The rise of private label: Strategic optimization for the modern marketplace

Aug 22, 2025 • 6 min

Private label used to be the budget option that consumers reached for only when they couldn’t afford the brand-name versions. But that’s no longer true.

Private label sales reached a record $271 billion in 2024, outpacing national brand growth for the first time in decades. This surge represents more than economic necessity — it signals a fundamental change in how consumers perceive store brands and how retailers position them.

Behind this transformation lies a complex web of supply chain orchestration, pricing intelligence, and space optimization that turned private labels from a cost-saving measure into a growth engine.

Private label’s strategic evolution

The traditional private label playbook focused only on price. Retailers offered basic alternatives to top-selling national brands, typically with plain packaging and lower quality expectations. Consumers bought these products when budgets were tight, viewing them as temporary compromises until they could return to their preferred brands.

That dynamic has reversed. Inflation and economic uncertainty initially drove more consumers toward private label options, but quality improvements and strategic positioning have kept them there. Generation Z and millennial shoppers are more likely to have tight budgets and view private label products as smart shopping.

As shoppers continue to turn to private labels, these products have begun to stand out by offering unique products shoppers can’t find anywhere else. Retailers like Trader Joe’s and Costco have leaned into this approach, creating large fan bases for their private-label products. Their exclusive availability tied to the retail brand creates a unique assortment and shopping experience, turning stores and online channels into shopper destinations.

Modern private label challenges

Retailers face increasingly complex operational challenges across three critical areas as private labels transition from a low-cost alternative to a strategic differentiator.

Forecasting and replenishment

Lead times often vary compared to national brands because retailers work directly with manufacturers rather than established distribution networks. The stakes are higher because private label stockouts directly impact store profitability and customer loyalty in ways that national brand shortages may not.

The interaction between private labels and national brands adds another layer of complexity. A successful private label promotion might cannibalize national brand sales, affecting supplier relationships and category profitability. Conversely, private label products can create halo effects, drawing customers to purchase additional items throughout the store. Understanding these dynamics requires sophisticated demand sensing capabilities that account for competitive interactions on the shelf and more accurate store and DC-level replenishment.

Space and assortment

Retailers must balance support for their private label investments with maintaining national brand relationships. Too much private label space risks alienating key vendors; too little undermines the investment in product development and brand building.

The challenge extends beyond simple shelf allocation to category-level planning. Retailers must understand which categories lend themselves to private label success and which require national brand strength. Pet food, for example, shows tremendous brand loyalty, making private label penetration difficult. Conversely, basic household items, like paper towels or lightbulbs, offer opportunities for private label products to match or exceed national brand performance while delivering superior margins.

Pricing and promotions

Private label products must be priced competitively enough to attract customers while maintaining the margin advantages that justify their existence. Setting pricing relationship rules — such as maintaining private label prices at a specific percentage below national brand equivalents — provides structure but requires constant adjustment as market conditions change.

Promotional strategy adds complexity because private label promotions serve multiple purposes. They drive immediate sales and margin, but they also build brand awareness and customer trial. The most effective private label promotions create long-term value by converting customers who might never have tried the product otherwise. Measuring this impact requires sophisticated analytics that connect promotional performance to sustained purchasing behavior.

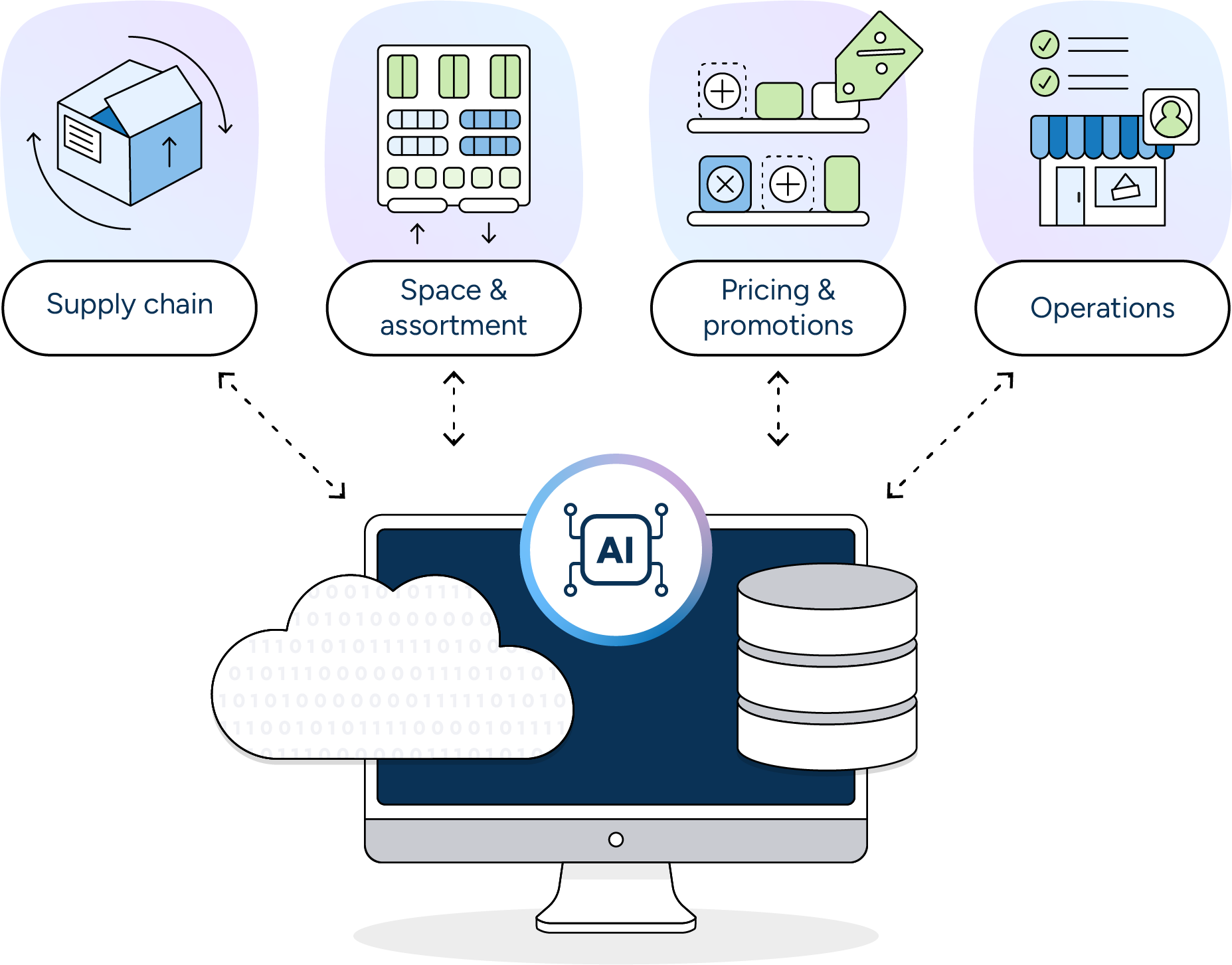

How RELEX fosters private label success

RELEX simplifies the operational challenges of private-label management by integrating advanced forecasting, space and assortment optimization, promotion planning, and pricing intelligence. With a unified platform, retailers can make data-driven decisions that enhance efficiency, profitability, and customer satisfaction.

Forecasting and replenishment excellence

RELEX leverages AI-driven forecasting to analyze category trends, seasonal patterns, and performance data from analogous products. This approach enables accurate demand forecasts even with limited historical data, helping retailers make informed decisions.

True Inventory capabilities optimize store-level inventory management by using probabilistic modeling to determine inventory inaccuracies and adjust reorder plans accordingly. This ensures high product availability and minimizes the risk of stockouts, which is critical for maintaining customer satisfaction and lifting sales.

Combining this advanced AI solution with the RELEX Mobile application enables even greater store-level accuracy and agility, simplifying work for store associates and helping shoppers find the private label products they love.

Collaborative replenishment lets retailers share demand forecasts and production schedules with private label suppliers. This visibility helps suppliers plan capacity and manage raw material procurement, reducing lead times and improving service levels. The collaboration extends throughout the supply chain, creating more responsive and efficient private label operations.

Space and assortment optimization

RELEX provides sophisticated space allocation capabilities that help retailers optimize shelf space to improve category performance. Rule-based allocation ensures that products are assigned the right amount of space based on data-driven insights, supporting both operational efficiency and customer satisfaction.

The platform enables category-level optimization by analyzing sales performance, margin contribution, and customer preferences across the assortment. Retailers can make informed decisions about product placement and identify opportunities to enhance category productivity.

With performance monitoring and dynamic reporting, RELEX supports ongoing adjustments to space and assortment strategies. Retailers can respond to changes in product performance by reallocating space or updating assortments to maximize sales and margins while maintaining a positive shopping experience.

Pricing and promotion intelligence

RELEX supports advanced pricing strategies that optimize product positioning and profitability. The platform enables retailers to leverage Key Value Items (KVI) to drive store traffic and customer loyalty while optimizing pricing for margin contribution and competitive positioning. These strategies help retailers balance customer value with profitability.

Automated pricing relationship rules ensure consistency across the assortment. Retailers can establish rules to maintain pricing relationships, such as discounts relative to national brand equivalents, with adjustments based on competitive price changes. This automation reduces manual effort and ensures pricing strategies align with broader merchandising objectives.

Promotion optimization capabilities analyze the full impact of promotions, accounting for factors like cannibalization, stockpiling, and vendor funding. RELEX identifies which products and discount levels generate the best return on promotional investment, enabling retailers to create effective promotional calendars and allocate budgets strategically.

Unified platform advantage

An integrated approach ensures forecasting, space, and pricing decisions work together to maximize private label performance. Changes in promotional strategy automatically flow through to demand forecasts and inventory planning. Space allocation decisions consider pricing strategies and promotional schedules. This coordination eliminates the inefficiencies and conflicts that arise when these functions operate in isolation.

The platform breaks down organizational silos that often limit private label success. Manufacturing planning, inventory management, and retail execution operate from shared data and aligned objectives. This unified approach enables the end-to-end optimization that private label success requires, ensuring that operational excellence supports strategic objectives throughout the supply chain.

The future of private label

Retailers who master the operational complexities of private label management — accurate forecasting, optimal space allocation, and intelligent pricing — create sustainable competitive advantages that extend far beyond individual products.

The most successful private label programs transform the entire shopping experience. They create unique assortments that customers cannot find elsewhere, build genuine brand loyalty that transcends price comparison, and generate the operational efficiency that funds continued innovation and expansion.

The retailers who embrace an integrated approach will define the future of private label — and the future of retail itself.

To learn more about building a resilient supply chain, read our blog post on balancing inflation, AI, and market volatility.