Open-to-buy: The bridge between financial goals and inventory reality

Jun 18, 2025 • 8 min

School is about to be out, pools are reopening, and summer is just around the corner. For retailers like your pet store chain, that means planning ahead with €2 million in seasonal inventory. You’ve secured the cooling mats, outdoor toys, and travel carriers for vacation-bound pets. But when the summer turns out cooler than expected, sales fall short at €1.4 million, leaving you with excess inventory destined for clearance pricing—and a reminder of how critical it is to align Open-to-Buy planning with demand.

And if we flip the scenario? Your team learns from past mistakes and orders conservatively for autumn. But then, a popular pet influencer showcases your premium dog backpacks just as families prepare for hiking season. Suddenly, your shelves are bare while customers head to competitors who stay in stock.

Here’s where it gets tricky: It’s mid-month, and you’ve budgeted €500,000 to keep your dog food section stocked. You’ve already spent €420,000 on scheduled deliveries when your supplier announces a popular premium brand will have limited availability starting next month. Your system shows you need €200,000 more in inventory now to avoid stockouts, but that would push you €120,000 over budget.

Do you exceed your budget and face tough questions from Finance? Or do you stick to the plan and risk empty shelves when loyal customers come to look for their dogs’ favorite food?

This type of scenario is where an Open-to-buy solution comes in. It doesn’t just track your merchandise budget—it helps you align inventory decisions with actual demand, trend shifts, and sales forecasts in real-time. No more flying blind—just smart, data-backed buying.

What is Open-to-buy (OTB)?

Open-to-buy (OTB) links merchandise financial planning and replenishment, translating strategic financial targets into actionable, category-level purchasing budgets. By aligning inventory investments with financial objectives, OTB ensures retailers can meet customer demand while maintaining control over stock levels.

Set for defined periods such as months or seasons, OTB budgets act as dynamic guardrails, enabling retailers to optimize purchasing decisions, adapt to market changes, and avoid the pitfalls of overbuying or stockouts.

How to calculate Open-to-buy

The OTB calculation is essentially a formula that considers:

- Expected sales during the period – Based on higher-level forecasting done in the merchandise financial planning (MFP) process, including any additional sales projections based on promotional activities

- Desired ending inventory – Inventory targets set for the end of the planning period

- Current inventory – What you currently have on hand

- Orders already placed – Merchandise already committed but not yet received

The basic formula can be expressed as:

OTB = Budget – (Inventory already delivered this period + planned receipts from open orders this period)

Where:

- Budget is the financial limit set for inventory spending over a specific period.

- “Current inventory that has been ordered this period” is merchandise purchased/ordered during the current planning period and has been received into inventory.

- Open purchase orders are the value of orders already placed but not yet received.

- Planned receipts are the value of inventory expected to arrive within the budget period.

Why Open-to-buy is important in financial and inventory management

Open-to-buy plays a critical role in retail operations for several key reasons:

- Execution of financial goals: OTB provides the mechanism to transform high-level financial targets into actionable purchasing decisions at the product and location level.

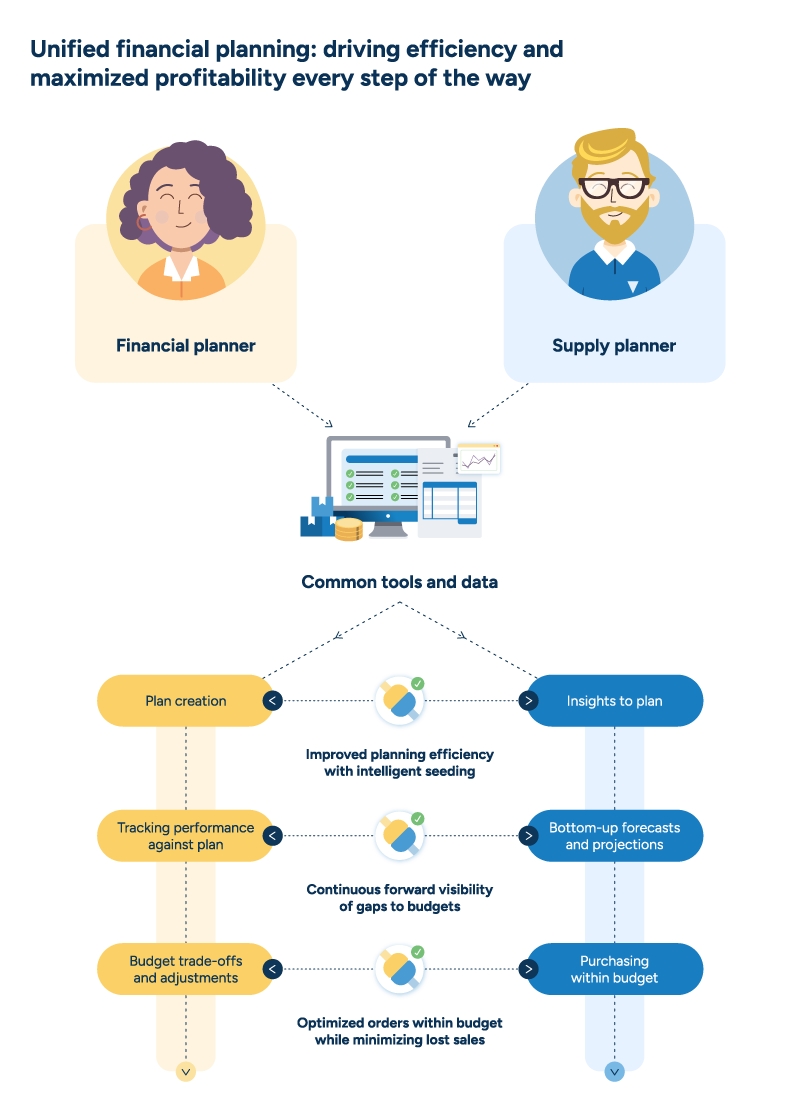

- Bridging planning layers: It is the essential bridge between top-down financial planning and bottom-up replenishment planning, ensuring both processes work harmoniously.

- Continuous monitoring: Rather than checking budgets only at the beginning of a planning period, OTB allows retailers to continuously monitor their spending against targets throughout the period, ensuring they stay on track.

Beyond tracking current periods, effective OTB systems also project future orders against upcoming period budgets, providing real-time visibility into current performance and forward-looking insights into potential budget gaps or opportunities. - Just-in-time planning: While financial plans are set in advance with longer horizons, replenishment planning often happens just in time. OTB allows retailers to compare their original plans against the most up-to-date forecasts and inventory needs, creating essential visibility between the two planning horizons.

Without effective OTB management, retailers risk disconnecting their financial goals from their actual inventory investments, which could lead to overstocking, stockouts, markdowns, and, ultimately, reduced profitability.

Use cases for OTB

Case 1: Responding to unexpected forecast changes

A retailer has created open-to-buy budgets for all their product categories following their merchandise financial planning process. For one category, the budget is set at €50,000, with inventory purchased during this period worth €20,000 and open purchase orders worth €15,000, leaving €15,000 in remaining OTB.

An unexpected event occurs—perhaps a product gains sudden popularity through social media exposure or celebrity endorsement. The forecasting system immediately shows a significant increase in projected sales, jumping from €40,000 to €70,000, which triggers higher recommended order quantities of €25,000 to meet the new demand.

Without OTB visibility, the company might simply approve all these orders, pushing the total spend to €60,000 (€20,000 inventory purchased this period + €15,000 open orders + €25,000 new orders), exceeding the budget by €10,000. However, with proper OTB monitoring, the system flags this overrun, giving merchandising teams two valuable options:

- Adjust order quantities: Reduce the new orders to €15,000, staying within the established budget. This reduction ensures financial discipline while prioritizing high-margin or fast-moving items.

- Revise the budget: Increase the category budget to €60,000, leveraging the opportunity to capture the projected €70,000 in sales. A 30% margin could generate an additional €9,000 in profit, justifying the investment.

Both options represent strategic choices rather than accidental budget overruns, ensuring the retailer remains agile and informed in response to unexpected demand shifts.

Case 2: Managing long-lead-time products

Many retailers, especially those dealing with imported goods, face challenges with products that have exceptionally long lead times. A DIY retailer has an August budget of €100,000 and a September budget of €120,000. They placed orders worth €80,000 for power tools and garden equipment expected to arrive in August.

With effective OTB tracking, these orders are assigned to the August budget. However, the shipment is rescheduled to arrive in September due to unforeseen shipping delays. Without OTB visibility, the August period might appear under budget with only €20,000 spent, while September unexpectedly exceeds its budget by €80,000, creating confusion and potential overspending.

A good OTB system automatically reassigns the delayed shipment to the September budget, ensuring accurate tracking:

- August spend: €20,000 (remaining budget: €80,000)

- September spend: €80,000 (remaining budget: €40,000)

This real-time adjustment prevents artificial budget discrepancies and allows the retailer to proactively adjust September’s purchasing plans, such as delaying new orders or reallocating funds from other categories. The retailer avoids financial surprises and ensures smooth operations by maintaining visibility and control.

Why companies struggle to optimize OTB

Despite its importance, many retailers face significant challenges with OTB management:

- Fragmented systems: Many companies manage their budgets in systems separate from their forecasting and replenishment planning systems. This disconnect requires manual exports, imports, and spreadsheet reconciliation, leading to delays in getting a complete picture.

- Lags in data: When OTB reporting isn’t continuously updated, merchandisers make decisions based on outdated information, increasing the risk of budget overruns or missed opportunities.

- Reactive rather than proactive management: Without forward-looking projections, many retailers only discover budget issues when they’re about to occur, leaving little time for strategic adjustments.

- Suboptimal order adjustments: When retailers need to reduce orders to stay within budget, they often lack sophisticated tools to determine which products should receive lower allocations. These outdated processes can lead to cutting orders across the board rather than preserving inventory for the highest-performing or most profitable items.

- Limited cross-departmental collaboration: Disconnected systems create barriers between merchandising, finance, and supply chain teams, making it difficult to make coordinated decisions that balance financial constraints with market opportunities.

These challenges often result in either excess inventory, which ties up capital and leads to markdowns, or insufficient inventory, which causes lost sales and diminished customer satisfaction.

Learn more: OTB constraints: Flexible financial planning for dynamic markets

How to improve OTB processes with AI-powered planning software

Modern AI-powered solutions like RELEX offer significant improvements to traditional OTB processes:

- Continuous budget monitoring: By integrating financial and replenishment planning into a single system, retailers can immediately see how current and projected orders align with established budgets.

- Proactive alerts: Advanced systems can identify potential budget overruns weeks or months in advance, giving merchandising teams ample time to make strategic adjustments.

- Inventory diagnostics: Modern OTB solutions combine historical performance data with current stock levels and future projections to provide detailed, actionable insights into inventory dynamics. These tools help buyers directly identify the root causes of stockouts, spoilage, or excess inventory within the planning process, enabling smarter, data-driven decisions without relying on disconnected systems or manual analysis.

- Enhanced cross-organizational collaboration: With merchandising, finance, and supply chain teams all working from the same data, companies can make more coordinated decisions that balance financial discipline with market opportunities.

- Early intervention: Problems identified early in the planning cycle are much easier and less costly to fix than those discovered later. AI-powered planning provides this early warning system, expanding the options available to merchandisers.

The key advantage of modern OTB solutions is their ability to make the process dynamic and responsive. Instead of static budgets checked after the fact, these solutions create real-time connections between financial planning, buying, and replenishment.

OTB as a catalyst for retail excellence

Open-to-buy is far more than a simple budgetary control—it’s the essential link between a retailer’s financial strategy and day-to-day inventory management. As retail faces unprecedented volatility and competition, effective OTB processes become even more critical for maintaining financial health while meeting customer expectations.

By upgrading from disconnected spreadsheets and manual processes to integrated, AI-powered planning solutions, retailers can transform OTB from a restrictive budget enforcement tool to a dynamic decision support system that balances financial discipline with market responsiveness.

The most successful retailers will leverage these advanced capabilities to make smarter inventory investments, ultimately driving customer satisfaction and profitability.

Open-to-buy FAQ

What is Open-to-buy in supply chain management?

In supply chain management, Open-to-buy (OTB) represents the inventory a retailer can purchase during a specific period. It is a budgetary control mechanism that ensures purchasing decisions align with overall financial goals while maintaining appropriate inventory levels to meet customer demand.

What is the Open-to-buy formula?

The standard Open-to-buy formula is:

OTB = Budget – (Inventory already delivered this period + planned receipts from open orders this period)

This formula determines how much additional inventory can be purchased during a specific period, considering sales projections, desired ending inventory, current stock levels, and orders already placed but not yet received.

How is Open-to-buy related to Merchandise Financial Planning?

Open-to-buy is directly derived from the Merchandise Financial Planning (MFP) process. MFP establishes high-level financial targets, including sales, margins, and inventory levels, typically at a department or category level. OTB translates these financial targets into actionable purchasing budgets, creating the crucial bridge between financial planning and actual buying decisions. While MFP sets the strategy, OTB provides the tactical framework for executing that strategy through day-to-day purchasing decisions.