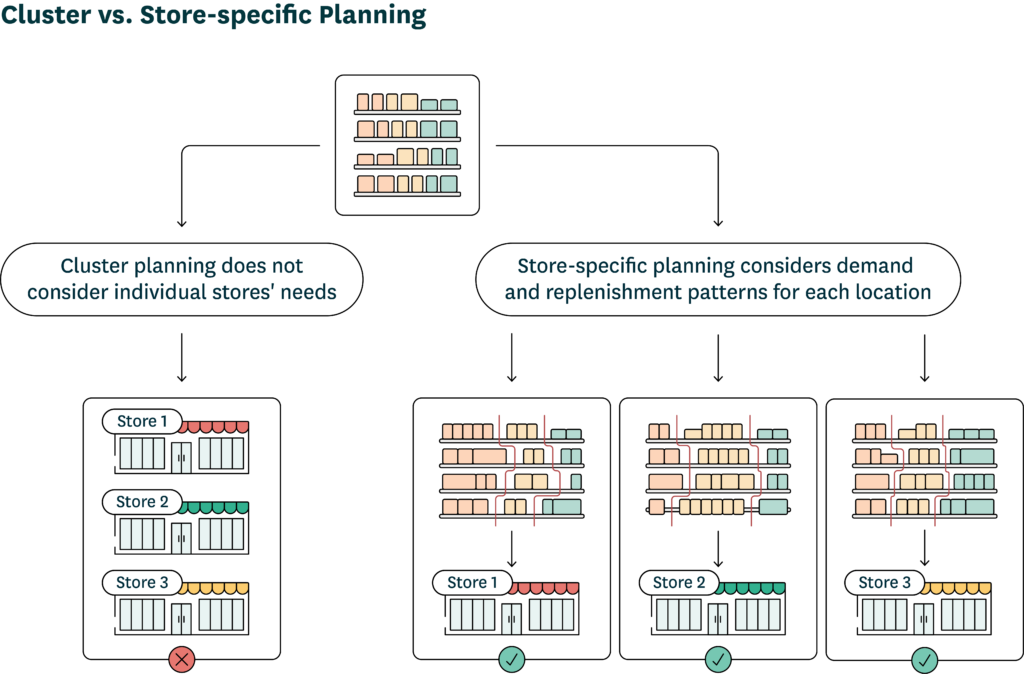

Retailers have long relied on planograms to drive sales and positive customer experiences at their stores. While planograms continue to be an essential aspect of retailers’ space strategies, many rely on a cluster-based model that involves sharing a singular, centralized planogram across all the stores within a group based on a defined set of characteristics.

However, planning at the cluster level can lead to several issues, as individual stores have unique demand patterns, footprints, and storage capabilities. Ideally, retailers would design planograms to fit each store’s space and local demand. The benefits of store-specific space planning are considerable – including improved availability, sales, and operational efficiency – but the implications behind implementing such a plan can be daunting.

Approximately 1 million calculations are required to produce just 3 feet of store-specific planograms, which becomes impossible when extrapolating across the entire chain of retail stores. Considering this, it becomes easy to see that the only way to achieve store-specific space planning is with an automated system that can quickly process vast amounts of data at scale.

1. Building a business case is critical to driving a space planning technology investment

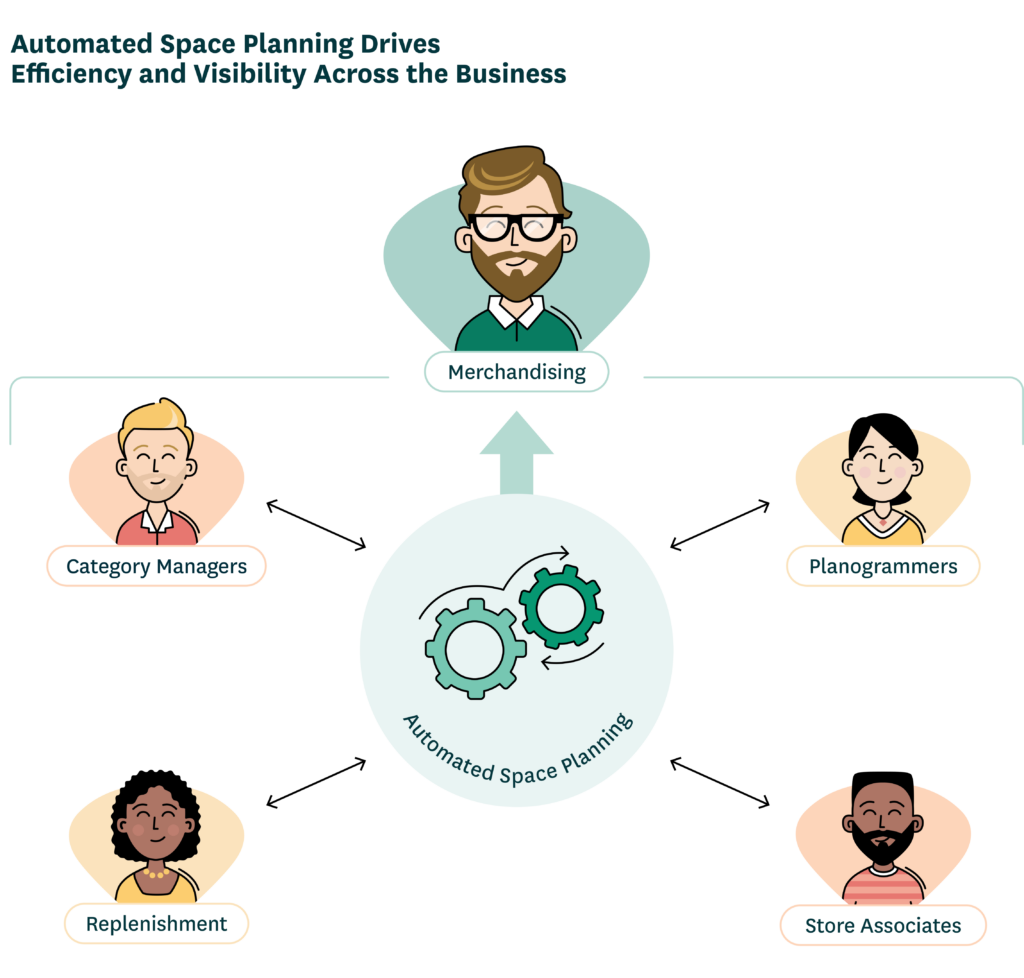

Smart retailers understand that the value of their merchandising departments lies in their scientific artistry – not their ability to crunch endless strings of numbers. When retailers rely on an AI-driven space planning tool to calculate massive datasets, they free their merchandising teams to work on more valuable tasks and ensure brand consistency and customer experience across stores. The right space planning technology can optimize merchandising, store operations, and replenishment to drive increased sales, product availability, and reduced waste.

Fortunately, several tools are available to meet these and other crucial space planning needs. With multiple options available, it’s essential to ensure that the technology your organization invests in will provide the most value and long-term benefit.

Careful evaluation of space planning technology vendors is critical, considering that the average lifecycle of technology investments is approximately a decade. As a rule of thumb, it’s safe to assume that any solution your company invests in is unlikely to be reconsidered for at least 7 to 10 years, so you should be sure the vendor you select can deliver on their promises over time.

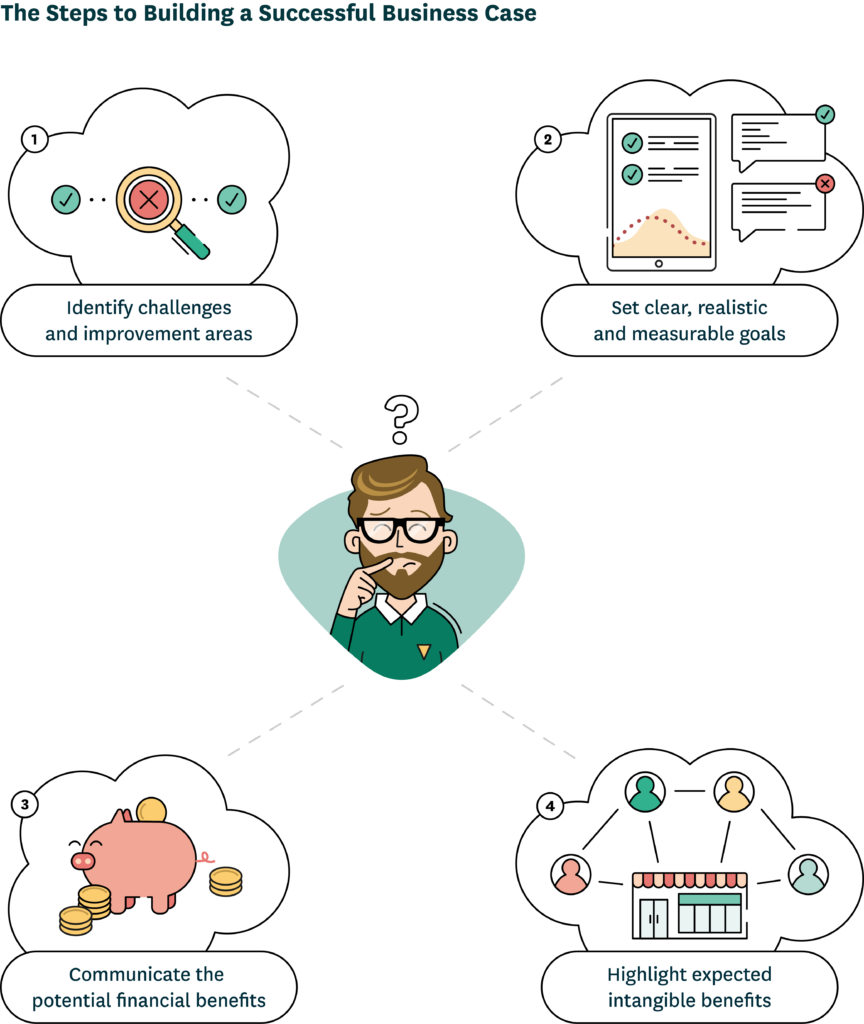

The best way to evaluate a potential investment in a space solution is to build a strong business case using accurate, real-life data to calculate the potential financial impact it will have on your organization.

If you decide to move forward with a new space planning technology investment, the business case will help you achieve a successful technology implementation. A well-considered business case empowers you to achieve your goals by clearly outlining your objectives and focusing on the key performance indicators that will drive the most value for your company.

2. Building the better business case: Family Hypermarket’s space planning starting point and improvement needs

To illustrate the best practices for building a business case, let’s revisit our fictional retailer, Family Hypermarket, who built a business case for a supply chain planning technology investment.

Family Hypermarket is a $5B general merchandise and grocery chain based in the United States. They operate 100 stores and five distribution centers, carrying an average of 40,000 SKUs per store. Family Hypermarket has grown significantly in recent years. They’ve scaled quickly, adding new locations to their network, and are simultaneously experiencing rapid growth in their online channel.

2.1 Assessing the current state of Family Hypermarket’s space planning process

Family Hypermarket has a team of 20 planogrammers that create and manage planograms for approximately 150 categories across all stores. Until now, these planners have relied on spreadsheets to input product data and output PDF planograms to deliver to stores. While this method worked in the past, it fails to provide the same results as the company scales.

Family Hypermarket’s planogrammers spend, on average, 20 minutes per plan. Expanding that time across the collective team reveals that they spend approximately 15,000 hours, or 750 hours per year per planner, on planogram management and creation. As they continue to grow, this manual space planning process will only become more time-intensive and the results less successful.

Further, planograms are causing problems in the stores, and store operations teams struggle to use them out of the box. Family Hypermarket’s current process is driven by geographical store clusters based on state.

Due to limited resources, the space planning team cannot manage cluster-based planograms for all product categories; some product categories still rely on a one-size-fits-all approach despite local differences in demand. The inaccuracies inherent in planning based on averages are causing too much or too little space to be allocated to certain items, leading to issues with planogram execution and compliance.

Taking the time to build an accurate and honest picture of their current state enables Family Hypermarket to identify the most critical areas of improvement and set the most meaningful goals and key performance indicators (KPIs) possible to address their challenges.

2.2 Identify key challenges and improvement needs

Matthew recently started as Family Hypermarket’s VP of Merchandising. In the months since assuming his role and working with his team, he’s noticed weaknesses in the space planning processes. In his last position, he witnessed how the ability to generate forecast-based, store-specific planograms more accurately aligns space allocation with local demand. However, he is also aware that his planogramming team is stretched to the limit, and they don’t have the capacity to create planograms manually at the store level.

Matthew uses his knowledge of Family Hypermarket’s current state to identify his key areas for focus and improvement.

Space allocation tends to be off, with too much space for slow movers and too little space for fast movers, which leads to store staff needing to replenish the shelves during the day and still suffering from empty shelves. However, the goods are available in the backroom. Excess stock and broken cases going to backrooms also create unnecessary goods handling caused by the need to replenish shelves from backroom stock because there is too little shelf space allocated to the product.

Space allocation issues are especially problematic for stores with sales patterns that deviate from the averages in their clusters. For example, sub-categories or blocks in cereal will be allocated the same space for every store with the same planogram. However, as every store is not physically identical, products may not fit as planned. Further, broad clustering ignores potential variances in customer demographics and demand, leading to misalignment between allocated space and local demand.

When plans allocate too much space to a product, additional inventory is needed to fill shelves and maintain their appearance. Conversely, if there is too much stock and too little space allocated, frequent trips to backrooms are required to replenish them, leading to potential stock-outs.

Planogram compliance challenges arise because, when doing resets, store operations teams must figure out how to make the cluster-based planograms work in their stores. This issue not only puts additional workload pressure on store staff but can also cause problems when managing trade agreements with consumer packaged goods (CPG) partners.

Making a shift to store-specific planogramming would solve Family Hypermarket’s primary issues. However, Matthew knows the only way to achieve store-specific planning is to invest in a new technology solution with built-in automation capabilities that will align and streamline Family Hypermarket’s space planning. Before he can propose an investment of this scale, Matthew wants to ensure that the benefits outweigh the costs and determine the criteria for the best solution.

During his onboarding, Matthew met Sue, who told him about her recent project creating a business case for modernizing Family Hypermarket’s supply chain planning. He decided to consult her about how she successfully outlined the targets and financial impacts of that investment. Sue reminds him that it’s important to have a clear picture of where he is and to create realistic and measurable goals based on data and research.

2.3 Develop realistic, tangible improvement goals

Matthew begins identifying specific goals for his proposed technology investment based on his discussion with Sue and his initial market research and vendor discussions. In his goal-setting process, Matthew recognizes that all his challenge areas are interconnected, and improving one will help to improve aspects of the others.

Matthew understands that making the shift to store-specific planograms will have several benefits on an operational level. Primarily, store-specific planning will help in-store teams perform more efficiently, drive better category performance, and increase planogram compliance because each planogram is designed to meet each store’s demand and space needs.

Automating processes to streamline planogram development and enable store-specific planning.

Matthew determines that a shift to store-level planogramming would require a four-fold increase in the number of planograms created each month, translating into approximately 3,000 hours of work per year for each of his planners. With Family Hypermarket’s current system, they would need at least nine more planners to accommodate the additional work, which is not a viable option for the business.

Matthew’s benchmarking shows that an advanced space planning and optimization solution would reduce time spent on planogramming by 25% by streamlining data inputs, increasing accuracy to mitigate manual adjustments, and speeding up revision and delivery processes. Reducing time spent on planning would allow greater collaboration with category planners and suppliers and analyzing category performance.

Shelf-specific allocations improve goods handling and reduce costs.

Space allocation that matches local demand, and considerations such as store replenishment frequency, ensures more direct-to-shelf deliveries and fewer situations where store associates must take part of a case pack to backroom storage. The result is a reduction in shelving frequency for fast-moving products because they have the space they need. Also, matching space to demand decreases inventory build-up of slow movers caused by the need to fill their shelf space.

Using an automated planning system to determine store-specific space allocation accurately, Matthew expects to reduce in-store handling costs by 15-20% and drive an overall inventory reduction of approximately 5%.

Improve on-shelf availability and increase sales through better space allocation.

Matthew knows that when shelf space is used optimally, based on that store’s demand, store teams will not spend as much time constantly ensuring shelves are stocked. This will also help reduce the risk of stock-outs caused by late or slow shelf restocks. Matthew estimates a 1-3% increase in on-shelf availability due to automated planning and space allocation efficiency. He expects this increased availability will deliver a .5-1% increase in sales.

While Matthew has these specific goals for Family Hypermarket’s technology investment, he is also aware that there will be additional, intangible benefits that may be harder to quantify. For instance, he wants to see an improvement in overall customer service and category performance once availability issues are solved. Additionally, he expects his relationships with CPG partners to benefit by ensuring their trade agreements are upheld across their locations.

3. Family Hypermarket’s business case for investing in automated space planning technology

Matthew knows that Family Hypermarket’s business leaders are focused on revenue growth, not cost savings related to technology investment. However, money saved is money earned, so he decides to shift their mindset and foster confidence that they can do the project without adding to their burden. Matthew collaborates with Steve, a business controller from the CFO’s team, to help translate his goals and expected benefits into potential financial impacts. Further, Matthew knows some benefits will be hard to quantify, so he creates a list of intangible or “soft” benefits.

3.1 The financial benefits of an automated space planning technology investment

Improved on-shelf availability drives sales.

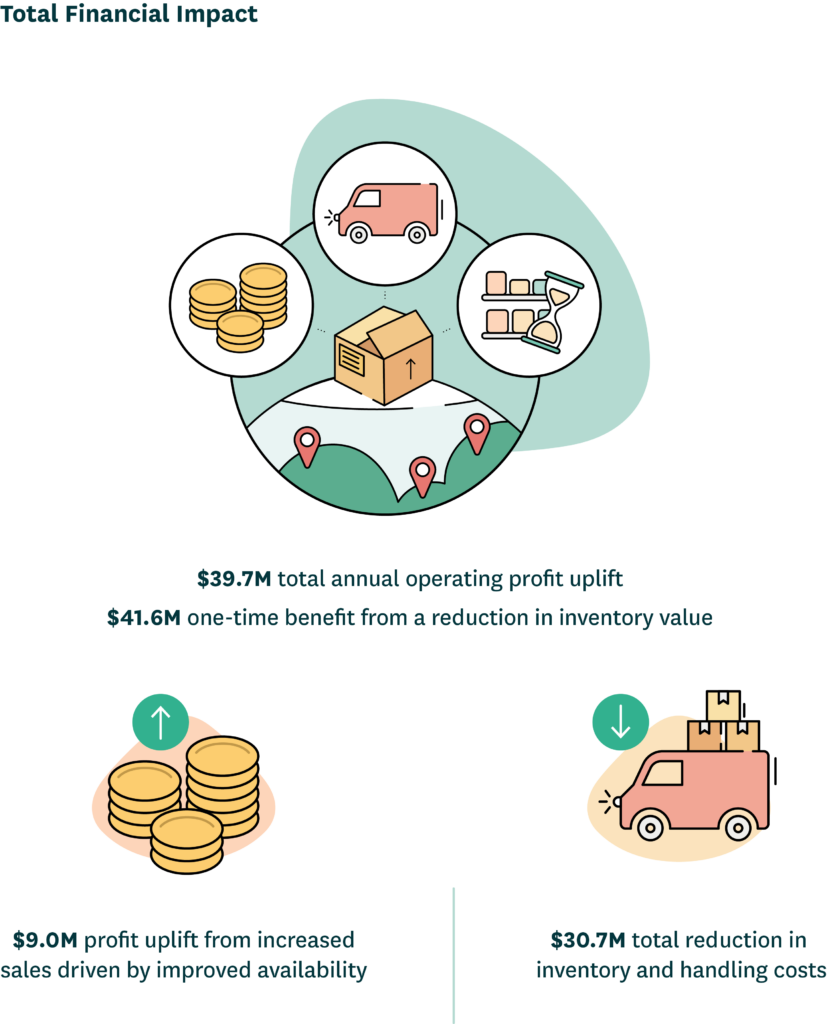

Family Hypermarket’s overall availability stands at 95%. Automating space planning to increase space allocation accuracy and store operations efficiency is estimated to result in a 1.5% increase in on-shelf availability for all categories up to 96.5%. Matthew expects a sales increase equivalent to $30M (+0.6%), translating into a profit lift of $9.03M per year due to this improved on-shelf availability.

Increasing space planning accuracy reduces inventory handling costs and stores’ operational efficiency.

Matthew estimates that more accurate space allocation driven by store-specific planograms will result in a 16.8% ($25.25M) reduction in goods handling costs in stores and a 5% ($5.21M) reduction in inventory carrying costs annually. He also predicts a one-time benefit of $41.65M in freed-up working capital from inventory.

Increased sales from better availability combined with a reduction in inventory carrying costs are expected to result in a +$14.2M annual gross profit impact and a +$39.74M annual operating profit impact.

Automating planning frees up resources for a more advanced, store-specific model.

An automated space planning system is estimated to reduce the time needed for planogram creation by 25%, saving 187 hours per planner per year. The time savings from automation would enable Matthew’s team to meet the needs of store-specific planning without the need for additional planners. Further, better accuracy for stores, streamlined planogram execution and delivery, and time freed for more valuable tasks for store operations means higher levels of efficiency, less manual manipulation, fewer revisions to planograms, and better customer experience for Family Hypermarket shoppers.

3.2 The total financial impact

After completing his calculations, Matthew is sure investment in an automated space planning solution will help his company reach their goals and smooth operational processes. He is confident in the results of his business case because he built it off an accurate current-state assessment of their space planning processes in relation to their goals. He understands the potential investment’s expected return on investment (ROI) and the drivers behind those expectations.

3.3 Additional “intangible” benefits of investment in advanced space planning

In addition to the tangible financial benefits of an advanced space planning solution, Matthew wants to learn about what other, less quantifiable benefits the investment can drive for his business overall. Space and allocation are critical components of their retail operations, and the benefits of the right solution will have far-reaching benefits.

By aligning Family Hypermarket’s space and merchandising plans with their supply chain and store operations, Matthew can see that each team will have improved visibility into each other’s plans and processes.

With a flexible, automated space planning solution, Matthew’s team can create optimized planograms for each type of fixture and shelf in his stores based on accurate replenishment data, driving better stock presentation and collaboration with Family Hypermarket’s CPG partners.

Additionally, a solution that enables teams to share planograms on mobile devices digitally gives store operations teams immediate access to the latest updates without spending time and energy on emails and waiting for PDFs. This level of flexibility will ensure that Family Hypermarket can adapt to changing business conditions and strategies quickly and efficiently.

Furthermore, with Matthew’s teams being able to work more efficiently, they’ll be better able to focus on strategic initiatives instead of time-consuming manual tasks. This will have far-reaching benefits that ripple across Family Hypermarket’s teams, improving workforce, store operations, promotional planning, and supplier collaboration.

As an additional benefit, a flexible and easily configurable solution that can be customized quickly by a core team of internal expert users is more operationally cost-effective than those that need a lot of vendor intervention. Matthew will work directly with his vendor to set up the solution. He understands that the longer it takes to put the solution into practice, the longer it will take to see results. Matthew trusts that his vendor’s experience and best practice advice will lead Family Hypermarket to a successful implementation.

4. The key takeaway: Using accurate data will drive the most reliable results

As Matthew and his colleagues have demonstrated, using accurate current-state data to create a business case is critical when evaluating vendors for investment in an advanced space planning and optimization solution. Had he relied on benchmark data alone, Matthew would not have been able to provide an accurate enough blueprint for successful investment and a long-term commitment.

With his business case in hand, Matthew can confidently articulate his findings and vendor selection to Family Hypermarket’s leadership. Interestingly, several of the expected benefits surpassed his initial goals. His business case is a valuable tool that will help him to:

- Direct conversations with potential vendors to ensure they can meet Family Hypermarket’s needs.

- Establish clear priorities both internally and with vendors to ensure long-term success.

- Set realistic, measurable goals.

- Guide the successful implementation process of the new technology solution.

When you work with a vendor directly, using your accurate, real-life data, you can see a much more exact estimation of the financial implications the investment will have for your business. As an added benefit, you’ll have the opportunity to ensure your teams will work well together during the implementation process and throughout the relationship.

In situations where a retailer lacks certain information or has insufficient historical data around their space planning processes, open collaboration with your potential vendors can help you select the most realistic figures possible in your calculation. Many vendors will be able to provide insight based on industry experience. However, it is essential to consider their customer references as a factor in the trustworthiness of their estimates.

As you create your business case for your organization’s next space technology investment, view your stores’ current space challenges as an opportunity to establish measurable, realistic goals to drive the most value for your business.