The splintered supply chain: Why regional hubs demand localized intelligence

Sep 24, 2025 • 6 min

The global supply chain is going local. The old playbook of long lead times, single-source strategies, and centralized production has become obsolete. Even companies with multiple sources face concentration risks when facilities cluster in the same geography.

What’s driving this change? A convergence of trade tensions, geopolitical shifts, and rising costs have fundamentally reshaped the decades-old model of centralized, single-source manufacturing. With the United States imposing tariffs of on major trading partners from China to Brazil, these are tectonic shifts reshaping global commerce.

Yet within this disruption lies remarkable opportunity. A new model is emerging: regional manufacturing hubs powered by AI-driven, localized intelligence. Companies that master this transition won’t just adapt, they’ll transform supply chain fragmentation into sustainable competitive advantage.

The collapse of the old model

Three major forces have converged to make traditional supply chain strategies obsolete: First, trade wars have expanded beyond bilateral disputes into global economic realignment. Second, costs have escalated even in traditionally less expensive manufacturing hubs. And finally, concentration risks that companies accepted for decades have become existential threats.

Understanding each of these forces is essential to grasping why regional hubs aren’t just an alternative, they’re the future.

Trade wars have gone global

The trade volatility that began with US-China tensions has expanded into a global phenomenon. What started as targeted measures has become wholesale economic restructuring, with tariffs now representing the largest tax increase since 1993.

India’s experience illustrates the severity. Electronics exports that previously faced minimal tariffs now confront duties exceeding 25%. Similar dramatic increases affect sectors from gems and jewelry to textiles, threatening millions of jobs and billions in trade.

Costs are spiraling beyond control

A majority of companies now report cost increases exceeding 10% year-over-year, with shipping and logistics costs reaching unprecedented levels.

These aren’t temporary spikes. They’re the new baseline. Supply chain disruptions, cyber attacks, and labor stoppages have become so frequent that volatility itself is the new normal.

Concentration risk has become existential risk

The pandemic exposed what risk managers always knew but executives often overlooked: single-source strategies are incredibly vulnerable. When the vast majority of organizations experience supply chain disruptions in a single year, the message is clear: geographic concentration isn’t efficient. In fact, it’s dangerous.

McKinsey’s 2024 report on supply chain vulnerabilities found that many supply chain leaders report ongoing challenges, yet only 30% of boards deeply understand supply chain risks. Companies are attempting to tackle today’s challenges with yesterday’s strategies.

Regional hubs: The new reality

The shift toward regional manufacturing isn’t just a trend, it’s a fundamental restructuring of global production. Three regions have emerged as clear winners in this transformation, each offering unique advantages and facing distinct challenges. Their success stories provide a roadmap for understanding how the new supply chain geography will function.

Mexico: North America’s manufacturing floor

Mexico has emerged as the undisputed winner of nearshoring. Foreign direct investment (FDI) hit $31 billion in the first half of 2024 alone, with manufacturing now capturing over half of total FDI. Companies like Samsung, LG, and major automotive manufacturers are expanding operations at unprecedented rates.

Mexico isn’t just an alternative to Asia; it’s becoming North America’s production powerhouse. So much so that infrastructure struggles to keep pace with demand. The question isn’t whether Mexico will grow, but whether it can scale fast enough to meet increasing demand.

Vietnam: Asia’s resilient electronics supplier

Vietnam’s rise defies simple categorization. Electronics exports alone reached $72.6 billion in 2024, with the nation successfully positioning itself as the alternative to China through competitive costs, improving infrastructure, and strategic location.

Vietnam now ranks as a critical node in global electronics, with major corporations accounting for significant portions of the country’s exports. Still, there are some challenges. The US doesn’t yet recognize Vietnam as a market economy and skills gaps remain despite massive training programs.

Poland: Europe’s unexpected champion

Poland has quietly become Europe’s electronics manufacturing leader, with an educated workforce exceeding the EU average and providing skilled workers for advanced manufacturing. The country offers what Western Europe cannot: competitive costs with EU membership benefits.

Major players have established significant operations, benefiting from Poland’s strategic location, skilled workforce, and improving infrastructure. The electronics market continues to grow steadily, positioning Poland as a key player in European manufacturing resilience.

The complexity challenge

Managing regional supply chains isn’t simply about replicating operations in multiple locations. Each region presents unique requirements, from consumer preferences to regulatory frameworks. Companies must navigate this complexity while maintaining efficiency and brand consistency.

Every region is different

Regional manufacturing isn’t as easy as copy-paste. Latin American consumers prefer smaller pack sizes and lower price points, while southeast Asian fulfillment must navigate fragmented infrastructure along with complex last-mile delivery, and European sustainability regulations differ dramatically from US requirements.

A product assembled in Mexico may avoid US tariffs but face barriers in Europe. Palm oil alternatives acceptable in North America may fall short of European standards. What works in Vietnam won’t necessarily work in Poland. This isn’t just complexity, it’s multidimensional chess.

The diversification imperative

The vast majority of businesses are actively de-risking their supply chains through diversification across regions, suppliers, and transportation modes.

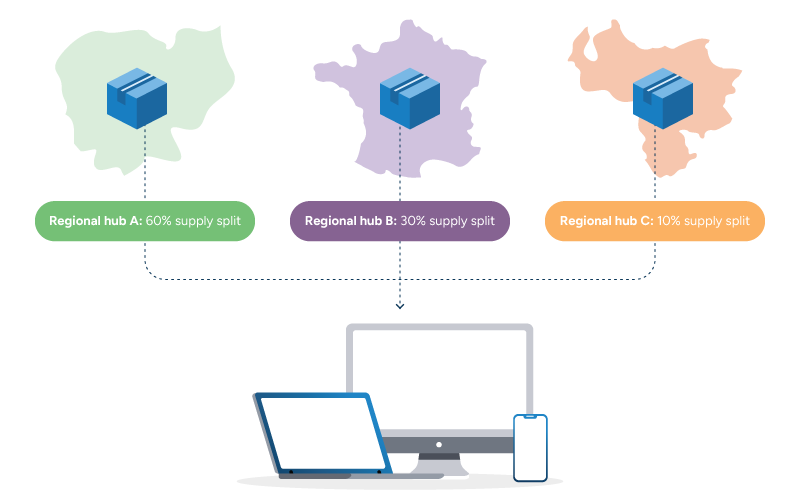

Some call it the 60/30/10 model: 60% from primary sources, 30% from secondary, 10% from tertiary. Others pursue more complex strategies, but they tend to revolve around the idea that concentration is vulnerability while diversification is resilience.

This isn’t just about adding suppliers. It’s about building networks that can flex, adapt, and reconfigure as conditions change. It’s about creating options, not just capacity.

Speed is survival

In an environment where conditions can change overnight, traditional planning cycles have become liabilities. Companies need new approaches to decision-making that prioritize fast manufacturing without sacrificing accuracy.

Traditional planning cycles are obsolete. When tariffs can change overnight, when a ship stuck in a canal can disrupt global commerce, when labor strikes can shut down ports, annual planning is fantasy.

Companies need to make decisions in days, not months. They need to adjust sourcing in hours, not weeks. They need visibility not just into their suppliers, but into their suppliers’ suppliers. And they need to do this while costs rise, complexity increases, and margins shrink.

The AI advantage

Artificial intelligence is the key to managing complexity at scale. The companies that can already successfully navigate regional supply chains are those using AI to turn data into decisions, evolving complexity into competitive advantage.

Transformation through intelligence

Early adopters of AI-enabled supply chain management report remarkable results: dramatic reductions in logistics costs and inventory levels, with service efficiency improving by over 60%. These are step-changes in performance.

This explosive growth reflects the simple reality that companies can’t manage modern complexity with traditional tools. Excel spreadsheets can’t optimize tariff-aware bills of materials across multiple regions. ERP systems can’t dynamically adjust sourcing based on real-time risk assessments.

Localized intelligence at scale

The winning formula combines global coordination with regional execution. AI models that understand local seasonality, promotions, and consumer behavior. Systems that automatically adjust sourcing based on factors like tariffs, lead times, and costs. Platforms that optimize bills of materials by region while maintaining global standards.

With the right functionality, these tools can improve human decision-making, giving planners the ability to see patterns humans can’t detect so they can evaluate a larger variety of options and respond at speeds humans can’t match.

From fragmentation to advantage

The splintering of global supply chains isn’t a problem to solve; it’s a reality to embrace. Companies clinging to centralized, single-source production will find themselves outmaneuvered by those who master regional complexity.

The winners will build unified systems that bridge global goals and local realities. The age of the monolithic supply chain is over. The age of intelligent, regional networks has begun. The fragmentation is the solution.

Ready to turn regional complexity into competitive advantage? Learn how to model multiple supply chain scenarios and optimize decisions across your regional hubs with the RELEX guide to supply chain scenario planning.