally, products are categorized as having either elastic or inelastic demand. Understanding the differences between elastic and inelastic products is crucial for pricing success, as they require completely different strategic approaches.

Elastic demand: The promotional powerhouses

Elastic products have a PE of more than 1, of which highly elastic products are usually around 2 or above. These products are highly sensitive to price changes, meaning that a slight change in price will significantly impact demand.

Examples of elastic products include:

- Non-essential items (such as entertainment subscriptions and gourmet foods)

- Travel and leisure services (such as hotels and airline tickets)

- Fashion and apparel (such as seasonal clothing and trendy accessories)

- Electronics (such as smartphones and gaming consoles)

- Prescription drugs not covered by insurance (in the US)

- Fuel

These items excel as promotional candidates because they build store traffic and create larger basket sizes. Customers perceive good value when seeing familiar brands at discounted prices. Many elastic products become Key Value Items (KVIs) that significantly impact customer perceptions of your overall pricing strategy.

READ MORE: How optimizing the price of a few Key Value Items (KVIs) can fuel market share growth

Inelastic demand: The profit generators

Inelastic products have a PE between 0 and 1 and are considered less sensitive to price fluctuations. Consumers tend to buy the same quantity of inelastic products and purchase them infrequently, so demand doesn’t noticeably shift if the price changes, resulting in more stable pricing overall.

Products that are typically inelastic include:

- Essential goods (such as bread, milk, and rice)

- Basic hygiene products (such as toothpaste and soap)

- Home goods (such as spatulas and cooking pans)

- Holiday staples (such as pumpkin pie mix, turkey, peppermint candy)

Products with inelastic demand are considered poor candidates for promotions because discounting won’t meaningfully increase sales. However, they’re excellent opportunities for strategic price increases to generate additional profit at their regular price. The extra profit from inelastic items helps offset discounts offered on elastic promotional products or for products like KVIs that are highly sensitive to competitive impact.

The price image paradox

Mathematical inelasticity doesn’t eliminate psychological impact on a retailer’s price image. Certain inelastic products carry disproportionate weight in customer price perceptions.

Milk exemplifies this paradox perfectly. Families buy the same amount of milk each week, regardless of the price, yet customers notice the price because they purchase it frequently. When milk prices rise too high, customers assume that everything else costs more as well.

This perception damages the overall price image despite milk’s technical inelasticity. Due to their inelastic nature, everyday food items like milk and bread are typically used in news reports to convey price changes across multiple retailers that are beyond their control. As a result, even minor price increases on these products can disproportionately affect how shoppers view a retailer’s prices overall.

Unitary elasticity: The balanced middle

Although the majority of products fall into the elastic or inelastic categories, some may be considered unitary elastic. These products have a PE of exactly or very close to 1, where the percentage price change equals the percentage demand change. Unitary elastic products tend to be rare in practice but represent perfect balance points in pricing strategy.

Examples of unitary elastic products are less common but could include:

- Mid-range restaurant meals (neither luxury nor fast food)

- Standard consumer goods (such as branded coffee or tea)

- Books and magazines (non-essential but moderately priced)

4 factors that influence price elasticity in retail

Although certain products are broadly elastic, inelastic, or even unitary elastic, it’s important to note that price elasticity isn’t static. It’s a dynamic measurement that fluctuates based on multiple factors. Understanding these variables is crucial for retailers who want to improve their pricing strategies and avoid costly mistakes.

1. Business goals and objectives

Specific profit margin and revenue targets influence how retailers apply elasticity insights across categories. Different product categories carry different margin requirements.

For example, organic breakfast cereals might target 40% margins while regular cereals aim for 35%. These precise objectives shape promotional strategies and determine which elastic products receive priority for discounting.

Store-wide goals also impact elasticity decisions. Retailers focused on market share prioritize elastic products that drive traffic, while those who emphasize profitability tend to lean toward inelastic products that offer higher margins.

2. Vendor funding availability

Vendor funding often drives promotional decisions more than elasticity itself. Retailers prefer discounting products where suppliers subsidize margin losses. This funding makes promotional pricing financially viable even for moderately elastic items.

When vendor funding supports promotions, retailers can afford deeper discounts. These partnerships enable aggressive pricing on popular brands without devastating profitability. Always consider funding availability when evaluating promotional candidates.

3. Seasonality effects

The time of year that a promotion occurs could have a dramatic effect on its overall success. Some products can experience dramatic seasonal elasticity changes throughout the year.

An obvious example of this is Christmas trees, which become highly elastic from November through December 24th. But after Christmas, they have zero elasticity because retailers stop offering them, and consumers stop buying them. Further examples include ice cream and soups. Ice cream shows summer elasticity while soup responds better to winter promotions.

Understanding these seasonal patterns helps retailers time their promotional activities accordingly. Promoting soup in July wastes valuable discount dollars on a product with low seasonal elasticity that could deliver stronger results if applied to items more responsive to price during that time.

4. Trends and external Influences

External trends and events can force sudden changes in elasticity, creating unexpected demand shifts. Celebrity endorsements, health scares, or viral social media trends can create artificial demand spikes, making normally inelastic products suddenly responsive to pricing.

Emergencies and crises, like natural disasters, can also create temporary elasticity changes. Whether it’s fuel, water, or other essential supplies, consumers will pay premium prices during crisis periods. These temporary shifts require retailers to understand emergency pricing laws and ethical considerations during these desperate times.

Price elasticity risks that can impact retailers

Price elasticity can be a powerful tool when retailers understand how to invest their discount dollars appropriately. But mismanaging elasticity can be fatal, with retailers going out of business for promoting the wrong products too deeply or raising prices on the wrong products at the wrong time.

Smart retailers balance elastic promotional items with inelastic profit generators and psychological price image to improve their pricing mix. They can choose to increase volume and revenue through elastic product promotions or increase revenue and profit through inelastic product pricing, but volume may decline.

Ultimately, it’s possible to optimize two of these three metrics simultaneously, but rarely all three at once. Understanding this trade-off helps retailers make informed strategic decisions and avoid the costly mistakes that result from mismanaging price elasticity.

Retailers face significant challenges when managing price elasticity across their assortments. If not properly addressed, these obstacles can seriously impact profitability.

Scale and complexity issues

Based on our experience, the average major retailer manages approximately 52,000 different products. They promote roughly 14,000 items weekly, accounting for over 20%-33% of their entire assortment. Calculating accurate elasticity for each product represents a monumental challenge.

Manual elasticity calculation becomes virtually impossible at this scale. Retailers need advanced systems to handle the mathematical complexity. Without proper tools, pricing decisions become based on intuition rather than data.

Historical data requirements

Accurate elasticity calculations require substantial historical data. Retailers need a minimum of two years of pricing and sales history before they can begin calculating elasticity effectively. However, global disruptions, such as the COVID-19 pandemic or the recent U.S. tariff changes, have created unusual demand patterns that skew calculations.

Filtering relevant historical data from anomalous periods requires careful analysis. Too little data produces unreliable elasticity calculations, whereas too much irrelevant data creates equally problematic distortions.

Competitive copying dangers

Some retailers find it tempting to substitute proper elasticity calculations for competitor analysis. They assume competitors have done the mathematical work correctly and that their calculations will be compatible with their products. Although this approach feels like a good way to outperform a rival, it can create dangerous vulnerabilities in pricing strategy.

Using competitor prices ignores the unique demand patterns that distinguish one retailer from another. Every retailer attracts different customer bases based on factors like product assortment, service quality, and store experience. These differentiators create distinct price sensitivities and purchasing behaviors among customers.

When retailers default to competitor pricing as their primary strategy, they risk misaligning their prices with their own customers’ demand patterns. Instead of competing effectively, retailers end up with pricing that neither leverages their strengths nor serves their customers’ expectations, ultimately losing ground to those who better understand and respond to their own market dynamics.

Price image consequences

Mismanaging elasticity creates a cascade of problems that damage the overall price image. Promoting inelastic products wastes promotional budgets while disappointing customers who expect discounts to deliver meaningful value. Price image can take years to build but can be lost in a week of poorly managed prices.

Price-matching strategies often backfire spectacularly. When a premium grocery retailer matches prices with a discount chain, they’re essentially advertising that the discount retailer offers better value. This messaging encourages customers to question why they shouldn’t shop at the discount chain directly. The premium retailer inadvertently undermines their own value proposition while highlighting a competitor’s strength.

Critical business failures

Poor elasticity management has driven even some of the biggest retailers into bankruptcy. Large specialty retailers have promoted themselves to closure through unsustainable discount strategies, creating a “desperation” atmosphere that signals financial distress to customers.

Smart elasticity management prevents these catastrophic outcomes. Retailers must understand which products deserve promotional investment and which are likely to generate a profit. Getting this balance wrong threatens a retailer’s long-term viability.

How to use pricing software to enhance price elasticity strategies

Managing price elasticity across thousands of products with efficiency and accuracy requires sophisticated planning software to achieve optimal results. RELEX manages the necessary technical complexities while delivering actionable insights that pricing teams can utilize.

Automated elasticity calculations and data intelligence

Advanced pricing platforms, such as RELEX, calculate elasticity automatically using years of historical transaction data. They process complex demand patterns to identify reliable elasticity insights without manual calculation errors. The software continuously updates these calculations as new data becomes available.

In addition to historical analysis, RELEX data handling employs Bayesian modeling techniques. This is crucial for new products and new retail customers without pricing history; the system utilizes hierarchical category structures to estimate elasticity. When data is limited, intelligent algorithms provide confidence ratings alongside their calculations.

To avoid the ill effects of anomalous real-world events, the system identifies when historical data patterns show unusual variability. It automatically shifts focus to recent sales trends when products show changing demand patterns. RELEX adjusts data weighting to prioritize relevant time periods over potentially deceptive historical periods.

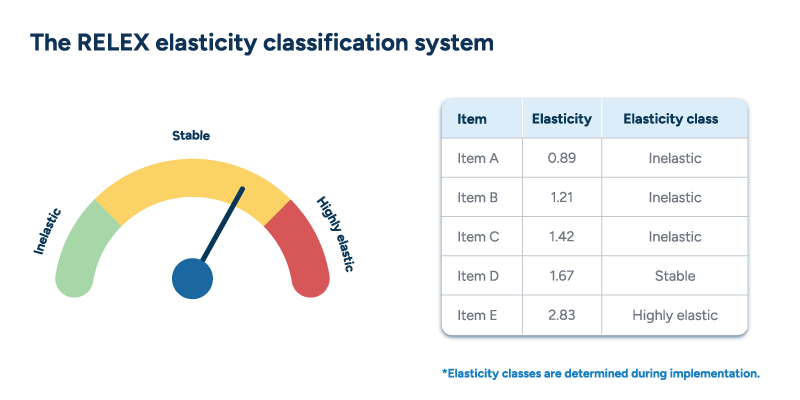

Intuitive elasticity classification system

Raw elasticity numbers like 1.347 don’t help busy category managers make quick decisions. Instead, RELEX converts traditional price elasticity values into three logical classifications:

- Highly elastic

- Stable

- Inelastic

Think of it like a car’s gear system, which rounds up to single-digit gears rather than displaying gear ratios. Category managers can instantly identify which products respond strongly to price changes without needing to interpret the meaning of the numbers. They can also spot inelastic products suitable for margin expansion without doing mental math.

Advanced sorting capabilities enable fast product analysis based on elasticity classifications. Managers can easily filter through thousands of products and focus on highly elastic items.

Predictive pricing and integrated forecasting

RELEX pricing software incorporates predictive pricing capabilities that automatically adjust pricing based on elasticity calculations, market conditions, and business objectives. The system implements predetermined pricing strategies when specific elasticity patterns emerge. When conditions change, the software alters pricing without manual intervention.

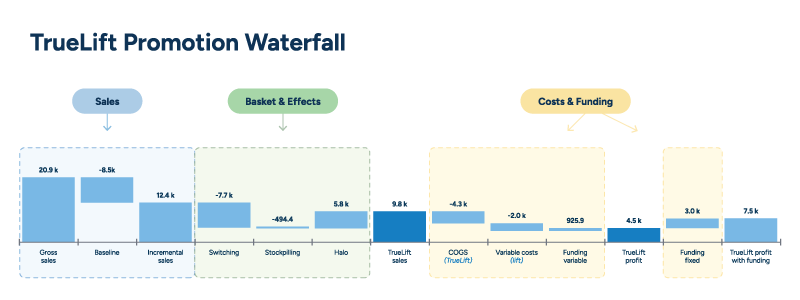

When using RELEX, elasticity is also embedded directly into demand forecasting through tools like TrueLift Sales and TrueLift Profit. When retailers consider promotional pricing, the system automatically calculates expected volume, revenue, and profit impacts. True elasticity calculations must take into account all of the variables involved in calculating the TrueLift impact of price activity. This includes incorporating cross-effect variables to determine the entire consumer response to price changes in a way that can be viewed and utilized. Variables include:

- Switching/cannibalization

- Stockpiling/pantry loading

- Halo/affinity

This integration improves retail pricing precision and eliminates guesswork from promotional planning decisions.

Retailers can model various discount scenarios before committing to a strategy. The software clearly illustrates how various price points affect key performance metrics. This predictive capability transforms pricing from reactive management to proactive optimization.

Take the calculated approach to price elasticity

Pricing teams face relentless pressure to balance competing demands across thousands of products and hundreds of weekly promotions. They must optimize revenue while protecting margins, respond to competitive moves, and justify every promotional dollar spent. Without the right systems, even experienced teams struggle to translate elasticity insights into confident, scalable decisions.

When natural elasticity patterns are understood and respected, retailers can build pricing strategies that drive volume, protect margins where sensitivity is low, and adjust quickly as market conditions evolve. However, to consistently make these informed decisions at the required speed, it’s essential to have tools that translate complex data into clear, actionable guidance.

Modern price optimization technology from RELEX gives retailers the visibility, automation, and foresight to work in harmony with price elasticity, instead of fighting against it. The system utilizes historical data to automatically calculate elasticity, categorize products intuitively, and forecast the impact of promotions, enabling retailers to compete effectively and avoid wasting promotional budgets. With RELEX, retailers can align every pricing decision with real consumer behavior to drive stronger, more profitable outcomes.