Navigating tariff volatility: Smart pricing strategies when costs get complicated

Jun 27, 2025 • 9 min

You wake up Monday morning to the news that tariffs just jumped 20%. By Tuesday, your competitors are scrambling with different responses. Some retailers absorb some of the costs, while others pass everything on to their customers. By Wednesday, you’re fielding calls from suppliers wanting to renegotiate terms. And Thursday? Tariffs change AGAIN.

Tariffs have surged back onto the business agenda in 2025, hitting retailers from different angles: procurement costs spiking, pricing strategies needing complete overhauls, and competitive dynamics shifting overnight. The retailers thriving in this environment aren’t just reacting faster but using data to make smarter decisions.

When tariffs hit, everything changes

The domino effect nobody talks about

Tariffs don’t just add a line item to your cost structure—they create cascading disruptions that alter how your business operates. The most immediate impact is obvious: the cost of goods sold jumps. Then, you’re forced into making an uncomfortable choice with no perfect answer. Retailers end up pursuing some combination of:

- Absorbing costs and watching margins evaporate

- Passing costs on to consumers and risk losing market share

- Pushing back on suppliers and potentially damaging key relationships

But while that looming question stares you down, don’t get caught off guard by the secondary effects. When tariffs hit your premium product line, demand might shift to alternatives, affecting everything from shelf space allocation to promotional planning. Your carefully constructed good-better-best pricing architecture can face significant disruption when different products face tariff impacts.

Suppose a specialty retailer had 20% tariffs hit their imported soy sauces and cooking oils. They raised prices on the premium specialty bottles from $8 to $10, expecting a little volume decline. They didn’t anticipate that most of their customers would switch to their mid-tier options at $6, which suddenly looked like incredible value.

The sales of complementary items also shifted—less imported rice vinegar and specialty noodles, more domestic cooking oils and generic Asian seasonings. Their entire international foods section needed replanning, and promotional calendars required overhauls.

Supply chains lately feel like a board game where someone keeps changing the rules after every round. When retailers frantically research suppliers in non-tariff countries, they often discover that alternative sources require different quality specs, have capacity constraints, or operate entirely different logistics models.

All of this chaos exposes a deeper problem that many retailers don’t see coming.

Why manual pricing systems fail during tariff volatility

Perhaps most critically, tariffs expose the fundamental inadequacy of manual pricing systems. Spreadsheet-based approaches become unmanageable when you need to recalculate costs and adjust prices weekly instead of quarterly. Pricing errors multiply, margins leak through system cracks, and strategic decision-making is reduced to crisis management.

Retailers could discover that entire product categories became unprofitable so quickly that their existing systems can’t keep pace. And making emergency sourcing decisions under pressure often leads to significantly higher costs than necessary.

The pitfalls of reactive pricing (and how to avoid them)

The pressure of tariff implementation creates a dangerous environment for knee-jerk reactions. The irony is that these missteps may cause more damage than the tariffs themselves, turning a manageable cost increase into something more alarming.

The most successful retailers distinguish themselves not by avoiding all mistakes but by recognizing these patterns early and having systems to prevent them.

Understanding the following common pitfalls is the first step toward building a more sophisticated, data-driven response:

1. The blanket price increase trap

When facing across-the-board cost increases, an enticing quick fix is uniform price hikes—raising many products in a category by the same percentage. The problem with this method is that it treats all products as equally price-sensitive, which is rarely the case. A 10% increase on premium organic products might barely register with affluent customers, while the same increase on basic staples could drive price-conscious families to competitors. Without price elasticity analysis, retailers unknowingly destroy demand for their most vulnerable products.

2. Playing pricing in a vacuum

Ignoring the competitive landscape leads retailers to make pricing decisions in isolation, often with very poor results. A mid-sized retailer could implement significant price increases in tariff-impacted categories only to discover that their main competitor was absorbing those costs to gain market share. By the time they adjust, they’ll have lost substantial customer traffic that takes months to recover.

Competitive intelligence isn’t just about matching prices. It’s about understanding the strategic context of every pricing decision. In this case, monitoring competitor pricing on tariff-impacted categories and utilizing tools that recommend optimized pricing strategies can help balance profitability and customer retention.

3. Promotional strategy breakdown

Promotional breakdown occurs when rising base costs make it impossible to maintain historical promotional depths without destroying margins. If you cut promotional frequency or depth across the board, you inadvertently signal to customers that value has decreased.

Use this pressure as an opportunity to optimize your promotional mix, shifting focus to higher-margin categories and more efficient promotional strategies that maintain customer perception of value while also protecting profitability.

For example, instead of offering “buy one, get one free” promotions that cut your margin in half, consider “Buy Two, Get One Free” or tiered discounts like “Buy 3, Save 20%” that encourage larger basket sizes while preserving better unit economics.

Read More: How accurate promotion forecasting and replenishment drive retail success

A smarter approach: The data-driven playbook

Step 1: Know your numbers (really know them)

Start with a granular cost analysis that goes beyond simply adding tariff percentages to product costs. You need end-to-end cost decomposition that reveals where you have room to maneuver and where you’re most vulnerable.

Maybe your premium products have enough margin to absorb a 20% tariff while maintaining competitive pricing, but your basic tier would become unprofitable. Perhaps certain stores in affluent areas can support higher prices while locations in price-sensitive markets cannot. Without this level of detail, you’re making multi-million-dollar decisions with incomplete information.

Step 2: Understand price sensitivity like never before

While every retailer knows some products are more price-sensitive than others, few have quantified these relationships precisely enough to make confident decisions under pressure. Advanced elasticity modeling shows how a 15% price increase will impact unit sales, revenue, and profitability across different customer segments and markets.

The sophistication lies in granularity. Where possible, model elasticity to individual store and product combinations for high-volume items while using cluster analysis for slower-moving products. Remember that elasticity isn’t constant. It varies by season, competitive context, and economic conditions. So, recompute your elasticities as frequently as you’re reasonably able.

The best-equipped retailers aren’t just tracking competitor prices but analyzing competitive pricing patterns and likely responses to market changes. Suppose you know Competitor A typically takes 60 days to respond to cost increases while Competitor B responds within a week. In that case, you can time your changes to maintain temporary advantages while markets adjust.

Set up rule-based systems that automatically maintain specific competitive relationships rather than manually checking prices and making subjective judgments. Stay within 5% of Competitor A on key value items, 10% of Competitor B on premium products, and 2% below Competitor C on promotional items.

Step 3: Plan for multiple futures

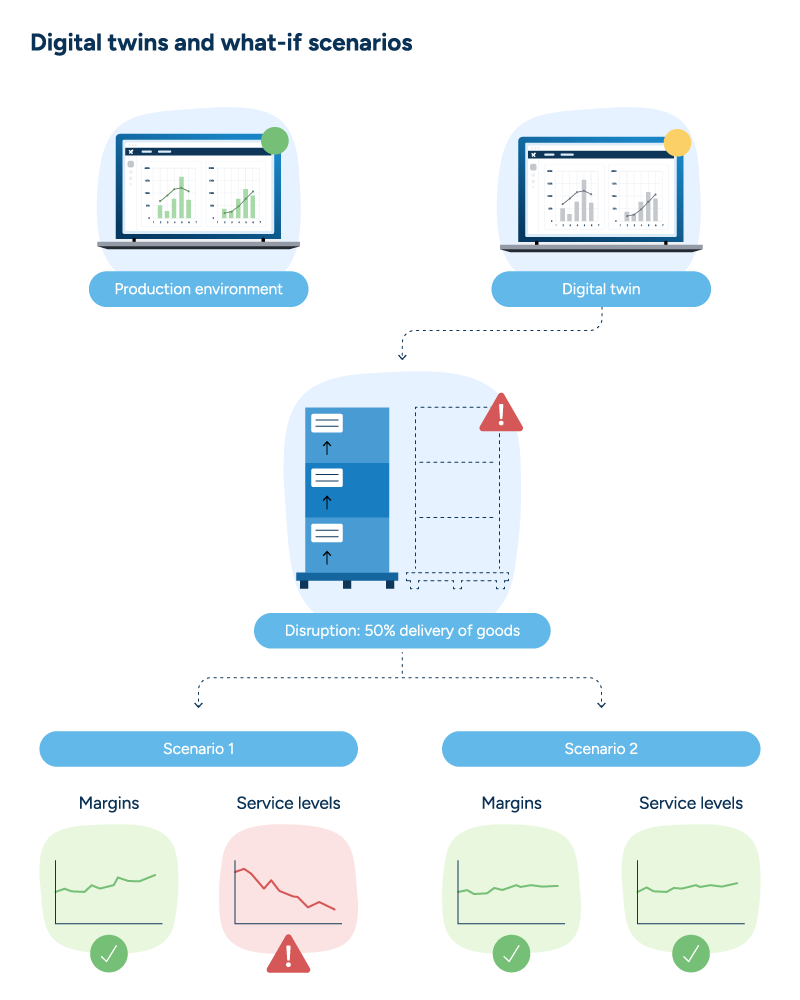

Rather than waiting to see what happens and then responding, model multiple “what-if” scenarios and develop contingency plans for each. What happens if tariffs increase by 30%? What if key competitors absorb all cost increases? What if consumer spending patterns shift dramatically?

Combine cost models, elasticity data, and competitive intelligence to forecast the financial outcomes of different strategic choices. This process becomes particularly powerful when integrated with promotional planning. You can model how different combinations of pricing changes and promotional strategies will perform under various scenarios.

Ways to rethink promotions when margins get tight

Shift your promotional focus strategically

When base costs rise, traditional promotional depths become margin killers. Instead of reducing promotional activity across the board, redirect promotional investment toward categories with more resilient margins that can support aggressive pricing.

Work with suppliers to secure additional promotional funding to offset tariff impacts. Many suppliers recognize that maintaining shelf space and customer loyalty during volatile periods benefits both parties, making them more willing to increase their promotional investment. And in the promotions game, every little helps.

Bundle promotions that combine small portions of premium imported products with larger quantities of domestic alternatives let customers experience specialty imports without paying full tariff-impacted prices on large quantities.

Change the promotional game

Move beyond traditional percentage-off discounts toward more sophisticated strategies. “Buy one, get one 50% off” or tiered pricing promotions encourage larger basket sizes while maintaining better unit economics than straight percentage discounts.

Value-added promotional structures, such as enhanced packaging, bonus quantities, or service upgrades, can increase perceived value without proportionally increasing costs.

Real-world example: How it works in practice

The difference between theoretical strategy and practical execution becomes clear when examining how a data-driven approach to tariff response unfolds in practice.

The following example illustrates how the strategic framework we’ve discussed translates into concrete actions and measurable results for a mid-sized specialty food retailer:

Smart segmentation: Analysis revealed premium artisanal products had low price elasticity among core customers, while everyday staples showed high sensitivity. This enabled differentiated pricing strategies.

Targeted pricing: Instead of uniform increases, they passed full tariff costs through on premium items (minimal volume impact), partial increases on moderately sensitive products, and absorbed costs on highly elastic traffic drivers.

Promotional reallocation: Shifted promotional investment from tariff-impacted imports to domestic artisanal products and private-label alternatives, maintaining customer value perception while improving margins.

Results: Despite significant tariff impacts, they maintained gross margins within 1.2% of pre-tariff levels while gaining market share and achieving 94% customer retention—significantly outperforming industry averages.

The technology advantage

Modern AI-powered pricing platforms automate existing processes and enable entirely new levels of strategic sophistication. These systems simultaneously process thousands of variables, model complex demand interactions, and generate real-time recommendations as market conditions change.

The technology advantage becomes pronounced during high volatility when decision volume and complexity overwhelm human analytical capacity. While one retailer manually analyzes tariff impacts on key categories, another automatically models impact across their entire assortment and optimizes response strategies across multiple scenarios simultaneously.

Building organizational muscle

Having the right strategy is only half the battle. The companies navigating tariff volatility most successfully have transformed their organizational capabilities to respond quickly and intelligently to rapid market changes.

This transformation involves investing in technology infrastructure and team members who can turn data into actionable insights under pressure. It requires flattening decision-making hierarchies and empowering teams to adjust within defined parameters.

Most importantly, it involves creating cross-functional coordination between departments that must work together—pricing, procurement, marketing, and supply chain—with clear governance structures and communication protocols.

Read More: Pricing optimization: How to build a case for technology investment

The path forward

The retailers emerging stronger from tariff challenges view these pressures as opportunities to build capabilities that create lasting competitive advantages. They’re not just surviving volatility but developing speed, agility, and strategic sophistication that serve them well beyond current trade tensions.

Success comes down to moving beyond reactive approaches toward systematic, data-driven strategies. The difference between thriving and merely surviving isn’t about having better intuition but better information and the analytical capabilities to act quickly and precisely.

The future belongs to retailers who can blend sophisticated analytics with organizational agility, creating pricing and promotional strategies that maintain customer value while protecting profitability, no matter what policy changes come next.