The case for demand shaping in manufacturing and consumer goods supply chain planning

Sep 3, 2024 • 9 min

Supply chain planning has been anything but smooth sailing for the last few years — and with economic uncertainty, geopolitical tensions, and labor market challenges ever-present, storm clouds still loom on the horizon.

Manufacturers and consumer goods companies are often forced to weather the worst part of the storm. In one direction, businesses face sudden raw material supply shortages and logistical disruptions. In the other, cost-conscious customers and their volatile preferences roil the waters.

It’s an unenviable position on a micro level; from a broader business management perspective, it’s akin to using stars to navigate toward profitability. In broad daylight. In the middle of a hurricane.

Demand shaping serves as a much-needed strategic lever for suppliers to pull when seeking a level of control in this sea of supply chain chaos. Manufacturers and consumer goods companies should integrate demand shaping strategies into broader planning frameworks to better predict and manage the ebbs and flows of market demand — and they’ll need sufficiently advanced demand planning software to do so.

What is demand shaping?

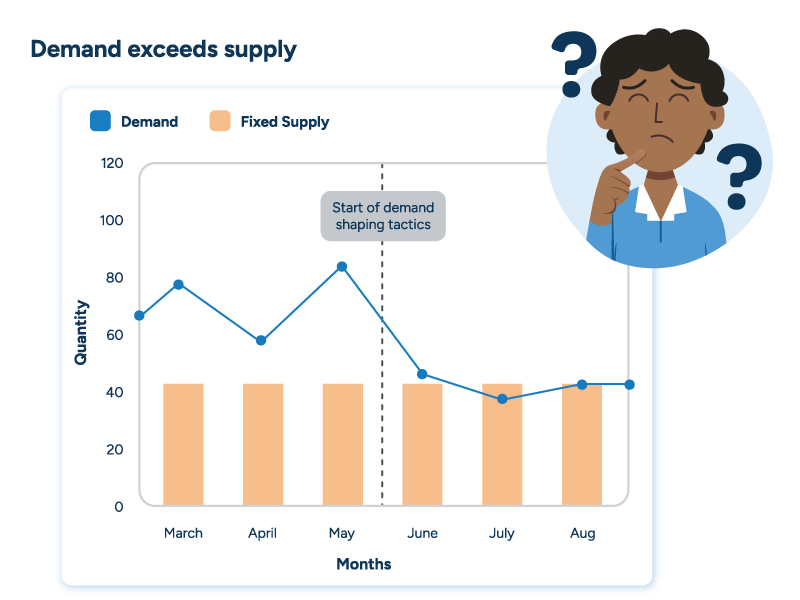

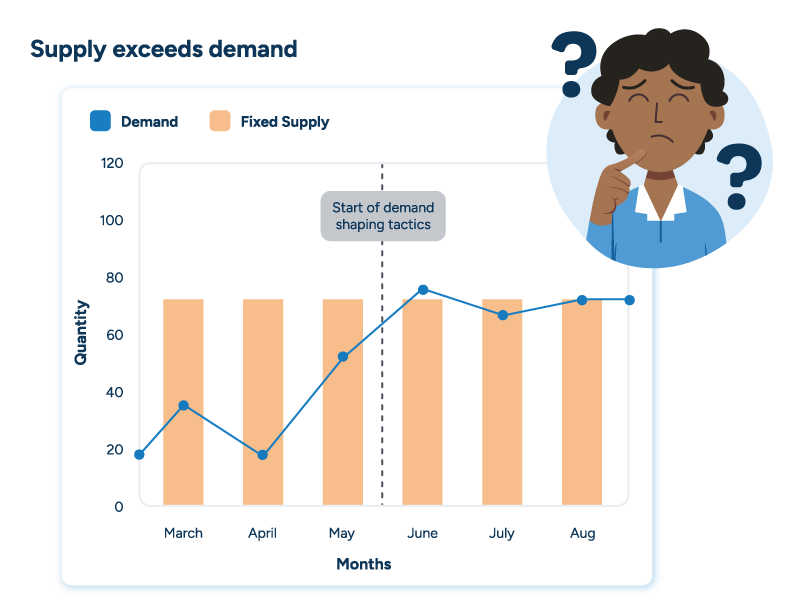

Demand shaping refers to a company’s collective attempts to influence customer demand for specific products. Companies use demand shaping to balance inequities in supply or demand. Surplus inventory of a product may lead a business to offer a promotion to incentivize turnover. Businesses could also use temporary pricing discounts to increase demand for a more abundantly available product when supply chain disruptions or shortages affect the customer’s initial preference.

Demand shaping requires close collaboration between marketing, sales, and operations teams to achieve success. A company’s decision to deploy a promotion or discontinue a product can stem solely from a need to improve profit margins. But demand shaping presents companies with an opportunity to also use these tactics to address supply and demand issues on the way to boosting revenue.

4 key benefits of demand shaping

Demand shaping enables businesses to proactively manage market dynamics and consumer preferences. It addresses critical imbalances between supply and demand, such as surplus inventory or product shortages. This strategic approach reduces financial and operational risks while optimizing responsiveness to market changes and consumer behavior.

Aligning demand shaping strategies with planning frameworks ensures operational decisions actively advance broader business and financial objectives.

Manufacturers and consumer goods companies gain significant benefits from integrating demand shaping into their sales and operations planning (S&OP) and integrated business planning (IBP) processes. This integration is particularly crucial for fast-moving consumer goods (FMCG), which are prone to spoilage or have short shelf lives. Aligning demand shaping strategies with these planning frameworks ensures operational decisions actively advance broader business and financial objectives.

Demand shaping capabilities help companies to:

- Improve service levels. Companies can accurately forecast demand and align supply chain activities to ensure that products are available when and where customers need them. Advanced demand forecasting tools use machine learning and real-time data to predict future demand with high accuracy. This level of accuracy leads to higher customer satisfaction and loyalty, as companies can maintain optimal stock levels and avoid stockouts.

- Reduce costs. Effective demand shaping helps optimize inventory levels, reducing the costs associated with overstocking and stockouts. Automated replenishment systems and inventory optimization algorithms minimize waste and improve the efficiency of production and distribution processes. This efficiency gain cuts costs and enhances overall supply chain performance.

- Enhance responsiveness. Demand shaping enables companies to quickly adapt to changes in market conditions, consumer preferences, and competitive actions. Real-time data analytics and demand sensing capabilities allow companies to detect shifts in demand early and adjust their strategies accordingly. This agility helps maintain a competitive edge and capitalize on emerging opportunities.

- Bolster sustainability efforts. Optimizing inventory and reducing waste through demand shaping contributes to more sustainable business practices. Advanced planning tools can help companies reduce spoilage and prevent obsolescence, minimizing excess inventory and waste. These sustainable practices not only lower environmental impact but also enhance a company’s reputation among environmentally conscious consumers.

Demand shaping tools leverage AI and real-time data analytics to surpass traditional demand planning methods. These tools proactively adjust strategies to align supply with anticipated demand rather than merely reacting to market conditions. This proactive approach transforms potential disruptions into opportunities for growth and competitive advantage.

The most effective short- and long-term demand shaping tactics

Companies looking to strengthen their planning processes with demand shaping have a wide range of tactics to choose from. Some of these tactics influence demand in the short term, while others play out over a longer timeline.

Short-term demand shaping tactics

Manufacturers and consumer goods companies have many levers to pull when it comes to affecting more immediate consumer demand. The most effective tactics include:

- Pricing. Temporarily reduce prices on specific products to increase turnover and reduce inventory levels. Use price changes to encourage the purchase of one product over another in the event of scarcity, like discounting the price of bottled drinks to reduce demand for aluminum cans.

- Trade promotions. Collaborate with retailers to run in-store promotions that attract special attention to particular products, especially those that could serve as alternatives to shortage-affected goods. Examples include in-store displays, on-site demos and samplings, or visible promotions like coupons or buy-one-get-one (BOGO) deals.

- Sales incentives. Change bonuses, commission rates, or other incentives offered to sales representatives or distributors to indirectly influence demand. Increase these incentives to move more of a particular product and reduce these incentives in the face of expected shortages.

- Channel-specific assortment prioritization. Manipulate assortment choices per channel to affect consumer demand. Companies can prioritize alternative products in particular channels to attract consumer attention away from scarce products.

Short-term tactics are essential because they allow manufacturers and consumer goods companies to affect demand in weeks, not months — an important point for companies that often sell products that quickly spoil or expire. This emphasizes the importance of open collaboration in shortening deployment timelines and maximizing the effectiveness of short-term demand shaping efforts.

Long-term demand shaping tactics

Truly effective S&OP and IBP processes look beyond immediate challenges and lay the groundwork for at least the next 18 months. This requires demand shaping tactics that play out over a longer period, including:

- New product introductions and changes to existing products. Develop products from abundantly available materials that serve as substitutes for existing goods vulnerable to supply chain shortages. An alternative tactic involves changing an existing product’s specs to avoid scarcity issues while also fueling consumer interest. These alterations include changes to packaging, materials, or even recipes for food and beverage products.

- Changes in distribution. Consider opening or expanding distribution within new sales channels. The pandemic and other disruptions have only accelerated the growth of channels like ecommerce, direct-to-consumer (DTC), and quick commerce. Companies can release and highlight specific products within these channels to increase demand for goods that are more readily available.

The phrase “long-term” can be misleading. A new product or distribution change can significantly impact demand within a short time frame. However, the market research, planning, and development phases of these tactics differentiate them from shorter-term methods.

READ MORE: How strategic distribution planning enhances supply chain optimization

4 must-have features for effective demand shaping

Not every manufacturer and consumer goods company takes advantage of demand shaping despite the clear benefits, a reality frequently attributable to a lack of proper demand shaping technology. Legacy planning systems often can’t perform the complex tasks required to detect immediate demand shifts. There’s also an understandable hesitancy to undertake resource- and labor-consuming demand shaping efforts without being able to quantify their potential real-world impact.

The best modern supply chain platforms have developed features specifically tuned to address these concerns, providing greater visibility into the process for all stakeholders involved. The most essential demand shaping features include:

1. Demand sensing and machine learning

Manufacturers and consumer goods companies can’t shape demand if they can’t measure it. Proper demand shaping software will also come equipped with demand sensing capabilities. Demand sensing combines a supplier’s internal reorder and historical data with retailer POS data and external data sources to create and adjust highly accurate demand forecasts.

Highly accurate demand sensing and forecasting require an AI-powered platform with machine learning capabilities. Machine learning systems detect demand changes faster and more accurately than any team of humans could hope to accomplish. They also retain insights gained from each event, reducing the amount of repetitive work planners end up doing in the long run.

READ MORE: Machine learning in CPG demand forecasting: Considering retail data drives results

These demand sensing forecasts provide a baseline understanding of the current state of consumer demand and help planners detect sudden shifts in that demand. This allows suppliers to evaluate and better understand the effects retail price changes, promotion strategies, and product substitutions have on consumers. Demand sensing also helps them determine if shaping efforts are needed in the first place, informing stakeholders of the best tactics for matching forecasted supply with expected demand.

READ MORE: Demand sensing: How to conquer CPG supply chain chaos

2. Digital supply chain twin and what-if analyses

The digital supply chain twin is software that provides a detailed model of the physical supply chain. The digital twin provides continuous visibility into how demand and business decisions affect capacity and resource requirements, deliveries and goods flow, and inventory and spoilage. Think of it as an advanced simulation of a company’s entire supply chain that receives data updates daily from numerous sources, helping to determine how goods and information flow within the system.

What-if analyses enable companies to experiment with different scenarios, gauging the effects of demand variations, supply interruptions, or strategic shifts.

Employing the digital twin for what-if analyses is pivotal in fortifying demand shaping strategies. These analyses enable companies to experiment with different scenarios and gauge the effects of demand variations, supply interruptions, or strategic shifts.

Integral to these analyses is scenario planning, which allows teams to probe diverse operational possibilities and gear up for assorted future states. The combined use of what-if analyses and scenario planning reveals the effect commercial decisions have on a company’s inventory, resource, and capacity requirements. This supply chain visibility allows them to make decisions that lead to a supply and demand equilibrium.

READ MORE: Digital twins in supply chain management: What companies get wrong

3. User-specific views

User-specific views are essential to gaining buy-in from stakeholders within a manufacturing or consumer goods organization. Demand shaping software contains great insights for stakeholders from various teams and departments. The difficulty lies in showing these busy stakeholders how to use the software in a meaningful way. Busy sales teams, planners, or operations managers aren’t likely to continue using a platform that requires time and effort just to unearth data relevant to their jobs.

Widespread, consistent usage from employees leads to enhanced company-wide collaboration and communication.

The best solutions allow users to configure views specific to their individual needs without forcing them to sift through irrelevant data, making them more likely to consistently use the platform. A sales representative will want to review different data sets than a supply chain engineer and won’t want to sift through massive volumes of data to find them. Widespread, consistent usage from employees leads to enhanced company-wide collaboration and communication, resulting in intentional business decisions based on the same information.

4. Collaborative planning

Effective demand shaping relies on comprehensive collaboration across the whole value chain. A unified platform enables manufacturers, suppliers, and retailers to share data and insights seamlessly. This collaboration aligns stakeholders in real time, which is crucial for adapting quickly to market demands and enhancing supply chain efficiency.

Strategic data sharing and communication facilitate better anticipation of market trends and consumer behavior. This enables companies to shape demand proactively, ensuring optimal service levels and minimizing costs. Collaborative planning thus becomes a cornerstone in creating a demand-driven supply chain that efficiently meets consumer needs.

READ MORE: Supplier collaboration: How to unlock its maximum potential

Shape demand — and then meet it

Legacy demand planning solutions are certainly an improvement over attempting to balance supply and demand manually. In today’s market, solutions with the ability to shape demand prove far more valuable to manufacturers and consumer goods companies. Companies adhering to either traditional planning methods or legacy systems are effectively using astrolabe to chart their course in the age of GPS.

RELEX enables suppliers to sense, shape, and ultimately meet demand. AI-powered machine learning enables our manufacturing and consumer goods customers to detect and react to volatile customer demand with highly accurate forecasts and automated replenishment. RELEX combines complex capabilities with ease-of-use, allowing companies to align the diverse teams involved in short- and long-term planning to meet business goals as a single unified organization.