Prescription for pharmacy supply chain planning: Diagnosing pharmacy retail challenges and how advanced technology can solve them

Sep 13, 2022 • 19 min

Section 1: Increasing retail complexity and competition require a modern approach to the pharmacy supply chain

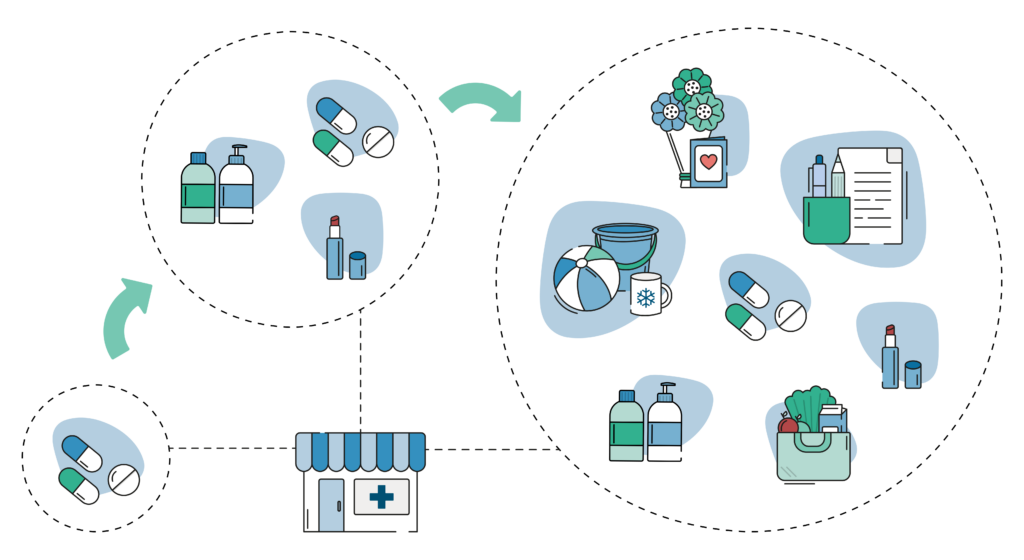

Pharmacy has among the most significant regional diversity in format and product offerings than any other retail vertical. The most significant of which, and the principal purpose of all pharmacies, is the management and dispensing of prescription drugs. Managing these drugs is highly complex due to the rules and regulations for handling and availability requirements that vary from region to region. Further, pharmacies in some areas are only beginning to expand beyond operating as prescription dispensaries and exploring a broader assortment range. In other regions, pharmacies already operate as small-format grocery or department stores, with a wide range of categories to meet the needs of their local customers.

Pharmacies in different regions are at different stages of retail maturity in terms of format and assortment and sales channel offerings. However, whether they seek to expand their retail model or take their current retail operation to the next level, they must modernize their supply chain planning. The rapidity and frequency of shifts in the prescription drug market need an automated, rules-based system to reduce manual processes and ensure availability. Additionally, the ever-evolving complexity of general merchandise retail, including assortment decisions, managing seasonality, and continuing omnichannel growth, are all issues that require modern pharmacy supply chain planning capabilities to remain competitive and drive margins.

Pharmacy retail:

Regional diversity and constant change present unique challenges

Section 2: Managing prescription inventory for high availability and outstanding customer service

For pharmacies, maintaining required availability targets for prescription drugs is their business’s single most important goal. If customers can’t access the medication they need when they need it, they will take their business elsewhere. Further, if consumers experience difficulties obtaining items as necessary as prescription drugs due to availability issues, their perception of the entire pharmacy brand could be damaged. The result is not only losing a sale but losing the customer altogether.

For most products in a general assortment, such as shampoo or paper products, retailers can arrange promotions, markdowns, or sales events to influence consumer demand. However, unlike those products, demand for prescription drugs is driven by need, not impulse, making planning for these products more of a mathematical exercise than it is for different retail types. Pharmacies don’t promote prescription drugs to attract customers; they focus on the hard data presented by their location’s demand patterns. This means pharmacies need an intelligent and automated system that will allow them to establish custom rules to drive optimal forecasting and replenishment decisions.

When given access to data, such as sales data and product costs, an advanced inventory management system can automate the replenishment tasks related to prescription drugs that once had to be managed manually by pharmacists. Such a system must also be flexible enough to allow users to customize and localize the replenishment strategy as needed. For instance, a local pharmacist will know that their location fills a rare prescription for one person and that they will need to keep that rare or expensive drug in stock to meet that one person’s needs – regardless of what the data trends suggest.

This level of automation enables pharmacies to generate forecasts based on demand across multiple prescription criteria – such as narcotics and drugs with temperature requirements or those with varying shelf lives – while factoring in specific drugs and their generic counterparts. They can then establish rules to help manage shifts in demand, even with slow-moving or new drugs that lack historical sales data.

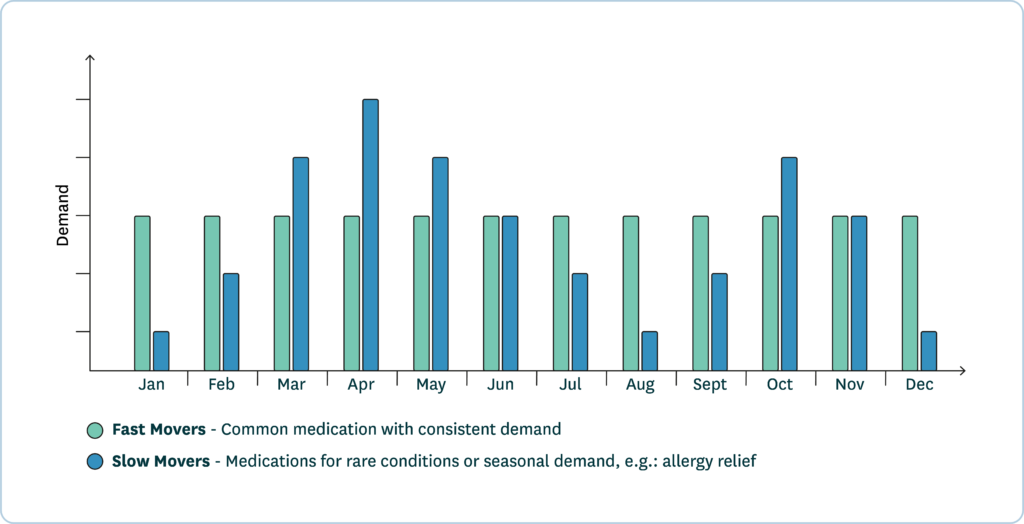

Balancing prescription availability with fluctuating demand

While maintaining accurate forecasting is essential, pharmacies face a pressing inventory challenge in determining which items to continually stock at which locations (whether a store, distribution center, or warehouse) and which ones they can order from suppliers on an as-needed basis. This requires pharmacies to maintain a careful balance of availability while meeting fluctuating demand. Their system must enable them to create and revise rules quickly and easily to drive assortment decisions. It would then automatically assess data, such as the frequency of sales versus how expensive a product is, to determine whether an item should be stocked and in what quantities.

In addition to the risk of lost sales and dissatisfied customers, pharmacies are also vulnerable to overstock and spoilage, threatening already tight margins. Pharmacies must be able to reconcile the cost of high inventory levels against the expense of managing the inventory itself, particularly in the case of one-off prescriptions.

- Fast-moving prescription drugs such as blood pressure management medications are typically inexpensive to stock, so pharmacies can ensure high availability to match the high demand for these items without financial risk. For fast-moving medications, replenishment challenges are generally centered around local capacity, storage space, and the frequency with which the drugs must be replenished.

- Slow-moving drugs such as those used to treat rare, life-threatening conditions like cystic fibrosis or hemophilia don’t typically have a lot of sales data available, making accurate demand forecasting for these medications difficult. When data is particularly sparse multiple aggregate levels can help estimate demand influencing factors and increase forecasting accuracy. An advanced forecasting and replenishment solution can automate the creation of these aggregate forecasts. For example, grouping comparable drugs enables more comprehensive planning based on the medication rather than the brand. Further, aggregate forecasting helps retailers detect trends and seasonality at levels that are not statistically significant at the individual SKU level.

A system that enables planners to configure their solution to automate replenishment for all orders while incorporating pharmacists’ information about local demand can accurately determine the medications for each location’s assortment, thereby mitigating the risk of lost sales or high inventory costs.

Managing the revolving door of generics, preferred drugs, and price shifts

Constant market changes drive replenishment complexity for prescription drugs

Substitutions are extremely common in pharmacy retail, and they can also be one of the most complex and constant challenges that pharmacies face. There are several vital components to drug substitutions that all affect each other and that pharmacies must continually manage.

- Generic drugs entering the market drives cannibalization. When the patent for a name-brand prescription expires, new generic medications will become available in the marketplace, leading to demand shifts. These new generics will cannibalize demand not only for the name brand but also for each other. Regardless of the number of generics entering the market and their effects on overall demand, pharmacies must be able to fill prescriptions for both generics and name-brand drugs. Further, when multiple generics of the same drug are available, and from multiple suppliers, pharmacies need to ensure that they order the most appropriate product from the best source available.

- Price shifts affect more than consumer preference. Like many other products, price is the most significant influence on the prescription drug market, and generic manufacturers compete heavily to become the market driver. The ability to respond rapidly to price shifts for prescription drugs can be more urgent than general merchandise. While prices for general merchandise items fluctuate, if a particular brand of paper towels is more expensive than the consumer wants to pay, substitution is simple at the shelf and does not directly influence the consumer’s immediate health and well-being. However, price fluctuations in drugs affect more than consumers’ purchase decisions. They affect the drugs preferred by health care agencies and insurance and government coverage. The urgency of rapid price shifts is enhanced in many regions by regulations that pharmacies recommend the least expensive option for prescription drugs, regardless of the physician’s prescription.

- Preferred drugs designated by the government or healthcare agencies cause rapid change. Government agencies or insurance companies frequently designate a specific generic drug as “preferred”, meaning it will be subsidized or covered with little or no financial responsibility for the consumer. In other cases, several generic manufacturers could be considered preferred at the same time, or none may receive a preferred designation at all. Depending on local rules and regulations, the preferred designation is not fixed and can change periodically. In Sweden, for example, government entities share monthly updates about preferred generics for name-brand medications, while in Denmark, those entities share updates as often as every two weeks. In Italy, all brand drugs and their associated generics are included in a monthly list that references the prices of each and the amount reimbursed by the government. In the US, insurance companies are the primary decision-makers on which drugs are preferred and the covered costs for each. Regardless of who is designating preferred drugs or by what method, the challenge for the pharmacy is the same.

An advanced inventory management system that enables pharmacies to easily configure rules based on multiple criteria such as preferred manufacturer, price, and availability can automatically determine the best supplier for an order. The system can then transfer overall category demand or demand for the previously preferred product based on historical sales data to the new preferred product.

Regardless of a pharmacy’s location or what regulations and situations they must contend with, the issue is the same: How to manage prescription inventory to meet availability and local demand effectively?

Pharmacies must account for thousands of SKUs per distributor. This amount of data is simply far too complex to manage manually. They need a system that can aggregate forecasting data across multiple product sets, locations, and suppliers to react immediately to change. Simply put, automation, flexibility, and speed are essential. A system that can apply customized business rules management allows for adaptation to a pharmacy’s unique situation, and ease of use makes updates seamless and easy for the user to execute without needing vendor support.

Using an automated system to handle prescription drug inventory ensures that customers in all locations get their medications when they need them while freeing local teams to focus on high-value tasks such as managing exceptions and modifying orders based on local demand.

Section 3: Growing assortment offerings require more robust inventory management technology

Today, customers expect to be able to make purchases from a single location to meet multiple needs. Pharmacies have had to update their assortment accordingly to remain competitive, carrying a broader range of items than ever before. This pharmacy model of increased inventory, which has been in place in the United States for many years and is now gaining momentum in Europe, the Middle East, and Africa (EMEA), brings multiple business benefits as well as a new level of complexity that some pharmacies may not have experienced in the past.In most regions, today’s pharmacies have evolved from dispensary-only locations to convenience retailers and mid-format retailers that carry groceries, household goods, toys, complete lines of health and beauty products, and more. Some pharmacies and regions are much farther along in this evolution than others. However, no matter where on that evolutionary scale they are, in order to keep up with their ever-expanding offering, they need an automated inventory management system to handle their general assortment, just as they need automation to handle prescription medication inventory.

Localization is essential for smaller format pharmacies to meet specific customer needs

Not all pharmacies within a region, or even the same cluster, will carry the same categories or assortment within the categories they share. Because most pharmacies have a smaller store footprint than their larger format competitors, they must allocate products optimally to meet local customer needs and maximize shelf space value. A pharmacy near a university may carry more shelf-stable groceries and household products to meet the needs of students in the area. In contrast, a pharmacy in a city center may have a more extensive inventory of prepared foods, chilled drinks, and office supplies for busy professionals to grab on the go. In addition, there are often products that are of vital importance and must be included in the assortment even though demand may be low.

As pharmacies’ assortments expand and localization becomes more of a priority, they can no longer rely on manual planning for forecasting and replenishment. Instead, they must have a robust, data-based system that can automatically handle issues related to inventory levels at each store. Such a system should generate orders in the right amount and at the right time to avoid both overstocks, which are hard to manage in a store with minimal storage space, and out-of-stocks, which can hurt competitiveness.

A system that uses machine learning and artificial intelligence can incorporate more data than any human can —footfall data, demand data, and local data from external factors like weather or events — to automate forecasts and orders, improving accuracy while freeing staff to focus on more critical tasks. Further, a unified system can apply forecasting data to create localized floor plans for the limited shelf space available which may differ in each location.

For instance, Apoteksgruppen, a chain of more than 160 pharmacies throughout Sweden, uses an automated system for inventory management. Before implementation, local staff relied on instinct and customer demands to place orders, and each team had to put hours of manual work into ensuring acceptable inventory levels. “When you handle some 10,000 products manually, it’s hard to keep tabs on which of them don’t sell,” said Pharmacist Daniela Rohlén, owner of Apotek Stenbocken. The automated system now creates order proposals based on forecast data, saving each pharmacy up to 10 hours of manual stock management each month.

Seasonal item and promotion management are high priorities for pharmacies

Diverse item types require specialized seasonal strategies

As they expand their assortment, pharmacies must contend with both standard retail seasons and more pharma-specific seasons. Examples of such seasons include “spring allergy season,” which increases the demand for allergy medications; “beach season,” which increases demand for products like sunscreen and pool supplies; and “cold and flu season,” which increases demand for OTC medications and tissues. While many pharmacies are familiar with managing some seasonal inventory, those that are expanding their assortments may be facing these demand patterns at a scale they have not had to handle before and for new categories.

Because their business now relies heavily on seasonal patterns, pharmacies need a system that can automatically order the inventory that will sell the best during a limited timeframe, reduce the stock that is not in season with markdowns that continue to protect margins, and ensure they have sufficient shelf space for the next season as it happens. An automated system can also ensure that stock doesn’t arrive too early, as there’s no space to hold it until the season starts or too late, missing sales opportunities during a short timeframe of increased demand.

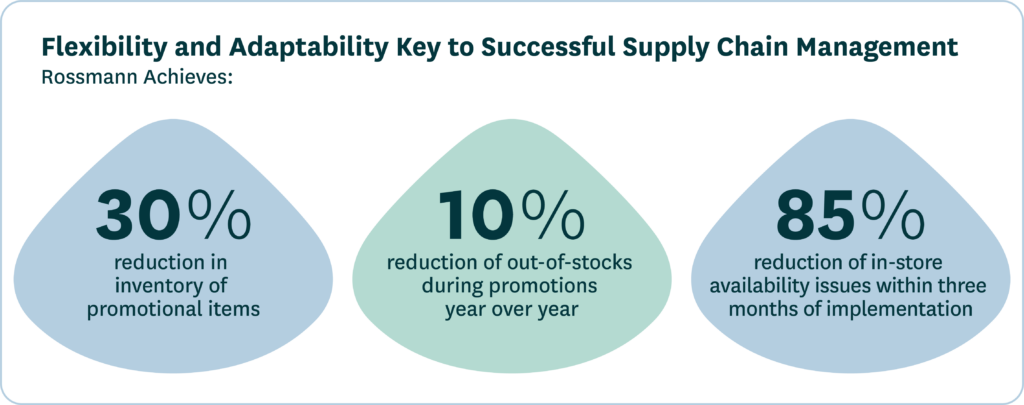

For example, Dirk Rossmann GmbH, Germany’s second-largest drugstore chain, reduced stockouts by 17% during their first December holiday season and 25% during their first Easter season after implementing an automated forecasting, replenishment, and promotion planning system. The chain was also able to reduce the number of stores experiencing availability issues by 85% within three months of implementing the system.

Similarly, promotions are something that general assortment retailers must contend with, but promotion may be new to pharmacies in some regions that previously only handled prescription medications. The added complexity of promotions means that pharmacies need an automated system to ensure availability during the promotional period while avoiding overstock that can take up valuable space. Such a system should also ramp down stock as demand declines with a carefully managed markdown process that protects margins while encouraging sales.

For instance, American omnichannel retailer The Vitamin Shoppe, which sells a specialized assortment of nutritional supplements, natural beauty products, and more, used an automated system to forecast promotional uplifts at the store/channel level. The system easily accounted for the impact of price discounts, duration of the promotion, and promotional displays on their assortment and adjusted orders accordingly.

As pharmacies worldwide either begin to branch into carrying a general assortment or work to refine what they already stock, the need for an automated solution becomes apparent. A system that can process a vast array of data into highly accurate forecasts that drive replenishment orders, manage seasonal and promotional items, and also support space and workforce planning, provides pharmacies with the ability to improve both availability and customer service while remaining profitable and protecting margins.

All of this adds another layer of complexity when an omnichannel pharmacy must manage in-store stock and the stock in dark stores, distribution centers, or warehouses that they must deliver to the end customer.

Section 4: As pharmacies expand their retail footprint, omnichannel capabilities are imperative

When considering omnichannel, pharmacies have additional complexities over other retailers. Namely, they must handle and dispense controlled substances and comply with regulations that vary drastically from region to region. At the same time, they must also manage slow-movers, seasonality, and substitutions. Further, in some markets such as the US, omnichannel isn’t only retail fulfillment but includes integration to healthcare providers (HCP) services such as consultations, history, insurance coverage, and copayment.

In addition to the above complexities, the emergence of online-based pharmacies is driving a new level of competitive pressure. One example is Medly, a full-service digital pharmacy that provides free same-day delivery for prescriptions and specialty health and wellness products in the United States. These businesses, born in the omnichannel world, have been on a steady rise across the globe. Traditional pharmacies that have been slow to modernize will have difficulty remaining competitive in the future.

Pharmacies need technology that is truly omnichannel, not just online

No matter the region or the level of retail maturity, pharmacies need advanced, unified technologies that can address challenges across all channels.

Executing a high volume of small orders, many of which require same-day delivery

Pharmacies and their distributors manage a very high volume of small orders daily, especially when filling prescriptions. In most cases, these orders must be delivered within 24 hours, sometimes within one hour. For example, Swiss pharmacy wholesaler Galexis processes up to 120,000 order lines for more than 4,000 shipments per day for their retail and health care customers. While retail pharmacies may not process numbers that high, they give insight into prescription drug demand on a large scale.

Let’s think about adding general merchandise into the mix and allowing customers to place delivery orders that include both prescriptions and general merchandise. A pharmacy chain could potentially need to manage tens of thousands of products across their sales channels daily. The only way to accomplish that level of inventory management is with an advanced solution that can efficiently classify, allocate, and distribute multiple product types to the right places at the right time.

Managing multiple levels of regulated items and general merchandise together

Regional differences in drug handling requirements, including regulation of controlled substances, are complex enough. But what happens when pharmacies need to manage general merchandise in the same order as a prescription? Pharmacies must decide how to manage the speed and service required for prescriptions and align them with customer expectations for delivery of other items.

Fulfillment methods and locations and the space and staffing of those locations are essential considerations for effectively managing omnichannel sales. Only a unified supply chain planning solution can seamlessly manage forecasting, replenishment, and fulfillment across multiple, varied product types, locations, and channels.

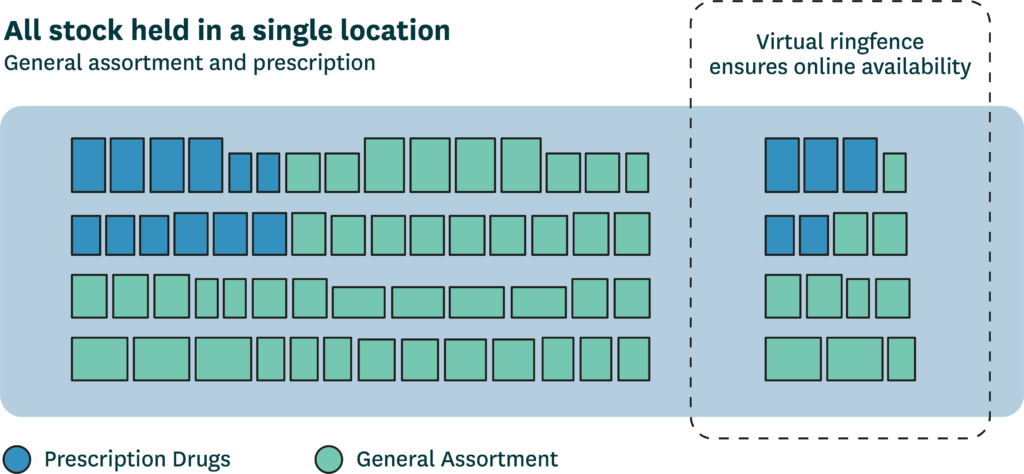

Optimizing inventory levels to maintain availability requirements for all sales channels

In many regions, the government mandates and regulates availability levels for particular drugs, and it can be labor-intensive for a local team to ensure that inventory can meet in-store service requirements. Adding online and app-based sales channels and fulfillment methods like click and collect and home delivery drives complexity to new levels. Pharmacies need technology solutions that enable ringfencing – allocating a forecasted amount of stock to online channels in a system that treats it as reserved – for regulated and general merchandise items to ensure availability is not compromised no matter how, when, or where customers order and receive their goods.

Different fulfillment models require unique considerations

Successful omnichannel strategies are based on unique goals

The two main cost drivers for online retail are speed of service and picking efficiency. Profitability is about balance, and each retailer must assess their own criteria to determine what they want to offer and how to execute it. Is their primary omnichannel goal to provide fast home delivery or click-and-collect? Or is the focus picking efficiency from a broader assortment with slower service?

Depending on their goals, retailers will gravitate to one of two main models for omnichannel service: centralized fulfillment utilizing large warehouses with fewer locations or decentralized using sites such as dark stores, micro-fulfillment centers, and in-store picking. Both models have advantages and challenges depending on targets set for service and efficiency.

Centralized model: Efficiency and scale at the cost of slower service and higher investment

Warehouses, especially those with high levels of automation, are by far the most efficient means of picking, but they are not without challenges. Retailers that utilize large warehouses and distribution centers may be highly efficient at picking, have a low substitution rate, and have the capacity for vast assortments. However, they run into challenges with distance from their customers, meaning longer drives and fewer available drops per trip. Most importantly, they must be able to commit to the sizeable investments in land, building, and resources that large fulfillment centers require.

It is essential for pharmacy retailers to carefully weigh the proximity of big warehouses to customers and how that limits their ability to serve orders with an immediate need. It is also critical to ensure they can execute and fulfill orders with the highest level of speed and accuracy possible, especially when considering urgent-need drugs as well as over-the-counter and consumer goods.

Doing so requires automating replenishment for all channels and inventory types in a single unified system. Ringfencing, as mentioned earlier, allows retailers to combine online and store-order forecasts and then allocate from a single stock pool. Combining this allocation level with forecasting at the channel-SKU-day level gives pharmacies the ability to manage a vast array of goods from a large central location without compromising service or availability.

The Vitamin Shoppe, an omnichannel retailer of over-the-counter nutritional supplements, offers an assortment of more than 6,000 SKUs per store and over 10,000 SKUs online. Automating their supply chain significantly improved The Vitamin Shoppe’s ability to optimize inventory by ringfencing inventory in distribution centers to ensure availability for online demand, especially for subscription-based orders from their most loyal customers.

Decentralized model: Proximity to customers drives speed but adds complexity and limits space

The chief benefit of store-based picking, dark stores, and micro-fulfillment centers is proximity to the customer, which enables click-and-collect or ultra-fast delivery options. Pharmacies tend to operate smaller locations and assortments and need to be able to deliver products as quickly as one hour may find this approach works better for their scale. Unless they separate drug orders from those for general assortment items into two different fulfillment methods, speed to service will be critical to their omnichannel success.

However, as with a centralized approach, there are compromises. Complexity rises when retailers must manage orders from multiple locations and formats. Picking online orders from stores can be invasive and result in out-of-stocks for in-store shoppers. Smaller footprints for dark stores and micro-fulfillment centers and limited storage space in stores create limitations on the assortment offering and inventory levels available in each location. Further, in some regions such as the US, retail pharmacies will manage the inventory for all channels but are unlikely to initiate in-house delivery services. Instead, they will rely on partnerships with third-party services such as Instacart to execute the picking and delivery of goods. In any case, effective communication and alignment with internal fulfillment resources and any third-party delivery partners is essential to ensure availability for all locations and channels.

Retailers operating on a decentralized approach need a system that can account for inventory needs for all locations across their network and differentiate between retail and dark stores or micro-fulfillment locations. The system must be able to unify forecasting and replenishment and allocate inventory to all locations with precision to maintain availability without overwhelming any of them with too much stock or not giving enough to another. This is especially important for promotions, markdowns, new product introductions, and seasonal demand shifts.

In some cases, pharmacies may operate on a mixed model, providing prescriptions and other urgent-need items from stores or dark stores and using central warehouses for their consumer goods assortment. Whatever the case, it’s crucial that they carefully consider the impacts of each model. They also need to invest in technology that is agile enough to drive their supply chain across any model and at any stage in their omnichannel development and scalable enough to meet their needs as they grow and develop further.

A modern pharmacy supply chain is scalable and agile to meet the needs of today and tomorrow

Pharmacies today contend with a litany of challenges when it comes to supply chain planning and vast regional differences in regulations and retail models mean that there is no one-size-fits-all solution that can be applied to pharmacy as a retail vertical. However, no matter where they are in the world or their retail evolution, there are some considerations all pharmacies have in common:

- Prescription drugs may have different regulations from region to region, but availability requirements are a universal truth. Automation, data, and a rules-based approach to forecasting and replenishment are the only ways to navigate drug replenishment with the speed and agility to meet customer needs.

- Expanding assortments and retail models are requiring some to face issues for the first time that others have years of experience managing. Just because some pharmacies that are just starting to expand into other categories, doesn’t mean they can take things slowly. In fact, it means they need to be able to catch up to their competitors quickly and efficiently. A scalable solution can fit a retailer’s needs in their current state and grow with them to into future. Further, a unified approach can connect supply chain, assortment, and space planning for seamless, automated execution.

- Omnichannel retail is no longer nice-to-have, it is essential. Emerging online pharmacies are putting pressure on traditional ones and omnichannel options for general assortment items are expected by nearly all consumers today. Replenishment processes need to be unified across all locations, products, and channels no matter what fulfilment model the retailer selects. Further, retailers need to carefully consider the best model for their goals, whether using a central warehouse or decentralized, using stores, dark stores, micro-fulfilment, or delivery partners.

Technology and automation for supply chain planning play a big part in the transformation of retail, and pharmacy is no different. Pharmacy supply chain planning needs to become more responsive and finely controlled than ever before to meet their unique requirements and the urgent – and not-so-urgent – needs of their customers with efficiency and accuracy.