Q&A: How capacity optimization pays dividends in retail operational efficiency

Apr 10, 2024 • 6 min

Retailers can’t expect to achieve long-term success when costly operational inefficiencies undercut sales revenue. We spoke with Product Lead and resident RELEX F&R guru Stuart Douglas about how capacity challenges negatively impact retail companies — and how they can overcome them with the right planning solution.

In this Q&A, Stuart pulls from his 14 years of industry experience to share insights on how retailers can strengthen their operational efficiency through capacity optimization to bolster their bottom lines.

Q: When we say “capacity optimization,” what specifically are we referring to?

Stuart Douglas: Well, the optimization of capacity!

Jokes aside, it’s worth providing a specific definition for “capacity” so we know what we’re trying to optimize. In retail supply chains, “capacity” refers to the maximum amount of goods a supply chain can store, transport, or process at any given time. When we talk about optimizing capacity, we seek to smooth the flow goods within a business’ constraints in the most cost-effective way.

Typically, this involves one of two paths. You’re either making the most efficient use of your assets to balance the operational costs against service levels, or you’re preempting capacity breaches to avoid bottlenecks and backlogs.

Q: What are the biggest challenges retailers currently face concerning capacity optimization?

Stuart: Perhaps the most significant hurdle retailers face concerning capacity — at least, in my mind —is managing uneven demand peaks.

As customers, we’re problematically ‘uneven’ little creatures. We show up to stores every week on Fridays, Saturdays, and Sundays more than, say, a Monday or Wednesday. But this tendency toward routine causes demand to spike on those days, which causes many retailers to schedule a higher volume of deliveries for week’s end.

It’s not just weekly routines, either. Across any given year, certain buying habits and trends ahead of certain seasons or holidays cause huge spikes in demand for particular product categories.

Q: What sort of headaches result from end-of-week demand spikes?

Stuart: When retailers see increased demand on the horizon, they’ll stock up in anticipation of the shift. But storage space is finite, and you can only fit so much in any given backroom or warehouse. Ordering and stocking a huge quantity of goods at any given time is inefficient from a space utilization perspective and makes managing inventory levels effectively quite difficult.

There’s also the matter of labor. Someone has to be there to receive, store, and stock these extra deliveries — usually, many “someones.” — but peak labor is usually neither cheap, infinite, or instantly available.

Q: Can you elaborate on the impact seasonal and holiday-related demand spikes have on capacity?

Stuart: Absolutely. Retailers know they’ll need to move a massive amount of product ahead of a given holiday, whether it’s food ahead of feast holidays or chocolates ahead of Valentine’s Day. Digital solutions aside — and I’ll get to that in a second — retailers don’t have a lot of good options for addressing the inevitable wave of demand and associated deliveries coming their way.

Say you’re a general merchandise retailer ahead of Christmas. If you order purely to customer demand, you need to build your DC capacity and your logistics capacity to handle the biggest peak day of the year. But all this extra capacity would be used for nothing the rest of the year. You might even be looking to outsource it.

Without delivery flow smoothing, retailers don’t have a lot of good options for addressing the inevitable wave of demand and associated deliveries coming their way.

Another option involves hiring temporary labor to address the temporary capacity needs for the day before Christmas. But so is every other retailer! So never mind how expensive that prospect would be on bid pricing. There just isn’t that kind of immediate tap of ad hoc labor available in the market, even in the so-called “gig economy.” The fact is that most people don’t sit around the day before Christmas hoping for this kind of work.

Q: What’s the solution to capacity issues caused by routine demand spikes?

Stuart: Good long-range forecasting is table stakes in retail. If you can’t foresee what’s coming with high accuracy, you really don’t stand a chance of wrangling capacity issues. Retailers need a planning solution that automatically forecasts for seasonality, holidays, local events, and similar peaks because manually trying to account for so many variables is extremely inefficient.

If you can’t see what’s coming with high accuracy, you really don’t stand a chance of wrangling capacity issues.

From there, retailers need to figure out how to distribute their deliveries more evenly, whether through any given week or in the weeks ahead of a major event. They can try to do so in spreadsheets, but that’s easier said than done. Companies that have achieved success in this area usually use a digital solution to achieve this.

Q: How specifically do retailers use digital planning platforms to achieve even delivery distribution?

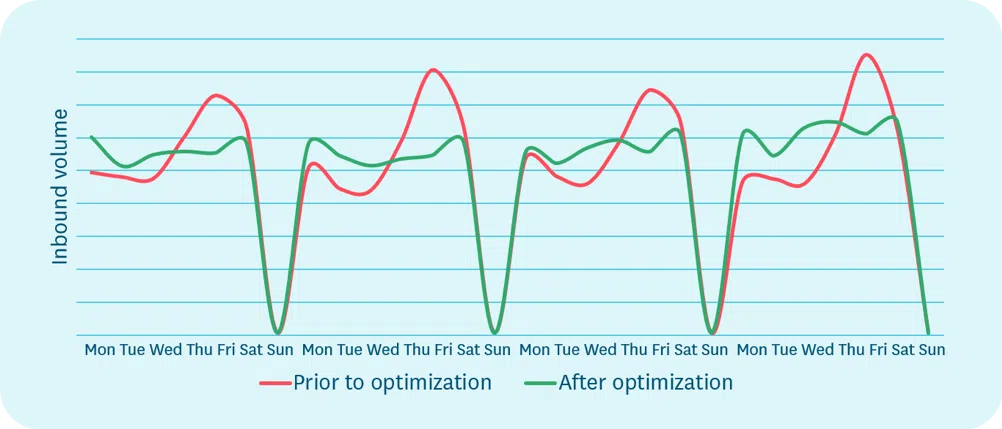

Stuart: At RELEX, we call this practice “delivery flow smoothing.” It’s exactly what it sounds like: using our solution to optimize inbound delivery schedules and evenly distribute stock, whether across a single week or multiple weeks. Delivery flow smoothing analyzes demand patterns and adjusts order quantities in a more cost-efficient way. For example, RELEX can prevent teams from ordering too much stock that would exceed shelf capacity. The solution can also combine multiple orders for the same item into a more efficient and less expensive single order.

RELEX allows retailers to plan, view, and maintain high-level control over how and when to smooth certain product categories or characteristics. This visibility and control helps to minimize backstock and the need for unnecessary additional handling. Retailers can also use the solution to run simulations and view pre-determined KPIs to evaluate different methods for achieving their capacity optimization goals.

If that all sounds complex — it is! Rather, it is without the right software. I don’t think anyone still forecasting and manually ordering will see anywhere near the same level of success as they would using RELEX.

READ OUR CASE STUDY: S Group: AI-optimized goods flow for efficient retail operations

Q: Are there any other capacity optimization methods retailers should prioritize?

Stuart: It’s worth mentioning that capacity optimization and promotion planning go hand in hand. Successful promotions increase demand. The difference between a promotion-based demand increase and one caused by external factors is that a retailer knows the spike is coming.

Capacity optimization and promotion planning go hand in hand.

At least, in theory. In practice, I’ve seen companies where inventory and planning teams lack visibility into planned promotions, which makes proactively anticipating those shifts impossible. It speaks again to the value of using software like RELEX that provides internal visibility and supports collaboration across teams.

READ MORE: How successful retail execution can optimize store efficiency

Q: What’s the one thing you’d want a retailer to take away from this conversation?

Stuart: The supply chain is simply too complex to do this without a digital solution. Retailers need to make changes before bottlenecks can occur in stores and DCs, and they must do so in a ‘smart,’ automated way to balance operational costs against service levels.

Capacity optimization is achieved in a very narrow band between “wait and risk ordering too much at once” and “pulling too much forward and manually fixing in advance.” We’ve talked a lot about the former and how it strains capacity. But inaccurate information, limited supply chain visibility, and reactive manual adjustments can also result in stockouts, which hurt retailers as well.

RELEX helps retailers operate in that sweet spot. And with the cost of everything from products to transportation continuing to skyrocket, I think retailers need to use every tool they can to cut costs and carve out a profit for themselves.