State of the retail supply chain 2018

Nov 2, 2018 • 4 min

How to Gain Competitive Advantage in Retail?

The current landscape for UK retailers is getting more and more competitive, with many leading retailers facing uncertainty. This highlights the need for an effective and efficient supply chain to ensure survival and growth.

This report identifies several areas where we believe retailers could improve their operational efficiencies based on deficiencies they have highlighted.

Key Takeaways from the Report:

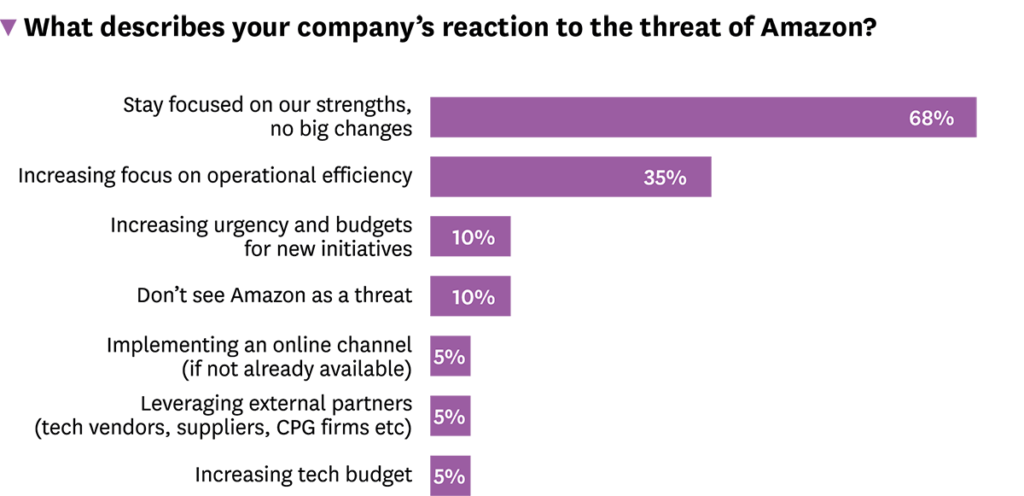

1) The threat of Amazon continues to rise

90% of the companies we interviewed see Amazon as a significant competitive threat and 70% of retailers feel that the market is more competitive than ever. The most popular way to respond to the threat of Amazon taking market share is to focus on existing strengths (68% of companies). A recent survey stated that online retailers have a significantly higher out of stock rate than traditional retailers, improving availability is clearly another way of competing with the online threat.

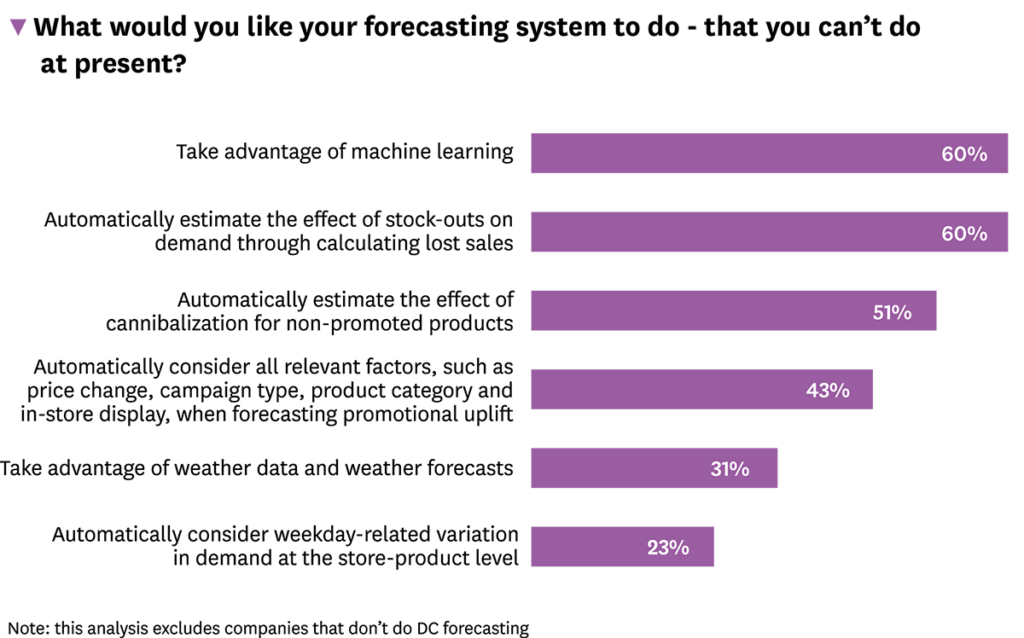

2) Better sales forecasts

The primary improvement requested by respondents was better sales forecasting to ensure superior availability. 60% of companies would like to be able to estimate the effect of out-of-stocks on demand through calculating lost sales.

3) Better promotion planning leads to increased customer satisfaction

The tough trading environment means that many retailers are relying on promotions to draw in customers and increase transaction value. But, promotion planning is letting a number of retailers down. 51% would like to be able to estimate the effect of cannibalization on non-promoted items to ensure promotions have the desired effect on the whole range. And 43% would like to automatically consider all relevant factors such as price change, campaign type, product category and in-store display, when forecasting promotional uplift. With these two measures in place the effectiveness of promotions would be significantly enhanced also leading to higher customer satisfaction.

4) Improve in-store experience by optimizing your space and assortment planning

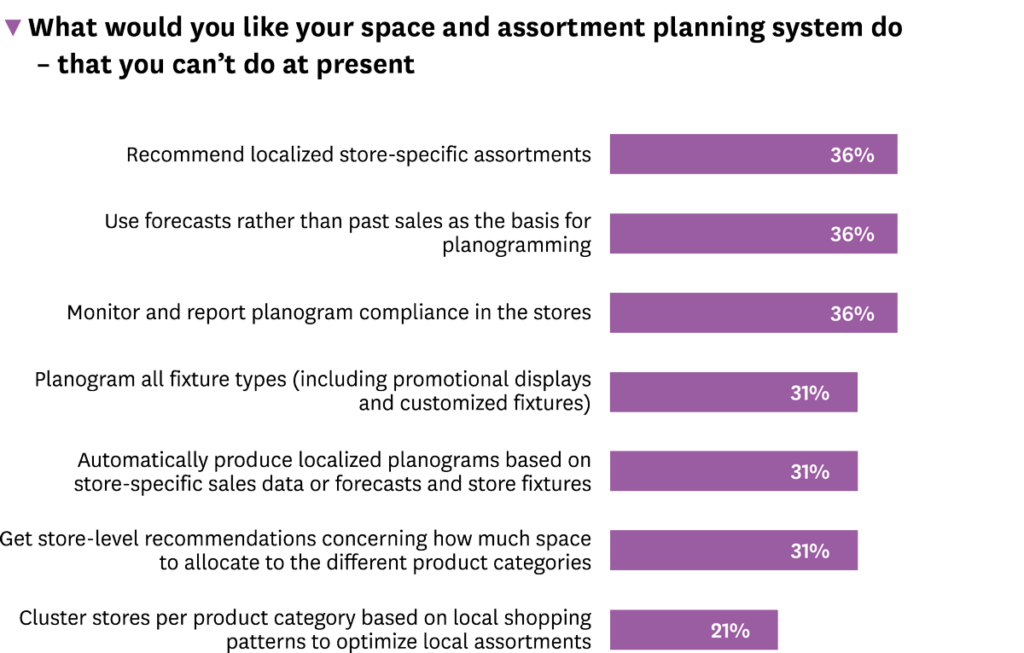

Optimized space and assortment planning is a way to respond to the threat of Amazon and other online competitors. Some 36% of retailers would like their system to be able to recommend localized store-specific assortments so that sales can be maximized across the business. Equally popular is the desire to use forecasts rather than past sales as the basis for planogramming. Some 31% of companies do not have systems that planogram all fixture types and this is a big omission that would go a long way to improving the in-store experience.

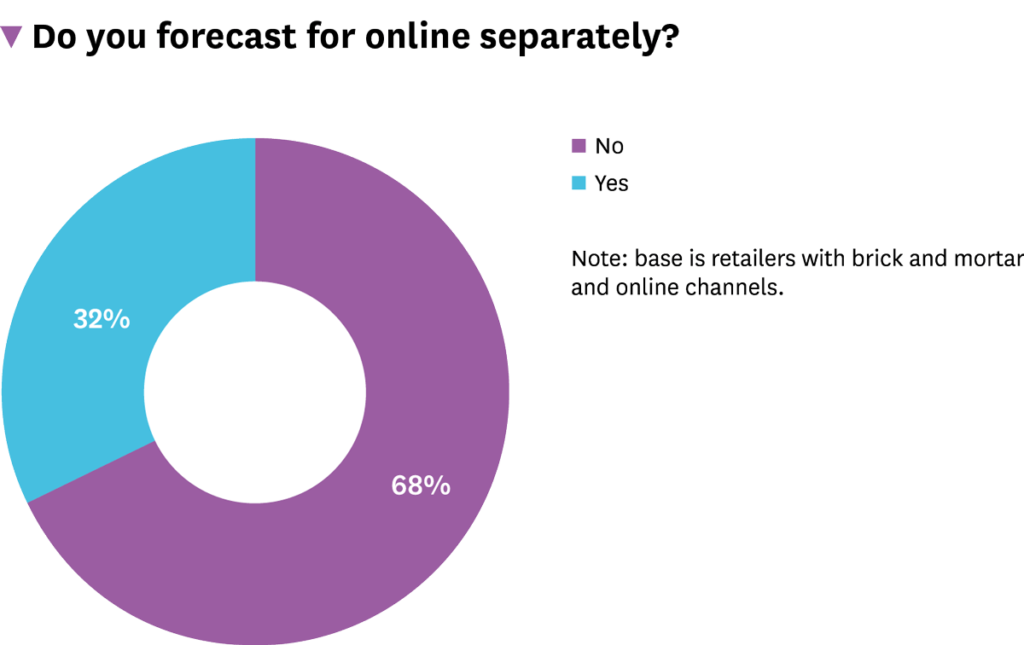

5) Only 32% of omni-channel retailers forecast store and online separately

Omni-channel retailers have plenty of scope to improve their sales forecasting as only 32% of them have separate forecasts for stores and online. Martec anticipates that as the value of online sales increases more companies will see the value of separate forecasts for each sales channel as a way of anticipating sales in the other channels.

6) Inefficient supply chains leading to £1.5b a year in spoiled fresh food

We estimate that the cost of expired and spoiled fresh products in the UK due to inefficient supply chain management to be at least £1.5 billion a year and probably nearer £3 billion. Food retailers who address this issue now will be better able to satisfy their customers, improve the quality of their fresh food offering and stay in business.

7) Retailers waking up to optimizing their supply chain

However, it looks as if there will be some major improvements in performance soon as we uncovered high levels of supply chain system replacement and implementation. 23% of companies plan to replace their automatic store replenishment systems in 2018-19 and 19% will replace their demand forecasting system in this time frame. So, it does seem that retailers are realizing that without automated processes and systems their availability and customer service will suffer unacceptably. The supply chain is a strong competitive weapon against traditional competitors and online retailers, it is clearly a major focus for many retailers and those who are not looking to improve will suffer.