Retail pricing strategies: How AI keeps retailers profitable and popular

Jun 6, 2025 • 14 min

Years ago, when I was in the trenches in retail, I had an all-powerful, indestructible laptop to safeguard the massive spreadsheet I used to calculate and track pricing KPIs. The office lights dimmed when I powered up my computer.

So, I sympathize with today’s category managers who are still mired in spreadsheets or outdated planning systems. Inaccuracies and inefficiencies are baked into the very processes they use to manage their retail pricing strategies. These processes can’t handle the requirements and scale of retail data analysis, no matter how heroically teams maintain their files.

The good news is that pricing solutions have advanced far beyond formulas and data tables teetering on the edge of breaking every time someone uses the office microwave.

AI-driven retail price optimization solutions now integrate, process, and analyze data from across the organization in near real-time. This level of visibility and control gives retailers the rapid insights they need to effectively manage pricing decisions across locations, categories, and banners – every week.

Let’s explore how the right solution helps companies determine and execute optimal retail pricing strategies that protect margins, maintain a competitive price image, and increase customer satisfaction.

Types of retail pricing strategies

A pricing strategy determines how a product will be priced to achieve a particular KPI. Before we talk about implementing a strategy, let’s consider our options.

There are five standard retail pricing strategies.

- Preserving the status quo: Often, for main stake products, retailers prefer to maintain revenue and margin levels. They’re not looking to make big changes that could upset the balance of demand for that product.

- Gaining incremental margin wins: In the convenience category, retailers may risk slightly wider margins, but they keep that risk to a minimum to avoid alienating customers.

- Maximizing margins: Your margin enhancers are products that allow you to significantly improve margins without negatively affecting demand or price image.

- Protecting your territory: In some cases, it’s worth pricing certain products somewhat aggressively, even to the slight detriment of your margins, if it means gaining an edge over the competition.

- Staying competitive – even if it costs you: Sometimes, competitors offer such low prices on specific items, you need to match them just to get customers through the door. Highly aggressive pricing may significantly shrink your margin on that product, but it’s worth it to protect your price image and increase traffic.

So now you have an array of strategies. How do you decide which strategy to apply to each product?

The challenges of selecting a strategy and the dangers of getting it wrong

There’s a lot at stake when designing a retail strategy. A poor strategy can create inventory inefficiencies, erode margins, reduce your competitiveness, and damage customer trust.

You’ll have to wade through a lot of considerations and data before you can determine which pricing strategy best fits each product, category, location, and season.

Data, data everywhere, but we don’t know what to think

To determine the impact pricing decisions have on demand, retailers must gather enormous volumes of data from multiple sources and then store, process, and analyze that data to make effective decisions.

Plus, as a retailer, you may have 100 categories, multiplied by five banners, available in five different pricing regions. That’s a lot of input to analyze, often on a very tight schedule.

Most planning processes cannot handle and organize this flow of information at the rate the industry moves. Without a system that creates a cohesive picture of data at a granular, product-specific level, retailers won’t have the insights and visibility to plan efficiently, meet demand, and achieve margin targets.

Determining price elasticity

Price elasticity refers to how drastically changes in price affect demand – a key consideration when devising a strategy.

Products that experience significant demand fluctuations in response to price changes are considered highly “elastic.” For example, if you put non-essential treats on sale – cookies, candy, chips – you’ll likely see a spike in demand as people stock up on their favorites.

Other products – usually staples like bread or milk – are “inelastic.” Demand for these products remains the same, regardless of price. If you raise the price of milk, consumers will likely still pay it because they consider milk a necessity. If you run a promotion, it probably won’t make a significant difference, especially for perishable items. People only go through so much milk in a week.

If you have the data processing capabilities to do it well, calculating price elasticity helps you determine how much flexibility you have when setting prices.

But there’s a catch. Strategies must be tempered by real-world factors like price image.

Protecting your price image

“Price image” refers to the consumer’s perception of how much value a retailer provides.

So sure, you could raise prices on an inelastic item like milk and still see the same demand, but consumers will remember and begrudge your attempts to make your margins on these staple products.

They may also assume that if you’re raising prices on milk, your prices for non-essential items are too high. You may end up losing sales and customers in the long run – especially since 62% of shoppers prioritize price and are willing to switch stores for better deals.

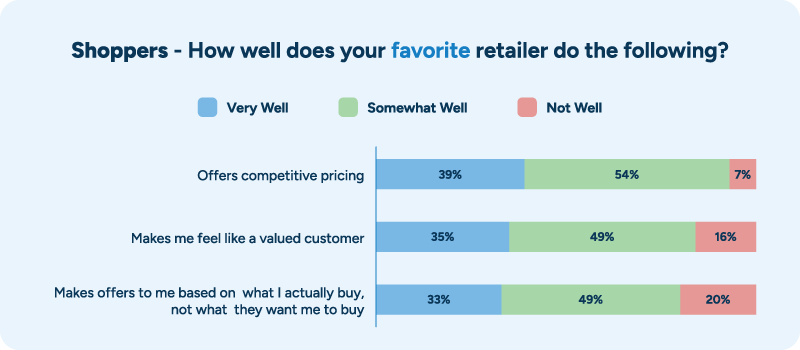

In fact, 54% of shoppers report that their favorite retailer performs only “somewhat well” in offering competitive pricing, meaning many companies could lose customers to competitors that swoop in and offer better perceived value.

Learn more: How retailers can thrive in price-sensitive times

Managing complexity

Aside from price elasticity and consumer loyalty, you also need to monitor your competition, market shifts, supply disruptions, geopolitical activities, and all the other factors impacting supply chain decisions.

For instance, is a national chain competitor opening down the street and running big promotions? Have market conditions upended the supply-to-demand ratio? Did a freak weather event delay shipments, forcing you to source from a more expensive supplier?

Amid this complexity, you have a careful balance to strike. For example, you may need several margin enhancers to offset the loss associated with every competitively priced item – while still maintaining a good price image and reacting to fluctuating circumstances.

You’ll need a cohesive, adaptable planning process to do so – and that’s another problem.

Disconnected planning systems

Many retailers use pricing spreadsheets that are just not built to handle retail’s daily influx of information and rapid decision-making. Plus, they’re often not connected to any other planning functions within the company.

Let’s look at a hypothetical example.

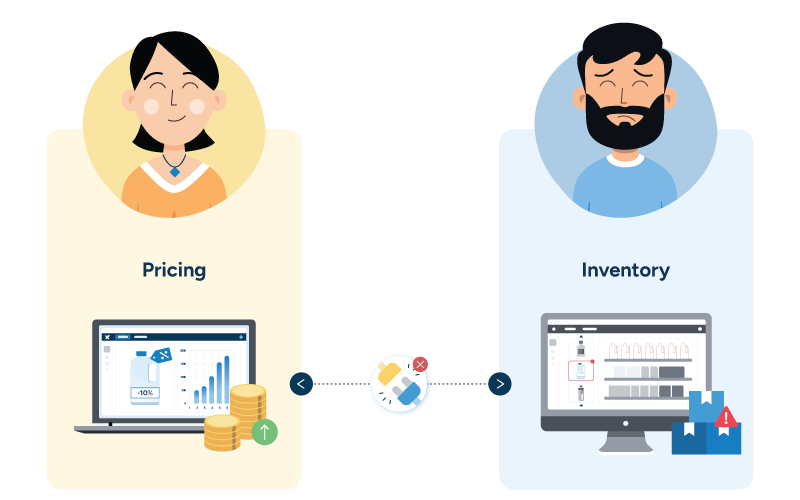

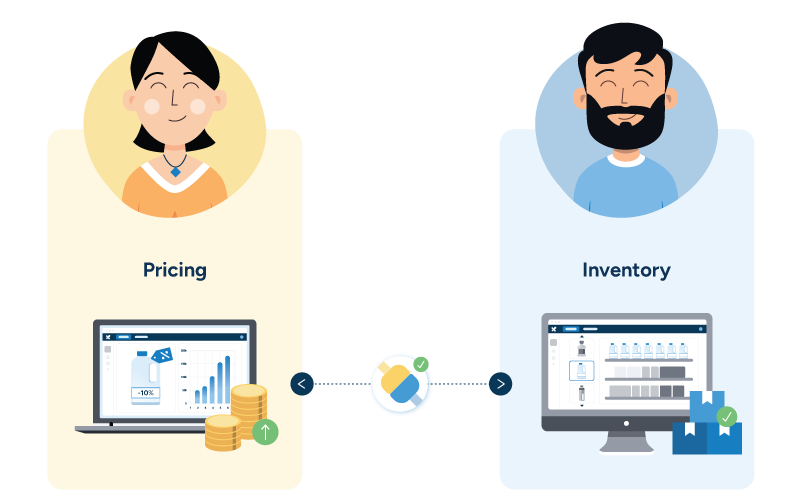

A category manager, Jan, has set what she believes is a profitable pricing strategy based on the data available to her. Even if Jan has designed a great strategy in theory, it may not be feasible.

Let’s say she decides to competitively price laundry detergent, dropping the price by 10%.

Does that price align with ongoing promotional campaigns? Is there enough inventory to support a sudden spike in demand? Do stores have enough shelf space to handle that extra inventory? The other planning teams may know, but without connected planning modules, Jan doesn’t.

What’s more, if there is no link between Jan’s pricing solution and, say, the inventory management solution, the inventory planners won’t know about Jan’s pricing changes and won’t realize the impact on demand until it’s too late. It’s a recipe for stock-outs and disgruntled customers.

This lack of supply chain collaboration and visibility leads to inefficiency and profit loss – not to mention frustration – across the business.

The impact of AI on retail pricing strategies

Most retailers are almost seven years behind advancements in pricing technology – and considering how rapidly AI is improving, this tech debt is growing exponentially. Many retailers are missing out on the near real-time data capabilities, advanced algorithms, and AI innovations that truly optimize pricing decisions.

These days, AI is a prerequisite for successful pricing strategies because it helps you understand how those strategies are performing and how to improve them. It analyzes huge swathes of data and weighs competing objectives and constraints so you can quickly gauge your best course of action.

An AI-driven tool like RELEX Price Optimization helps you focus on and balance your top five KPIS:

- Sales

- Profit

- Traffic

- Halo effects

- Low-investment margin enhancers

Accounting for these goals, RELEX finds the best opportunities and items for price adjustments so teams can better understand how to generate more traffic, increase basket sizes, monitor competition, and protect price image.

Five ways AI-driven pricing software enhances pricing strategies

So, how does RELEX help companies achieve all these benefits? What tools, methods, and technology do we use?

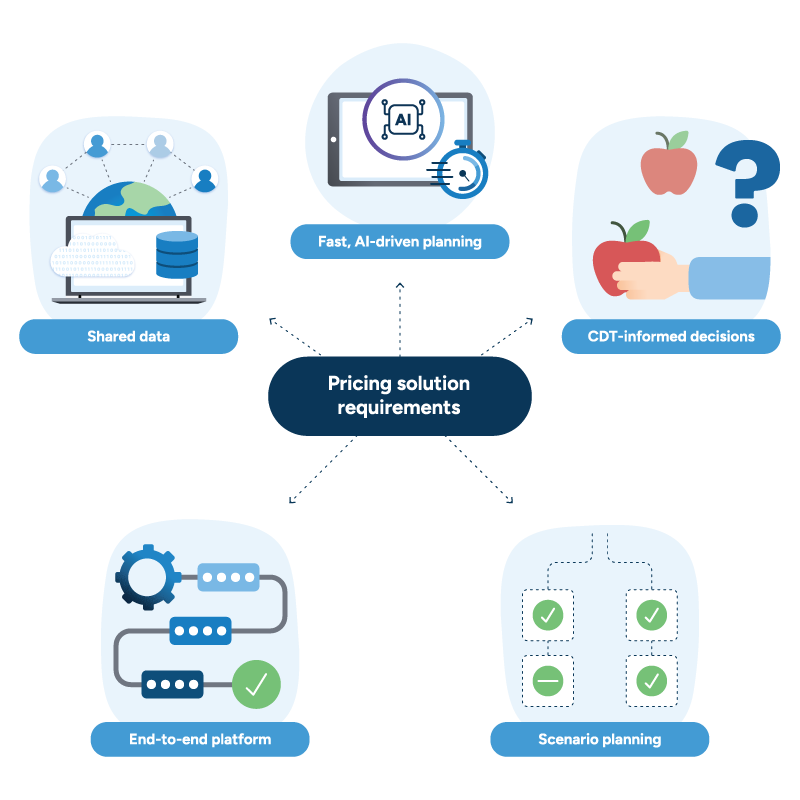

Our pricing solution improves planning accuracy and speed by incorporating different AI algorithms into an environment powerful enough to handle retail-scale data. It also applies consumer decision trees (CDTs) and scenario planning for even better-informed pricing decisions. But the benefits don’t stop there.

The solution integrates with the rest of the RELEX platform, connecting data and plans across functions and sparing teams the negative — and often unexpected — ripple effects of siloed decisions. With a unified platform, teams can plan efficiently and collaboratively, delivering shopping experiences that give customers good reason to keep coming back.

Let’s examine each of these capabilities in turn.

1. Sorting and analyzing data

Retail generates a lot of data, and the RELEX platform is built to handle it, capable of managing tens of millions of SKU-locations. The solution can pull information from across POS systems and different planning functions, while also incorporating external information concerning suppliers, weather, seasonal events, and more.

Whatever ERP, REST API, or bespoke process you’re using, RELEX channels these multiple data streams into a single data pool for easy collaboration. It also employs data-cleansing capabilities to ensure the information is accurate and up to date.

This data-sharing foundation feeds, streamlines, and improves all your AI calculations and supply chain decisions.

Learn more: The IT Playbook for Successful Data Management

2. Accelerating and improving planning with machine learning and gen AI

Once you have all that data, you need to process and analyze it quickly to keep up with the market, but planners have limited time and bandwidth. That’s where AI steps in. RELEX uses machine learning (ML) algorithms to eliminate the grunt work of forecast calculations and analyze data at superhuman speeds.

For instance, ML-based forecasting can account for pricing and promotional initiatives to calculate how those teams’ decisions will affect overall demand.

This combination of automation and planner expertise allows teams to focus on the exceptions that require a human judgement call, increasing the speed and accuracy of forecasting decisions and all the planning decisions that rely on those forecasts.

Learn more: The complete guide to machine learning in retail demand forecasting

The RELEX platform also gives planners access to Rebot, an interactive gen AI system that provides quick answers to planners’ industry and solution questions.

Plus, we’re actively developing Rebot into an assistant that will be able to provide company-specific recommendations and proactively assist planners in countering market disruptions.

3. Incorporating consumer decision trees

AI works with any data set you give it, but the more that data set reflects the real world, the better the outcomes.

RELEX uses consumer decision trees (CDTs) to inject reality into AI calculations. The system learns from every consumer decision so teams can set better pricing rules.

For instance, let’s say the CDTs help you decipher consumer buying patterns that indicate negative customer responses to frequent or major price changes. You then set rules to prevent the system from changing prices more than once a month or by more than 10%. The system can also alert your teams if there is no price that meets every requirement so they can manage by exception.

With strategic rules guiding automation and improving decisions, your planners can focus on their targets. They have the insights they need to meet not only their primary objectives but also their secondary and tertiary targets, boosting overall business performance.

4. Running scenarios

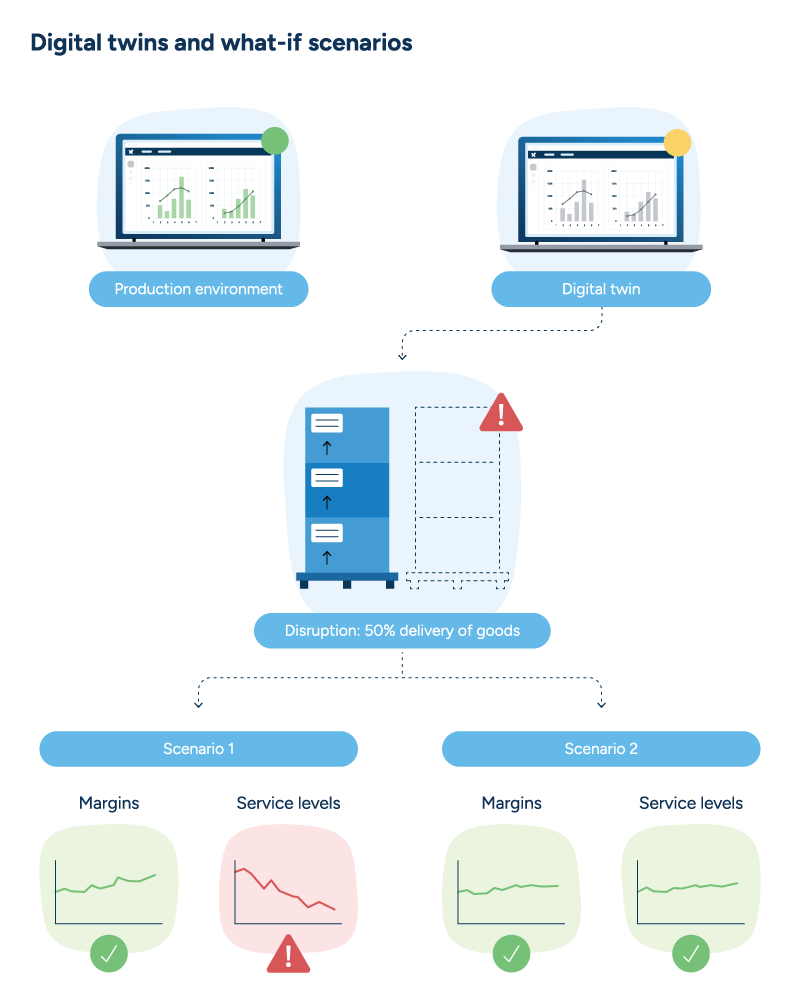

Retail planning is full of “what-if” questions, and our pricing solution makes it possible for planners to answer them.

RELEX provides a digital twin, a replica of the physical supply chain, that allows teams to test outcomes based on real-world data.

For instance, say that a sudden disruption makes it likely that only 50% of an expected shipment will be delivered.

Before committing to any specific action, planners can run scenarios in this sandbox environment to see which decision will most likely protect or balance their prioritized objectives.

Learn more: Digital twins in supply chain management

5. Unifying planning processes to improve KPIs and reduce volatility

RELEX Price Optimization easily integrates with the rest of the RELEX unified platform. Our platform helps you avoid fractured data and tunnel-vision planning by connecting every retail and supply chain planning function to a shared core of data and AI-driven calculations.

Let’s return to our category manager, Jan, for a moment to illustrate the impact of a unified planning solution on pricing decisions.

This time, when Jan decides to competitively price laundry detergent, the unified solution can automatically check if there is a conflict with upcoming promotions.

The supply chain team also gets an alert and can verify if they can source enough stock at the right price to fulfill projected demand and make a profit.

At the operations level, space planners can ensure there’s enough shelf space for the extra stock and position inventory where it will best attract customers.

This unified approach:

- Improves and aligns decisions between functions.

- Uses AI to enrich data, accelerate decisions, and increase productivity across the entire planning suite.

- Balances competing needs and constraints to directly support the company’s goals.

- Improves customer satisfaction without sacrificing efficiency – driving down costs, reducing waste, and protecting margins.

Staying two steps ahead: Connecting retail pricing strategies to promotions

Retail pricing strategies are only as effective as the planning platform they’re built on. You can try to scale with spreadsheets until your laptop starts billowing smoke, but an AI-driven pricing tool will give you far better value for far longer, with the added bonus of not setting off your fire alarm.

But that’s not the end of the story. When it comes to implementing a new pricing solution, it pays to think two steps ahead.

Once that pricing solution is up and running, how do you ensure those strategies are effective and account for other planning decisions? What’s the best next step?

Many retailers plan to integrate their pricing module with their promo planning solution. Promotions drove $1 trillion in sales in 2023, so it’s no surprise that 69% of retailers reported interest in automating processes that communicate price changes across their organizations.

Connected AI-driven solutions are the foundation of investments that drive long-term ROI, and they hold the key to efficient and competitive price and promo planning.

FAQ

What is a pricing strategy?

A pricing strategy is the method retailers use to set prices to meet specific business goals while accounting for factors like cost, competition, demand, and customer behavior.

What do businesses need to determine and execute successful pricing strategies?

Retail pricing strategies rely on planning solutions that can:

- Process data at retail scale.

- Improve and accelerate calculations with AI-driven capabilities.

- Incorporate consumer decision trees and scenario planning.

- Unify pricing decisions with the rest of the organization’s supply chain and retail planning processes.

What are the five types of retail pricing strategies?

The five types of retail pricing strategies are:

- Status quo pricing: For core products, retailers typically prioritize consistent revenue and margin levels, avoiding major changes that could disrupt established demand patterns.

- Minimal margin improvements: Within the convenience category, retailers might pursue slightly higher margins while limiting risk to prevent customer dissatisfaction.

- Maximum margin optimization: Certain products serve as margin enhancers, allowing for substantial margin improvement without compromising demand or overall price perception.

- Moderately aggressive pricing: Some products benefit from aggressive pricing strategies, even to the slight detriment of margins, to effectively counter competition.

- Competitive positioning: Extremely competitive pricing tactics may be necessary on certain items, despite significant margin impacts, to match competitor prices and drive store traffic.